Lihat juga

28.03.2025 07:26 AM

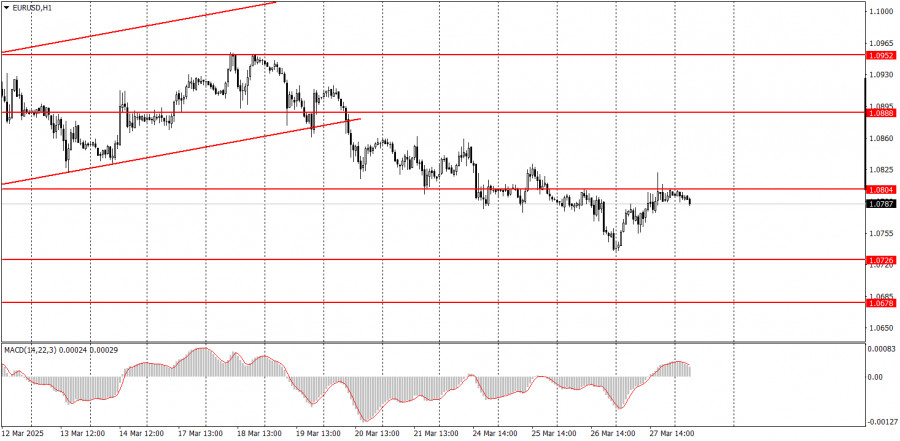

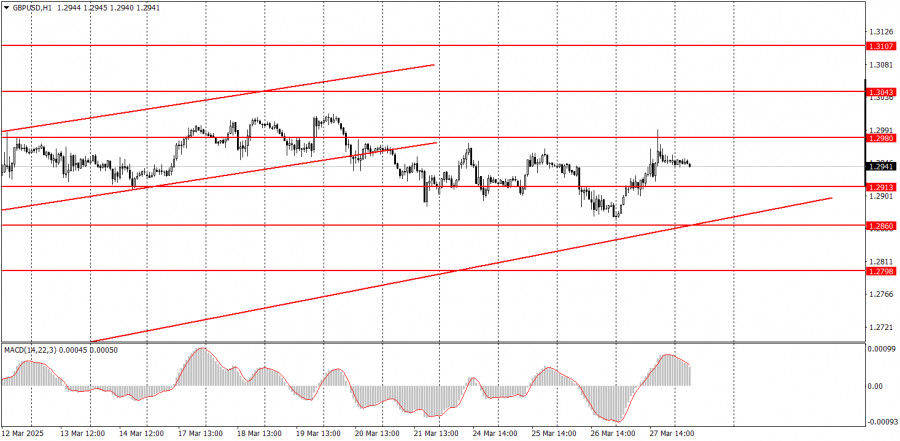

28.03.2025 07:26 AMA fair number of macroeconomic events are scheduled for Friday, but we believe they will likely trigger only a localized market reaction. The UK will publish Q4 GDP data in its third estimate and retail sales figures. Are these critical reports? Yes, they are. But yesterday, the market ignored the U.S. GDP report. In the Eurozone, the only notable release is Germany's inflation report. In the U.S., the focus will be on the PCE indices and the University of Michigan's consumer sentiment index. Each of these reports could spark a market response, but it's unlikely to be strong or affect the overall trend of the currency pairs throughout the day.

Among Friday's fundamental events, only the speeches from Federal Reserve officials Michael Barr and Raphael Bostic stand out. However, they are scheduled for late in the evening and will have no impact on the intraday movements of either currency pair. The market remains focused on news related to Donald Trump's tariffs. Nonetheless, the euro and the pound have tested nearby levels and bounced off them. We believe that a dollar rebound is possible and quite likely today. Both pairs have started a kind of corrective move.

On the fifth trading day of the week, both currency pairs could resume the declines that have been building up in recent weeks. Both pairs have settled below their ascending channels, and the Fed's position gives the dollar a chance to reclaim some of its unjustly lost ground. Again, Trump triggered a dollar drop yesterday, but this time, it was a decline—not a collapse like two weeks ago. At the moment, the British pound appears more inclined to consolidate than to enter a downward correction.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pasar tenaga kerja Australia telah melampaui ekspektasi—hampir semua komponen laporan ketenagakerjaan bulan April berada di "zona hijau." Meskipun rilis ini memiliki beberapa kekurangan, secara keseluruhan menguntungkan bagi Aussie, karena kemungkinan

Pada hari Kamis, terlihat perlambatan yang jelas dalam reli pasar saham—bahkan bisa dikatakan telah terhenti. Hal ini disebabkan oleh pasar yang sudah memperhitungkan gencatan senjata 90 hari antara

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Kamis, tetapi sangat sedikit yang kemungkinan akan memicu reaksi pasar yang kuat. Estimasi kedua dari laporan PDB Q1 dan produksi industri akan dirilis

Pada hari Rabu, pasangan mata uang GBP/USD melanjutkan pergerakan naik yang telah dimulai sehari sebelumnya. Ingat bahwa pada hari Selasa, tidak ada alasan fundamental yang kuat untuk penjualan besar-besaran dolar

Pada hari Rabu, pasangan mata uang EUR/USD melanjutkan pemulihannya meskipun kalender makroekonomi kosong. Kami tidak menghitung laporan inflasi tunggal dari Jerman, karena awalnya tidak memiliki potensi untuk memengaruhi pergerakan pasangan

Laporan pasar tenaga kerja Inggris menunjukkan bahwa pertumbuhan upah tetap tinggi meskipun ada sedikit perlambatan—rata-rata tiga bulan menurun dari 5,9% menjadi 5,6%, dan termasuk bonus, menurun dari 5,7% menjadi 5,5%

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.