AUDCHF (Australian Dollar vs Swiss Franc). Exchange rate and online charts.

Currency converter

30 Jun 2025 14:44

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/CHF is a cross rate of the Australian dollar to the Swiss franc. In comparison with majors, this instrument is of a quite low liquidity.

When forecasting the trend of the AUD/CHF instrument, the main economic indicators of the USA should be taken into account, because each currency of this pair is influenced considerably by USD. Such indicators include, for example, the GDP level, unemployment rate, discount rate, jobs growth, etc.

The currencies can respond to the change of the USD trend with different paces, and because of this, the AUD/CHF currency pair can be serve as some kind of an indicator measuring the pace of the currency rates change. Australia’s dependence on natural resources makes AUD/CHF responsive to the global gold prices.

The swiss franc is one of the world most reliable and stable currencies; it enjoys large confidence. During many years, the Swiss economy remains on a high level – that's why during crisis, CHF becomes a 'save haven' for investor's capitals and rises significantly against other currencies. It is, very likely, the most crucial aspect that should be kept in mind while dealing with the AUD/CHF instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 30/06/2025: EUR/USD, USDX, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, USDX, USD/JPY, Gold and BitcoinAuthor: Sebastian Seliga

10:30 2025-06-30 UTC+2

1828

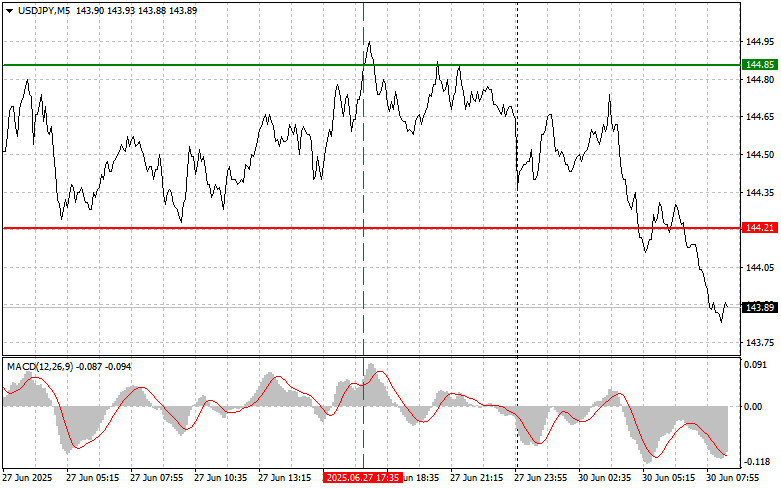

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:08 2025-06-30 UTC+2

1078

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD as of June 30th

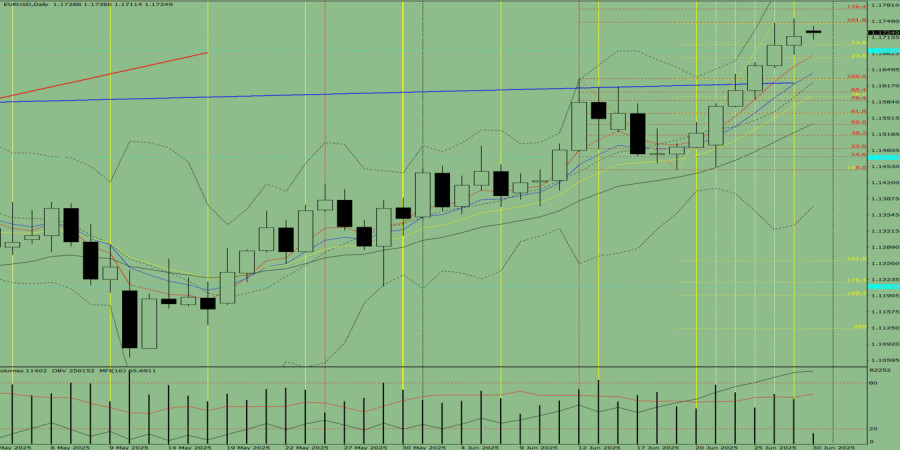

In the coming days, the euro is expected to remain in a sideways flat phase. Near the calculated resistance area, there is a high chance of a pause and the formation of reversal conditions. A downward movement in the euro is likely to begin by the end of the week.Author: Isabel Clark

10:57 2025-06-30 UTC+2

913

- Hedge funds sold energy stocks last week at the fastest pace since September 2024 and the second fastest in 10 years as oil prices fell on easing tensions in the Middle East, Goldman Sachs (GS.N) said in a note on Monday.

Author: Thomas Frank

11:14 2025-06-30 UTC+2

883

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:08 2025-06-30 UTC+2

883

Trading Recommendations for the Cryptocurrency Market on June 30Author: Miroslaw Bawulski

09:30 2025-06-30 UTC+2

853

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/CHF, and the US Dollar Index as of June 30th

In the coming trading days, the British pound is expected to continue its sideways movement. A return to the resistance zone is likely, followed by a possible reversal and resumption of the bearish trend, extending toward the calculated support levels.Author: Isabel Clark

11:27 2025-06-30 UTC+2

853

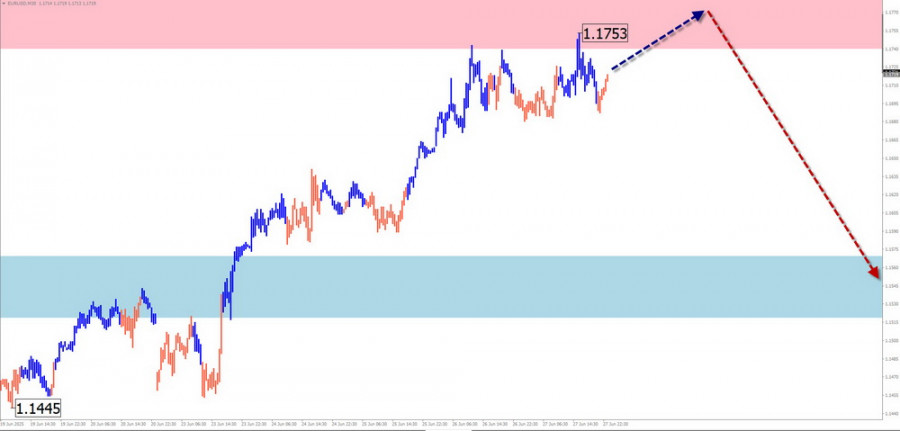

On Friday, the pair moved upward and tested the 161.8% target level at 1.1746 (red dashed line), after which the price reversed downward and closed the daily candle at 1.1718. Today, the price may attempt to start a downward movement. On Monday, important calendar news is expected.Author: Stefan Doll

10:33 2025-06-30 UTC+2

838

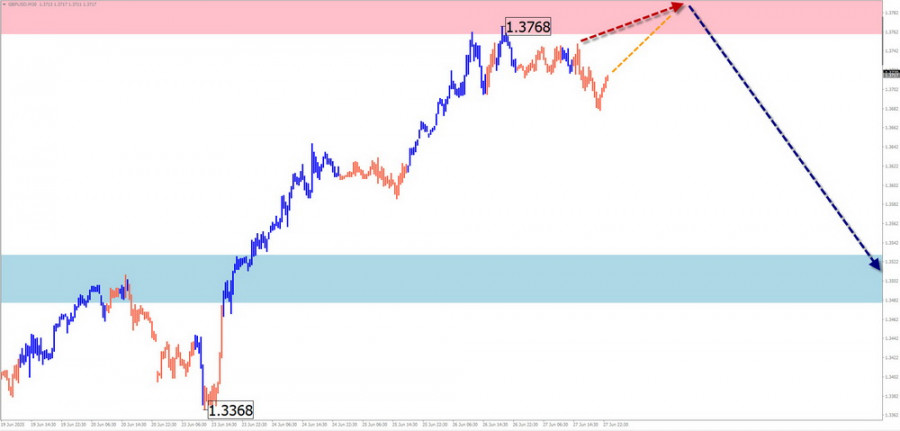

On Friday, the pair moved downward and nearly tested the 23.6% retracement level at 1.3675 (yellow dashed line), after which the price rebounded upward and closed the daily candle at 1.3719. Today, the price may attempt to resume the downward movement. On Monday, significant calendar news is.Author: Stefan Doll

10:37 2025-06-30 UTC+2

823

- Technical analysis / Video analytics

Forex forecast 30/06/2025: EUR/USD, USDX, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, USDX, USD/JPY, Gold and BitcoinAuthor: Sebastian Seliga

10:30 2025-06-30 UTC+2

1828

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:08 2025-06-30 UTC+2

1078

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD as of June 30th

In the coming days, the euro is expected to remain in a sideways flat phase. Near the calculated resistance area, there is a high chance of a pause and the formation of reversal conditions. A downward movement in the euro is likely to begin by the end of the week.Author: Isabel Clark

10:57 2025-06-30 UTC+2

913

- Hedge funds sold energy stocks last week at the fastest pace since September 2024 and the second fastest in 10 years as oil prices fell on easing tensions in the Middle East, Goldman Sachs (GS.N) said in a note on Monday.

Author: Thomas Frank

11:14 2025-06-30 UTC+2

883

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on June 30. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:08 2025-06-30 UTC+2

883

- Trading Recommendations for the Cryptocurrency Market on June 30

Author: Miroslaw Bawulski

09:30 2025-06-30 UTC+2

853

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/CHF, and the US Dollar Index as of June 30th

In the coming trading days, the British pound is expected to continue its sideways movement. A return to the resistance zone is likely, followed by a possible reversal and resumption of the bearish trend, extending toward the calculated support levels.Author: Isabel Clark

11:27 2025-06-30 UTC+2

853

- On Friday, the pair moved upward and tested the 161.8% target level at 1.1746 (red dashed line), after which the price reversed downward and closed the daily candle at 1.1718. Today, the price may attempt to start a downward movement. On Monday, important calendar news is expected.

Author: Stefan Doll

10:33 2025-06-30 UTC+2

838

- On Friday, the pair moved downward and nearly tested the 23.6% retracement level at 1.3675 (yellow dashed line), after which the price rebounded upward and closed the daily candle at 1.3719. Today, the price may attempt to resume the downward movement. On Monday, significant calendar news is.

Author: Stefan Doll

10:37 2025-06-30 UTC+2

823