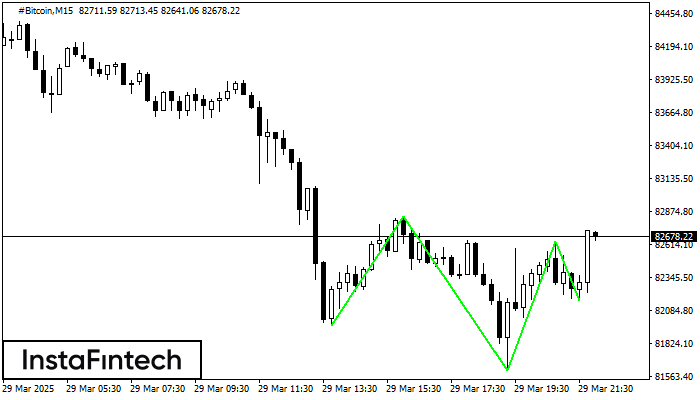

Inverse Head and Shoulder

was formed on 29.03 at 22:00:17 (UTC+0)

signal strength 2 of 5

According to the chart of M15, #Bitcoin produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 81609.29 while the median line of the Neck is set at 82839.07/82640.15. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of #Bitcoin will go towards 82640.38.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

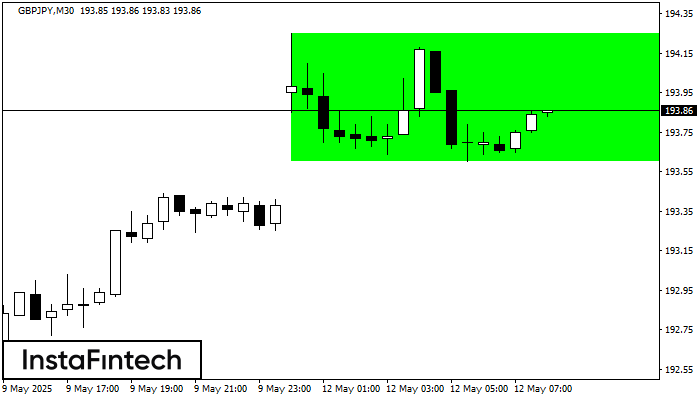

Bullish Rectangle

was formed on 12.05 at 07:02:40 (UTC+0)

signal strength 3 of 5

According to the chart of M30, GBPJPY formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 194.25, the lower border is 193.60. The signal means

Open chart in a new window

Triple Top

was formed on 12.05 at 07:00:37 (UTC+0)

signal strength 2 of 5

The Triple Top pattern has formed on the chart of the NZDCHF M15 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 2, support level -4

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

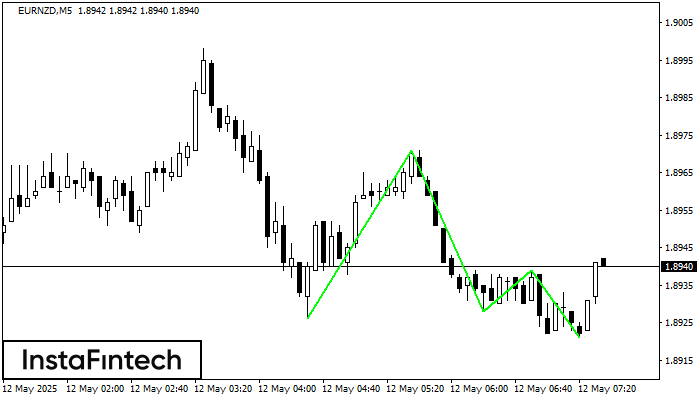

Triple Bottom

was formed on 12.05 at 06:35:29 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of EURNZD M5. Features of the pattern: The lower line of the pattern has coordinates 1.8971 with the upper limit 1.8971/1.8939

The M5 and M15 time frames may have more false entry points.

Open chart in a new window