Lihat juga

30.05.2022 01:02 PM

30.05.2022 01:02 PMMay was one of the hardest months in the crypto industry, and several events contributed to this. The bearish trend is in full swing, what could be worse than this? That's right, the collapse of one of the largest projects in the industry. The collapse of the UST algorithmic stablecoin and the LUNA token was a real shock to the market. In a matter of days, one of the largest dollar stablecoins with a capitalization of more than $ 16 billion in vain depreciated, as did the LUNA token, which lost 99.99% of its value.

The cause and consequences of the collapse lie in several suspicious transactions, where experts suggest that this was a coordinated attack on the project tokens.To support the value of the UST stablecoin, the project began to sell off its reserves, which is about 80 thousand BTC, creating additional pressure on the market.As a result, it was not possible to save the tokens, and the Terra project decided to create a new Terra 2.0 network, partially paying off losses to investors with new tokens.

This story clearly showed the market how fragile the cryptocurrency is and where to be careful when investing in it.

Despite all the events, the head of MicroStrategy, Michael Saylor, said in an interview with Fox News: "Bitcoin remains an asset free from government and corporate interference, instilling confidence in this uncertain world."

According to the head of Saylor, financial markets are in a bearish trend, but this will not stop him and the company from further investing in BTC.

Let me remind you that MicroStrategy holds 129,218 BTC on its balance sheet - almost $ 4 billion.

Major players, including institutional investors, continue to be interested in digital assets. The CFTC report demonstrates the growth of long positions on Bitcoin futures on CME. This indicates that the market situation is gradually stabilizing after a prolonged decline.

At the same time, ARK Invest founder Cathie Wood said that the growing correlation between cryptocurrency and traditional assets indicates that the bear market will end soon.

"Cryptocurrency is a new asset class, it should not be similar to Nasdaq, but similar. Now they are strongly interconnected. You know that you are in a bear market and are close to its end when everything will start behaving the same way, and we are witnessing the capitulation of one market after another," she said.

What happens on the Bitcoin trading chart?

Bitcoin has been declining in value for 9 weeks in a row - this is one of the longest declines in the history of cryptocurrency. Panic prevailed in the market, thereby reinforcing the bearish trend. As a result, a clear flat of $ 28,000 / $ 31,500 appeared on the BTC chart, within the boundaries of which the quote closed.

At the moment, traders are analyzing the boundaries of the flat with special attention, since holding the price beyond the aisles of a particular frame will indicate the subsequent price move. This strategy is considered to be the most optimal and in the future can bring not a small profit.

At the same time, the 9-week decline indicates that short positions on BTC are overheated, which may provoke buyers to change direction. This movement will lead to a correction of the downward trend.

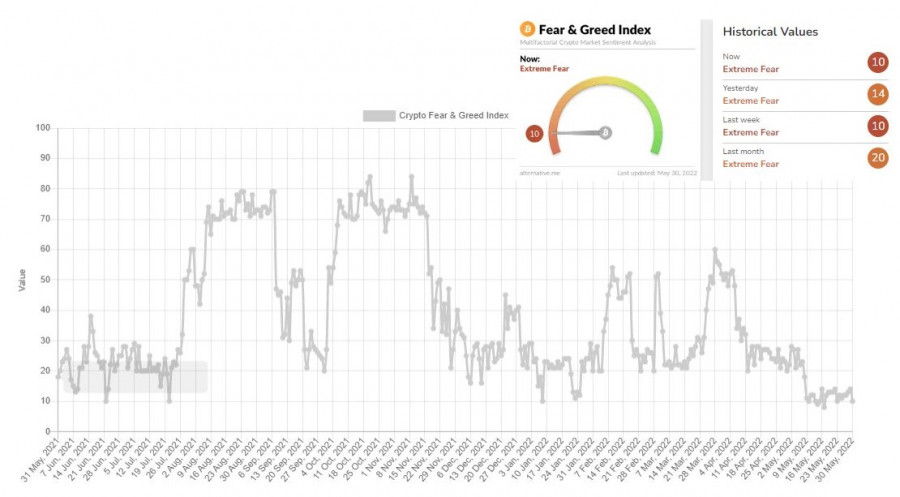

The index of emotions (aka fear and euphoria) of the crypto market moves within the critical level of 10 throughout May. This indicates a high degree of fear among traders. Such prolonged pessimism may eventually lead to a correction in the market.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Bitcoin telah naik di atas $100,000, sementara Ethereum mencoba untuk berkonsolidasi di atas $2,000. Setelah reli tajam kemarin, yang berlanjut selama sesi Asia hari ini, Bitcoin sekarang trading pada $103,000

Pada chart 4 jam dari mata uang kripto Bitcoin, nampak terlihat indikator Stochastic Oscillator sudah berada dalam kondisi Overbought dan kini tengah bersiap-siap Crossing SELL dan tembus kebawah level

Bila Kita perhatikan chart 4 jamnya dari mata uang kripto Ethereum, nampak pergerakan harganya bergerak diatas WMA (30 Shift 2) yang juga memiliki kemiringan slope menukik keatas, dimana artinya momentum

Sementara indeks saham tetap stagnan, emas berkonsolidasi mendekati titik tertingginya, dan Bitcoin kembali menarik perhatian. Aset utama pasar kripto ini mendekati level psikologis penting $100.000, bukan karena ledakan atau emosi

Bitcoin mencapai sedikit di bawah $100.000, sementara Ethereum mencapai $1.900. Pertumbuhan besar di pasar cryptocurrency ini sekali lagi mengonfirmasi prospek bullish-nya, yang belakangan ini banyak dibicarakan. Bitcoin saat ini diperdagangkan

Harga Bitcoin saat ini berada di dekat ambang batas psikologis yang signifikan, dan para pelaku pasar bersiap menghadapi lonjakan naik lainnya atau reversal mendadak yang dapat menghapus ekspektasi bullish jangka

Kontrak berjangka indeks saham AS melonjak tajam pada pembukaan sesi perdagangan hari ini setelah berita bahwa perwakilan dari AS dan Tiongkok telah melanjutkan konsultasi mengenai masalah perdagangan. Laporan media mengungkapkan

Bitcoin dan Ethereum Terus Tumbuh Berkat Berita Legislatif Crypto yang Positif Saat ini, Bitcoin diperdagangkan pada $96.700, setelah bangkit dari posisi terendah $93.400, sementara Ethereum telah pulih ke area $1.835

Bitcoin diperdagangkan dalam kisaran $93.000–$94.000, sekitar 0,5% di bawah titik tertinggi lokal terbarunya sebesar $97.900, yang tercatat pada 2 Mei. Volatilitas telah menurun, dan pasar tampaknya berada dalam keadaan jeda

Bitcoin dan Ethereum menghabiskan hari dalam channel mendatar, meskipun tanda-tanda penjualan aktif selama sesi Amerika kemarin menimbulkan beberapa pertanyaan terkait prospek kenaikan jangka pendek dari instrumen trading ini. Bitcoin saat

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.