Lihat juga

31.03.2025 08:08 PM

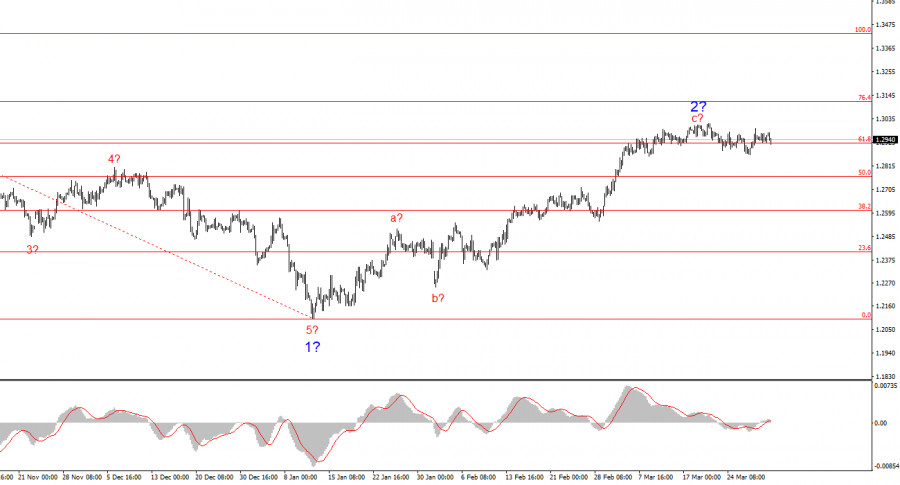

31.03.2025 08:08 PMThe wave structure for GBP/USD remains somewhat ambiguous, though overall acceptable. Currently, there is still a high probability of a long-term downward trend formation. Wave 5 has taken a convincing shape, so I consider the larger wave 1 to be complete. If this assumption is correct, wave 2 is currently developing with targets around the 1.26 and 1.28 figures. The first two sub-waves of wave 2 appear to be complete. The third may be completed at any moment—or already is.

Recently, demand for the pound has grown solely due to the "Trump factor," which remains the main support for the British currency. However, in a longer-term perspective, beyond just a few days, the pound still lacks a fundamental basis for growth. The Bank of England's and the Fed's positions have recently shifted in favor of the pound, as the BoE is now also in no rush to cut interest rates. The current wave structure remains intact, but any further rise in the instrument would raise serious concerns about its validity.

The GBP/USD exchange rate showed no change again on Monday. Even on the smallest timeframe, it's evident that the instrument has been moving sideways in recent weeks. This suggests that wave 2 may have already completed, as demand for the pound is no longer increasing. However, April 2 may trigger a new decline in demand for the dollar, which could lead to renewed growth in the instrument and make wave 2 appear unconvincing. Unfortunately, this is one of those cases where the news background works against the wave count.

There was no fundamental news for either the pound or the dollar on Monday. But traders won't have to wait long. Tomorrow, key reports on business activity and job openings in the U.S. are due, followed by a speech by Donald Trump on Wednesday. Naturally, not every Trump speech should be treated as a major event, since he speaks multiple times a day. Nevertheless, on April 2, the market is expected to receive information about new tariffs.

From there, two scenarios are possible: either the market has already priced in all potential tariffs, and we will finally see the formation of the presumed wave 3, or the market will continue discarding and selling off dollars with every tariff-related headline. It's worth noting that it's not only Trump's tariffs that pose risks to the economy—countermeasures also negatively impact both the U.S. and global economies. In such times, market participants usually prefer safe-haven assets. The dollar used to be one. Not anymore.

The wave structure for GBP/USD indicates that the downward trend is still unfolding, along with its second wave. At this point, I would advise looking for new short-entry opportunities, as the current wave count still points to the development of a downward trend that began last fall. However, how long Trump and his policies will continue to influence market sentiment remains uncertain. The current rise in the pound appears excessive relative to the wave structure, but I still expect a move into the 1.20 area and lower.

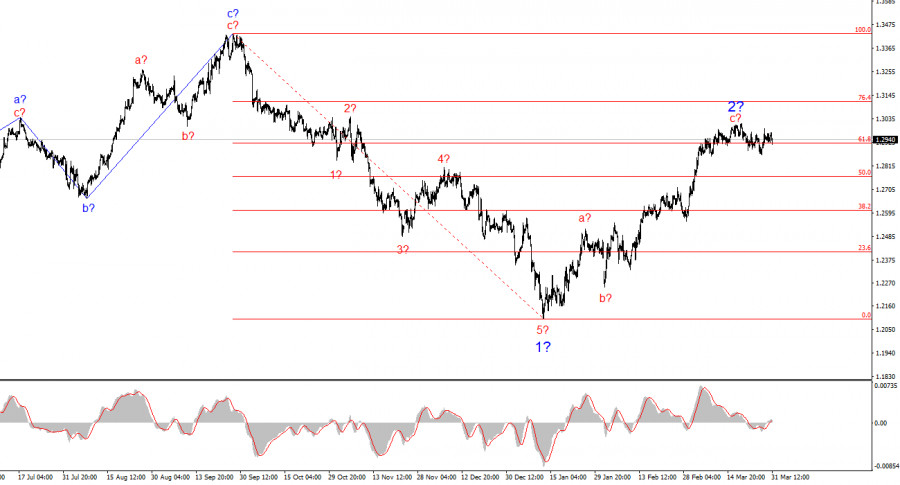

On the higher wave scale, the wave pattern has shifted. We can now assume that a downward trend section is forming, as the previous three-wave upward structure has clearly ended. If this assumption is correct, we should expect a corrective wave 2 or b, followed by an impulsive wave 3 or c.

Core Principles of My Analysis:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

EUR/USD Analisis: Pada grafik 4 jam dari pasangan mata uang utama euro, tren naik telah berkembang sejak awal Februari. Struktur gelombang telah membentuk segmen akhirnya (C) selama beberapa minggu terakhir

GBP/USD Analisis: Grafik harian pasangan mata uang Inggris menunjukkan struktur wave bullish yang sedang berlangsung sejak 13 Januari tahun ini. Bagian tengah wave (B) telah berkembang dalam beberapa minggu terakhir

EUR/USD Analisis: Pada pasangan utama euro, tren naik yang dimulai pada awal Februari terus berlanjut. Kuotasi tetap berada dalam zona potensi pembalikan yang luas. Selama tiga minggu terakhir, harga membentuk

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.