Lihat juga

28.03.2025 08:07 PM

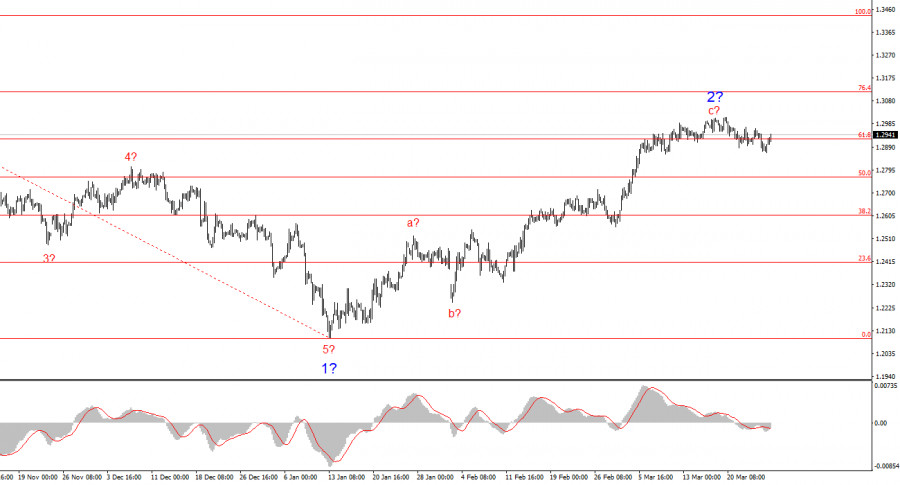

28.03.2025 08:07 PMThe wave structure of the GBP/USD instrument remains somewhat ambiguous, but overall digestible. At this stage, there is a strong likelihood that a long-term downward trend segment is forming. Wave 5 has taken a convincing shape, so I consider the larger wave 1 to be complete. If this assumption is correct, wave 2 is currently in progress, targeting the 1.26–1.28 range. The first two sub-waves within wave 2 appear complete, and the third could finish at any moment.

Demand for the pound has recently been supported solely by the "Trump factor," which remains the main driver behind sterling's strength. However, in the longer term—beyond a few days—the pound still lacks a fundamental basis for growth. The Bank of England's and the Federal Reserve's positions have recently shifted in favor of the pound, as the BoE is now also not rushing to cut interest rates. The current wave structure remains intact for now, but any further rise in the pair could raise serious doubts.

The GBP/USD rate rose by 70 basis points on Thursday and gained another modest 10 points on Friday. The rate may still shift by the end of the day, but I don't expect much market activity as the week closes. Demand for the pound has been increasing for two days straight, but not as strongly as some might hope. On Thursday night, Donald Trump introduced new tariffs on all auto exports to the U.S., which partially affected the UK. Yet it wasn't the British pound that fell—it was the U.S. dollar. This is how the market currently reacts to any new tariffs and escalations in trade tensions instigated by Trump.

Today, the UK released strong retail sales figures and a surprisingly solid GDP report for Q4. While the economy didn't show significant growth, it still expanded by 1.5% year-over-year compared to the 1.4% forecast, and by 0.1% quarter-over-quarter, matching expectations. Retail sales volumes rose by 1%. It's worth noting that the UK doesn't often deliver upbeat statistics. Just on Wednesday, the inflation report gave the pound another headache. However, Trump once again came to the rescue, and the pound managed to avoid losses. Price movement has been minimal this week, so the wave structure has remained largely unchanged. There's nothing new to add.

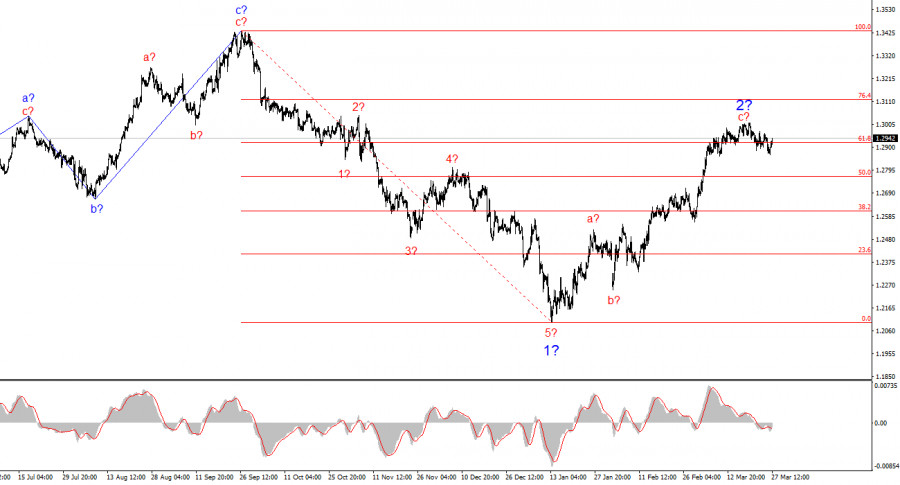

The wave pattern for GBP/USD suggests that the formation of a downward trend segment continues, as does its second wave. I would currently recommend looking for new selling opportunities, as the existing wave structure still indicates the formation of a bearish trend that began last autumn. However, how Trump and his policies will continue to influence market sentiment—and for how long—remains an open question. The current rally in the pound appears excessive relative to the wave pattern. The recent BoE and FOMC meetings could have been the launch point for wave 3, but they likely won't be. And April 2 is still ahead...

At the higher wave scale, the structure has shifted. We can now assume that a downward trend segment is developing, as the preceding upward three-wave pattern has clearly completed. If this assumption holds, we should expect a corrective wave 2 or b, followed by an impulsive wave 3 or c.

Key Principles of My Analysis:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

struktur wave , sebagian besar dipengaruhi oleh Donald Trump. Pengaturan gelombang hampir identik dengan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur korektif yang meyakinkan dan tidak menimbulkan kekhawatiran. Namun

Pola wave untuk GBP/USD terus menunjukkan pembentukan struktur wave impulsif bullish, berkat Donald Trump. Gambaran wave ini hampir identik dengan pasangan EUR/USD. Hingga 28 Februari, kami mengamati perkembangan struktur korektif

GBP/USD Analisis: Sejak 8 April, GBP/USD telah bergerak naik pada grafik harga. Dari batas bawah zona potensi pembalikan, koreksi balik telah terbentuk selama dua bulan terakhir. Kenaikan dari

EUR/USD Analisis: Sejak Februari, grafik EUR/USD telah membentuk wave naik. Selama satu setengah bulan terakhir, segmen korektif (B) telah berkembang dalam wave ini, yang masih belum selesai. Seminggu yang lalu

Struktur gelombang untuk instrumen GBP/USD terus menunjukkan pembentukan rangkaian gelombang impulsif bullish. "Berkat" Donald Trump, pola gelombang ini sangat mirip dengan EUR/USD. Hingga 28 Februari, kami mengamati perkembangan struktur korektif

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.