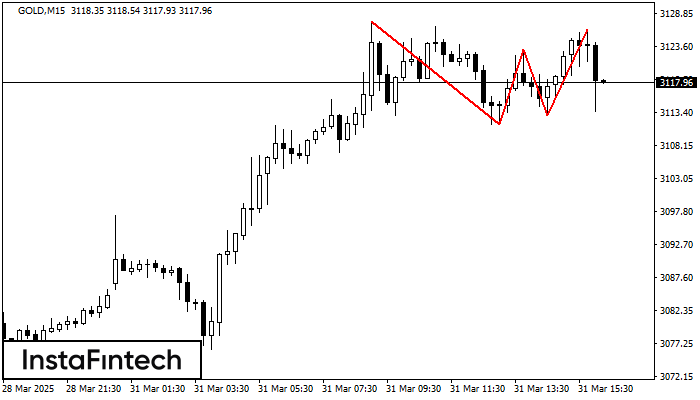

Triple Top

was formed on 31.03 at 15:15:11 (UTC+0)

signal strength 2 of 5

The Triple Top pattern has formed on the chart of the GOLD M15. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 3111.43/3112.94 with the upper limit 3127.49/3126.34; the projection of the width is 1606 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 3111.43, the price is most likely to continue the downward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

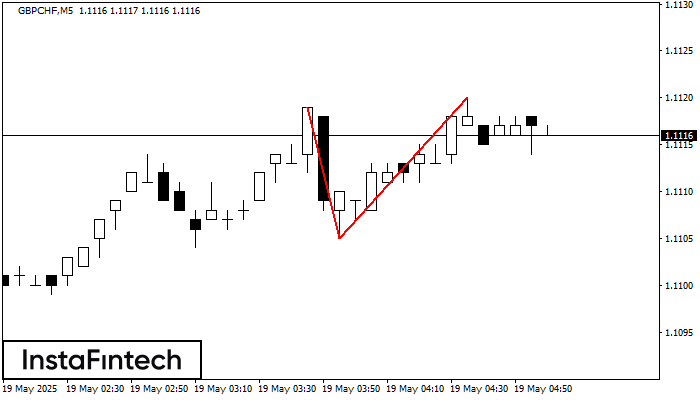

Double Top

was formed on 19.05 at 04:00:13 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on GBPCHF M5. Characteristics: the upper boundary 1.1119; the lower boundary 1.1105; the width of the pattern is 15 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

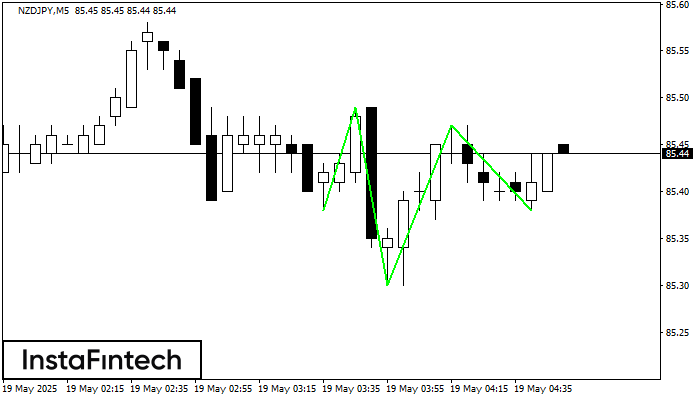

Inverse Head and Shoulder

was formed on 19.05 at 03:50:15 (UTC+0)

signal strength 1 of 5

According to M5, NZDJPY is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 85.49/85.47 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

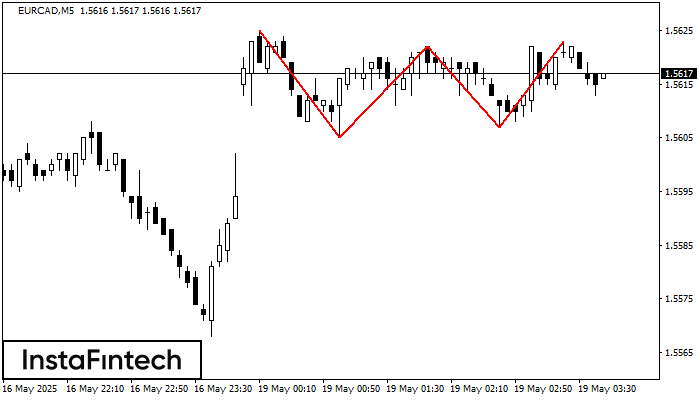

Triple Top

was formed on 19.05 at 02:45:05 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the EURCAD M5 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 2, support level -2

The M5 and M15 time frames may have more false entry points.

Open chart in a new window