AUDMXN (Australian Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

24 Mar 2025 18:00

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/MXN is not a very popular currency pair on Forex. AUD/MXN represents the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present in this currency pair, it still has a significant influence on it. Thus, by combining AUD/USD and USD/MXN price charts, you can get and approximate AUD/MXN chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that AUD and MXN could respond differently towards changes in the U.S. economy, therefore, the AUD/MXN currency pair may be a specific indicator reflecting changes within the two currencies.

To date, Mexico is one of the most developed countries in Latin America. The country ranks first among Latin American countries in terms of per capita income. The Mexican economy is largely composed of private sector, due to mass privatization of state enterprises mostly in the 80s of last century to overcome the economic crisis. For the most part the former state-owned enterprises in Mexico are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, this country has an active trade with its rich neighbors - the United States and Canada, which is a significant part of government revenue in Mexico.

Mexico is the largest exporter of oil in its region. Currently most of the country’s revenues are generated in the oil sector. However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. This makes the government to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to the forecasts, with such a policy, Mexico will soon be forced to import oil from abroad, to meet the needs of its economy. All these circumstances have a significant impact on the currency of Mexico, which is largely dependent on world oil prices, which are formed in global financial markets. In addition, the Mexican peso exchange rate is highly dependent on international ranking of the country, which is based on complex economic formulas calculated by major rating agencies.

This trading instrument is relatively illiquid compared it with major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this financial instrument, focus primarily on those currency pairs that include a U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for this currency pair than for more popular ones, so before you start working with the cross rates, learn carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

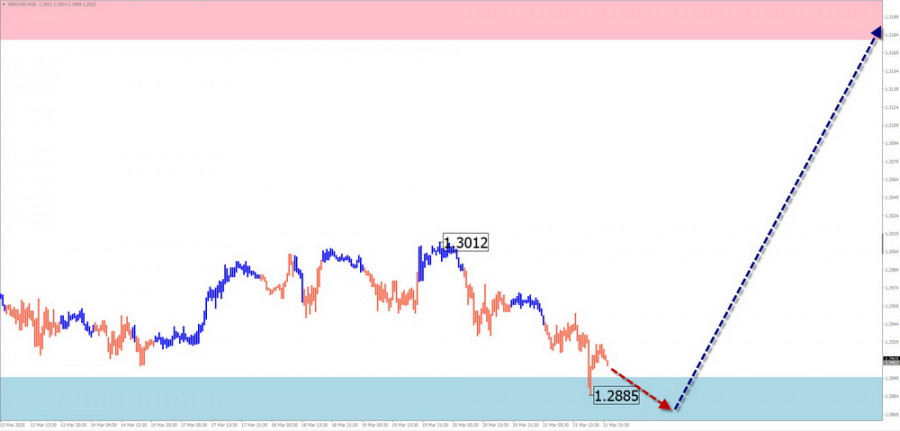

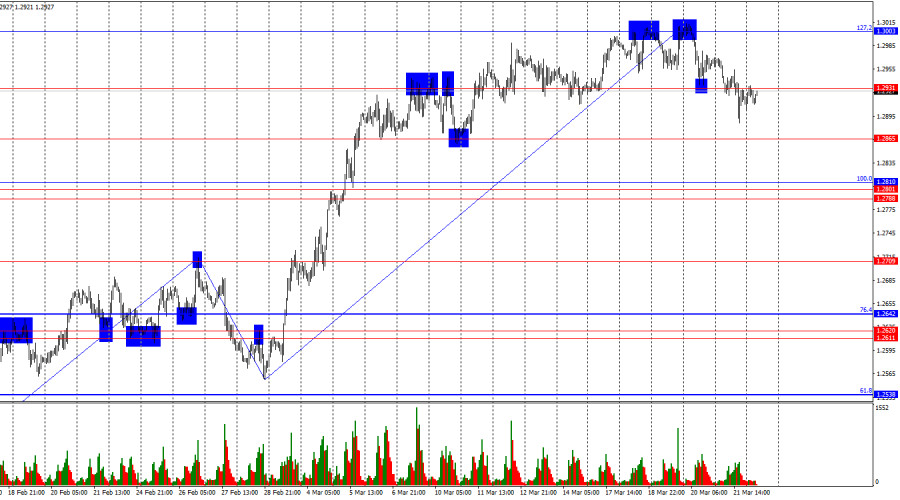

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

733

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

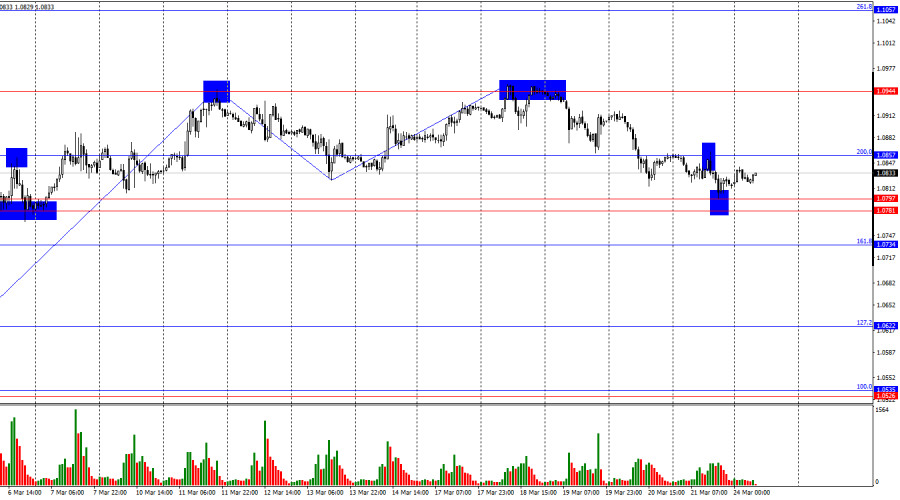

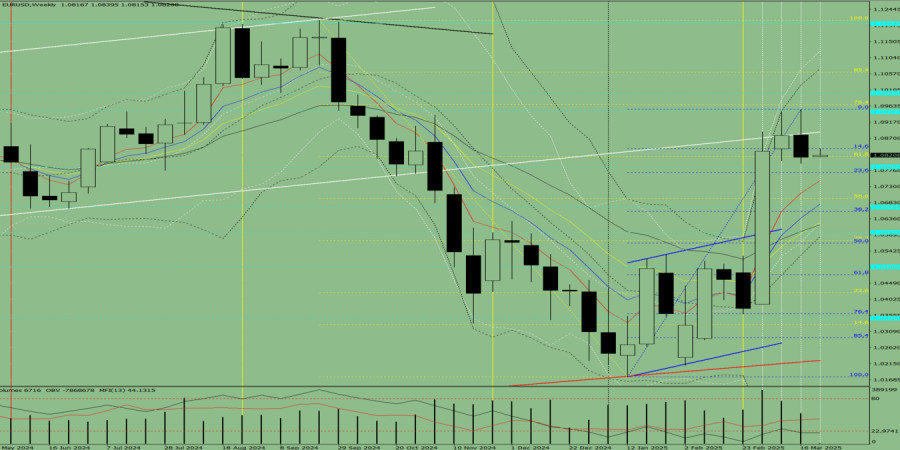

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

Stock MarketsUS stock market on March 24: SP500 and NASDAQ gathering steam in light of news on tariffs

Following Friday's regular session, US major stock indices closed with modest gains. The S&P 500 rose by 0.08%, while the Nasdaq 100 added 0.22%.Author: Jakub Novak

11:42 2025-03-24 UTC+2

628

Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

- Stock Markets

US stock market on March 24: SP500 and NASDAQ gathering steam in light of news on tariffs

Following Friday's regular session, US major stock indices closed with modest gains. The S&P 500 rose by 0.08%, while the Nasdaq 100 added 0.22%.Author: Jakub Novak

11:42 2025-03-24 UTC+2

628

- Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.

Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613