CADPLN (Canadian Dollar vs Polish Zloty). Exchange rate and online charts.

Currency converter

26 Mar 2025 08:21

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/PLN pair is not in high demand in the forex market. The pair is a cross rate against the US dollar. The Canadian dollar is the base currency, while the Polish zloty is the quoted one. The cross rate indicates how many units of PLN should be paid for one unit of CAD. The quote of the pair is based on the exchange rate of each of these currencies against the US dollar.

Features of CAD/PLN

The CAD/PLN pair hinges on world oil prices, as Canada is one of the largest oil exporters.

Therefore, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls.

Poland is a developed European country with a relatively high level of economy. In addition to active financial support from the EU, the state's main sources of income are engineering, chemicals, coal mining, and shipbuilding, as the country has access to the Baltic Sea.

Although Poland is part of the European Union, its national currency is the Polish zloty. The exchange rate of Poland's national currency depends on such factors as the country's international credit rating, as well as the state of the major sectors of the Polish economy and the European Union.

How to trade CAD/PLN

When trading cross rates, speculators should be aware that brokers usually set higher spreads on them than on the more popular currency pairs. Therefore, you should carefully read the terms and conditions offered by the broker for this trading instrument.

The CAD/PLN pair is significantly influenced by the US dollar. This can be seen by combining USD/CAD and USD/PLN price charts. This way, we can get an estimated chart for the CAD/PLN pair. When forecasting the price movement of this financial instrument, such economic indicators as GDP, discount rate, unemployment rate, etc. must be taken into account.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

1393

USD/JPY: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)Author: Jakub Novak

19:29 2025-03-25 UTC+2

1228

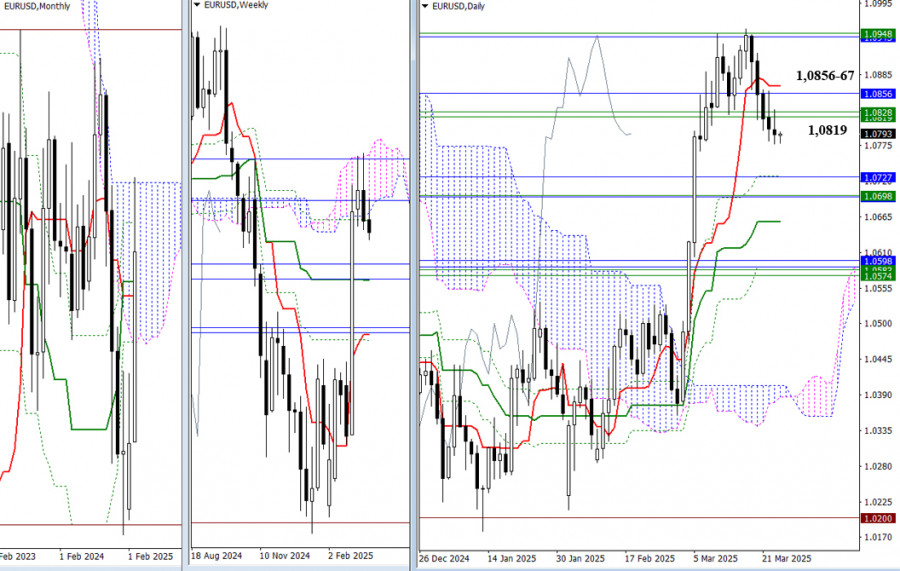

As the week begins, bearish players are trying to confirm and extend the prevailing downtrend, but they have yet to achieve strong results — The pair continues to stay close to the weekly levels. (1.0819 – 1.0828). If the decline does progress, the nearest target and next support zone for todayAuthor: Evangelos Poulakis

05:26 2025-03-26 UTC+2

1198

- The GBP/USD rate rose by 30 basis points on Tuesday.

Author: Chin Zhao

19:36 2025-03-25 UTC+2

1183

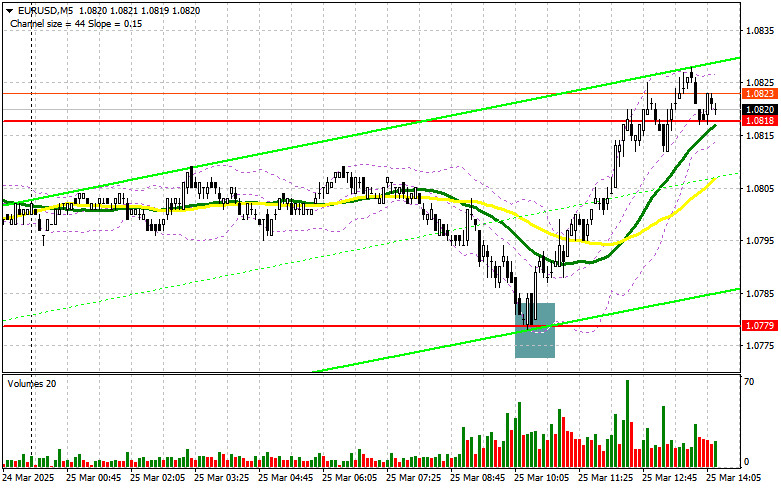

The EUR/USD currency pair traded with low volatility on TuesdayAuthor: Paolo Greco

03:40 2025-03-26 UTC+2

1168

Despite "unipolar" macroeconomic reports, long positions in EUR/USD still appear risky.Author: Irina Manzenko

00:59 2025-03-26 UTC+2

1153

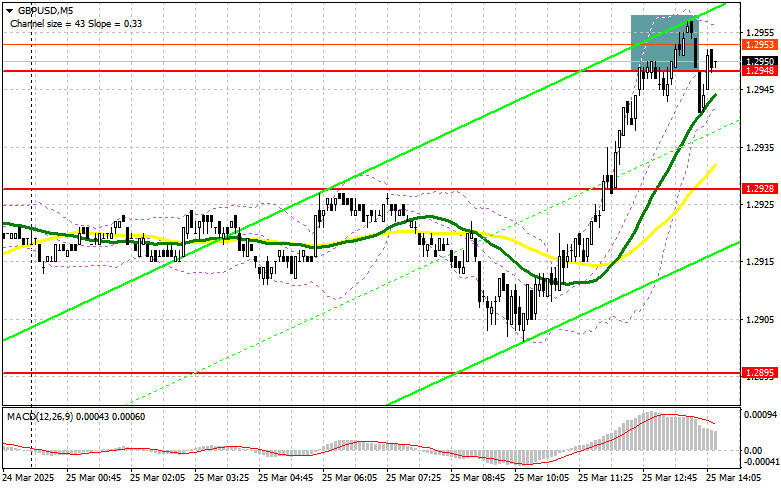

- GBP/USD: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)

Author: Jakub Novak

19:26 2025-03-25 UTC+2

1093

GBP/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)Author: Miroslaw Bawulski

19:15 2025-03-25 UTC+2

1093

EUR/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)Author: Miroslaw Bawulski

19:13 2025-03-25 UTC+2

1078

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

1393

- USD/JPY: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)

Author: Jakub Novak

19:29 2025-03-25 UTC+2

1228

- As the week begins, bearish players are trying to confirm and extend the prevailing downtrend, but they have yet to achieve strong results — The pair continues to stay close to the weekly levels. (1.0819 – 1.0828). If the decline does progress, the nearest target and next support zone for today

Author: Evangelos Poulakis

05:26 2025-03-26 UTC+2

1198

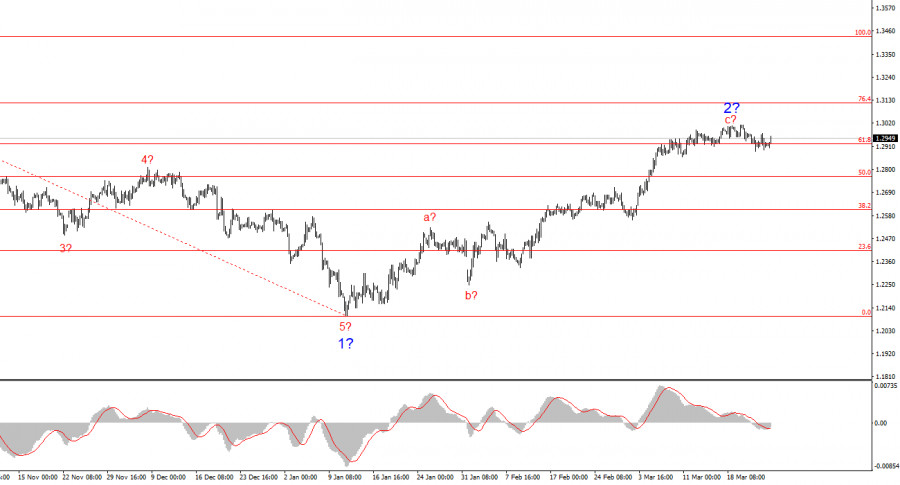

- The GBP/USD rate rose by 30 basis points on Tuesday.

Author: Chin Zhao

19:36 2025-03-25 UTC+2

1183

- The EUR/USD currency pair traded with low volatility on Tuesday

Author: Paolo Greco

03:40 2025-03-26 UTC+2

1168

- Despite "unipolar" macroeconomic reports, long positions in EUR/USD still appear risky.

Author: Irina Manzenko

00:59 2025-03-26 UTC+2

1153

- GBP/USD: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)

Author: Jakub Novak

19:26 2025-03-25 UTC+2

1093

- GBP/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:15 2025-03-25 UTC+2

1093

- EUR/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:13 2025-03-25 UTC+2

1078