See also

29.04.2025 11:30 AM

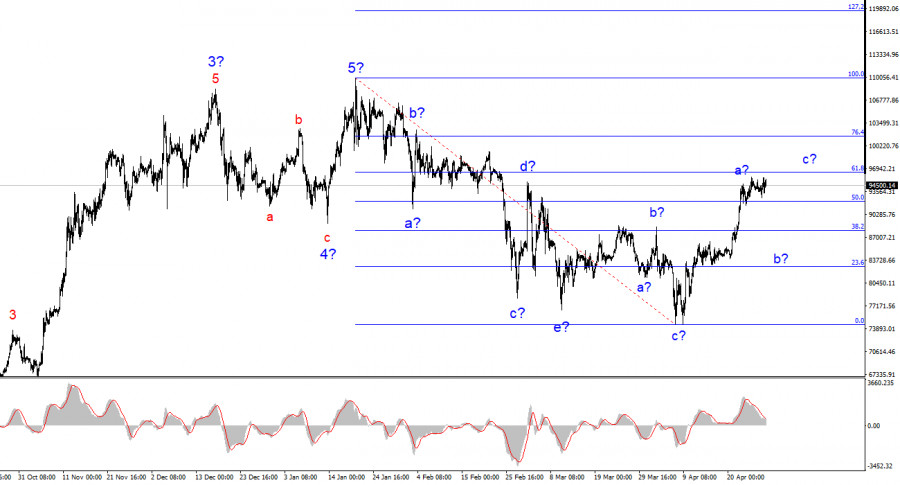

29.04.2025 11:30 AMThe wave pattern on the 4-hour chart of the BTC/USD has become somewhat more complex. We observed a corrective downward structure that completed its formation around the $75,000 mark. After that, a fairly strong rally began, which could be the start of a new impulsive trend. At this stage, the first wave has formed, so a corrective wave 2 or b is expected. Afterward, Bitcoin's upward movement is likely to resume, at least as part of wave c.

The news background has supported Bitcoin for quite some time, fueled by a steady stream of updates about new investments from institutional traders, certain governments, and pension funds. However, Trump and his policies have driven some investors out of the market. Still, with the U.S. stock market and bond markets currently in decline, investors may turn to Bitcoin — which is independent of Trump's decisions. Once again, Bitcoin is becoming a "crisis hedge," so a new rally in the digital asset is possible.

The BTC/USD price has significantly increased over the past few weeks. I did not expect to see such strong growth, but it must be acknowledged that under current conditions, Bitcoin is serving as a capital preservation tool. Just think about it: stock markets have stopped falling, but they remain unstable and volatile. Few now expect Donald Trump to introduce new tariffs or raise existing ones — but we are, after all, talking about Trump. The U.S. President is highly unpredictable and may take actions that only worsen the economic situation.

Market participants are used to believing that a country's president or central bank chief should make decisions that promote economic growth, reduce unemployment, or lower inflation — in other words, serve the economy's and the state's best interests. Therefore, they don't expect moves that would clearly worsen the situation. However, Trump has shown he is capable of such actions. Of course, his decisions are often made under the premise of "things must get worse before they get better." But whether they will actually improve remains unknown. In the meantime, capital needs protection from devaluation now — while things are already getting worse.

That's why Bitcoin is once again in demand. In my view, it's too early to speak of a full-fledged new bullish trend, but even forming a corrective wave b before the next leg up is already proving problematic for the market. Bitcoin is also being strengthened by the falling U.S. dollar. As the dollar weakens, Bitcoin — priced in dollars — becomes more expensive. I wouldn't rule out the possibility that half of Bitcoin's recent gains are simply due to the dollar's decline. But in the end, does it matter why Bitcoin is rising? Given the current situation, I would still expect the formation of a corrective wave b and would look for buying opportunities there. But I still do not believe in a quick return to the $110,000 mark.

Based on the BTC/USD analysis, I conclude that the formation of a bearish trend segment is ongoing. Everything currently points to a complex, multi-month correction. For that reason, I have previously advised against buying cryptocurrency — and now I recommend it even less. Given the current outlook, I consider searching for short opportunities to be the better option. At the moment, Bitcoin is likely in the process of forming a corrective upward wave set, which does not yet appear complete. Once wave c is formed, I would begin to look for selling opportunities with targets near the $75,000 level.

On the higher wave scale, a five-wave upward structure is visible. Currently, the market appears to be forming a corrective or full-fledged downward structure.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum spent the day in a sideways channel, although signs of active selling during yesterday's American session raise certain questions about the trading instruments' further short-term upward prospects

Bitcoin is under pressure once again. On Monday, the price of the world's largest cryptocurrency dropped below $95,000, and this is more than just another correction. It's a symptom

Bitcoin and Ethereum buyers have achieved new key resistance levels, indicating strong demand. Bitcoin has reached the $97,400 level, while Ethereum has approached the $1,870 mark. Meanwhile, the buzz around

With the appearance of the Bullish 123 pattern followed by the appearance of the Bullish Ross Hook which managed to break the previous downtrend line and the Stochastic Oscillator indicator

Amid a steady outflow of coins from exchanges, renewed futures market activity, and a rise in short-term holders, the world's largest cryptocurrency lays the groundwork for a potential move that

While financial mainstream market participants are mulling over recession risks and interest rates, Bitcoin is steadily gaining ground. April has turned out to be the strongest month for the leading

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.