AUDDKK (Australian Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

25 Mar 2025 14:51

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/DKK pair is not on the list of the most traded pairs on Forex. This is a cross-rate pair. It means that the exchange rate of the AUD/DKK pair is calculated by the reference to a third currency, namely the US dollar. Therefore, even if both currencies are not quoted against the US dollar, it still has a significant impact on its rate.

Main features

Denmark stands out from many other countries with its high economic indicators (low inflation and unemployment, sufficient oil and gas inventories, focus on high tech development). Yet, it also has some weak points, e.g. high taxes as well as a low level of competitiveness in foreign markets. These factors may adversely affect its national currency.

Nevertheless, the Danish economy is one of the most stable in the world, so its national currency firmly holds its position versus other major forex currencies.

AUD/DKK is a nonvolatile pair (mostly because of its counter currency, the Aussie). The Australian economy is quite stable. On top of that, the Australian dollar is the sixth most traded currency worldwide.

The pair is distinguished by low volatility (the price swings within a narrow corridor). So, it is highly unlikely to make a quick profit on such assets but the medium and long- term positions may bring high returns. Besides, one should remember that even nonvolatile pairs may jump sharply, especially during the publication of crucial economic reports.

How to trade AUD/DKK

When trading AUD/DKK, speculators should take into account the economic indicators of Denmark as well as the cost of oil and other commodities imported by the country to maintain the manufacturing production.

Always keep in mind that the US dollar also affects both currencies in the pair. For this reason, when predicting the further trajectory of the price, pay attention to the main economic indicators of the United States (GDP, the benchmark rate, the unemployment rate, labor market figures (the NFP report), etc.

AUD/DKK is a low-liquid pair compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, before making any predictions, it is necessary to focus on those instruments that are quoted against the US dollar.

When trading cross-rates, remember that brokers usually set a higher spread on such pairs than on the most popular currency pairs. So, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

See Also

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1078

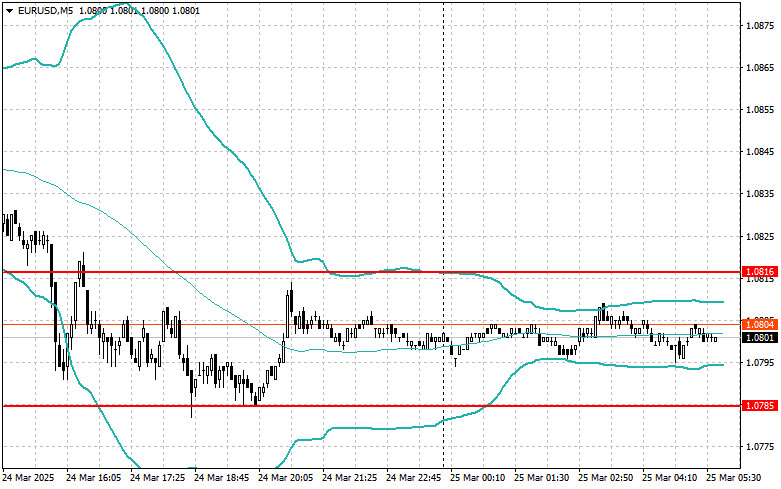

The Euro is Searching for a Foothold for ReversalAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1078

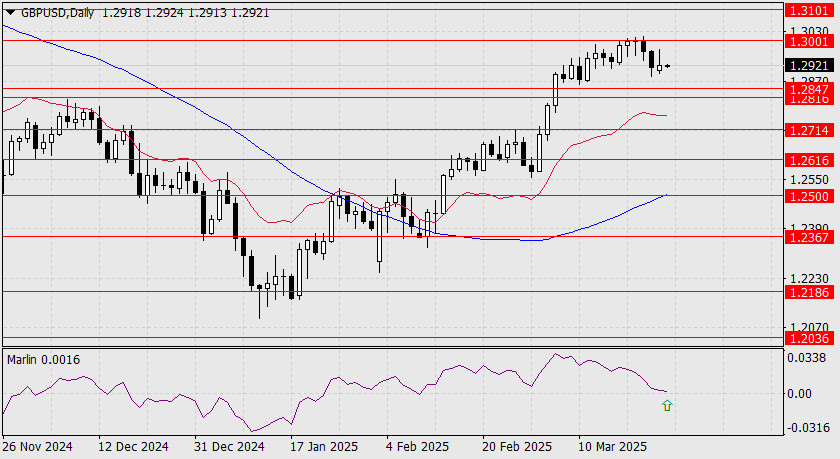

The Pound is Ready to Resume GrowthAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

928

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

868

AUD/USD Eyes the Upside AgainAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

853

Fundamental analysisWhat to Pay Attention to on March 25? A Breakdown of Fundamental Events for Beginners

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importanceAuthor: Paolo Greco

07:30 2025-03-25 UTC+2

823

- Technical analysis

Technical Analysis of Intraday Price Movement of EUR/JPY Cross Currency Pairs, Tuesday March 25, 2025.

From what is seen on the 4-hour chart of the EUR/JPY cross currency pair, it is clearly visibleAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

793

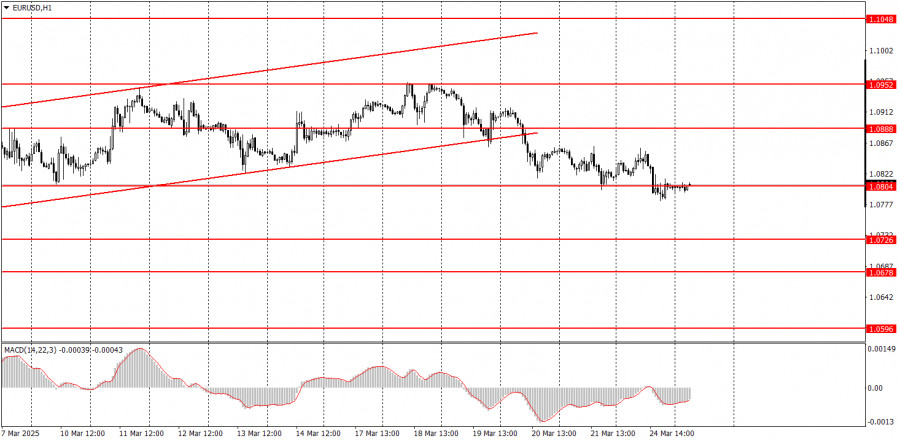

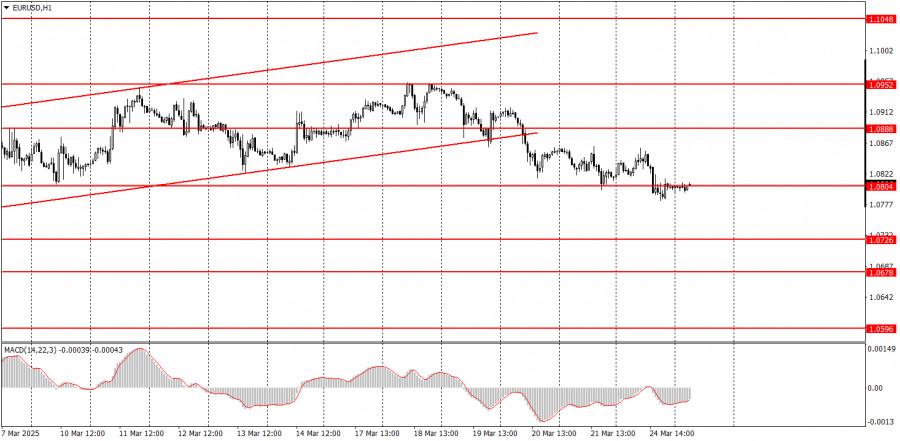

Trading planHow to Trade the EUR/USD Pair on March 25? Simple Tips and Trade Analysis for Beginners

The EUR/USD currency pair continued its weak downward movement on MondayAuthor: Paolo Greco

07:29 2025-03-25 UTC+2

793

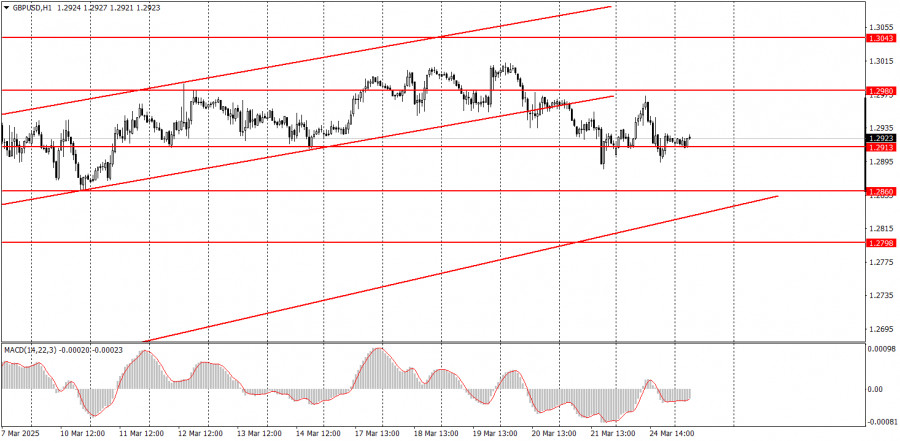

Trading planHow to Trade the GBP/USD Pair on March 25? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair traded both up and down on MondayAuthor: Paolo Greco

07:29 2025-03-25 UTC+2

778

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1078

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1078

- The Pound is Ready to Resume Growth

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

928

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

868

- AUD/USD Eyes the Upside Again

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

853

- Fundamental analysis

What to Pay Attention to on March 25? A Breakdown of Fundamental Events for Beginners

Very few macroeconomic events are scheduled for Tuesday, and none are of significant importanceAuthor: Paolo Greco

07:30 2025-03-25 UTC+2

823

- Technical analysis

Technical Analysis of Intraday Price Movement of EUR/JPY Cross Currency Pairs, Tuesday March 25, 2025.

From what is seen on the 4-hour chart of the EUR/JPY cross currency pair, it is clearly visibleAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

793

- Trading plan

How to Trade the EUR/USD Pair on March 25? Simple Tips and Trade Analysis for Beginners

The EUR/USD currency pair continued its weak downward movement on MondayAuthor: Paolo Greco

07:29 2025-03-25 UTC+2

793

- Trading plan

How to Trade the GBP/USD Pair on March 25? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair traded both up and down on MondayAuthor: Paolo Greco

07:29 2025-03-25 UTC+2

778