See also

29.04.2025 10:59 AM

29.04.2025 10:59 AMAt the close of the previous regular session, U.S. stock indices ended mixed. The S&P 500 rose by 0.06%, while the Nasdaq 100 fell by 0.10%. The Dow Jones Industrial Average increased by 0.08%.

Asian indices climbed to their highest level in a month amid expectations that President Donald Trump will ease the impact of tariffs and possibly lift some of them — including those on automobiles — boosting hopes for a further reduction in trade tensions.

Futures on the S&P 500 index rose after a White House official announced that import tariffs on cars would be postponed. Hyundai Motor Co. led gains among South Korean automakers. The U.S. dollar index strengthened by 0.2%, while gold fell by 1.1%.

The five-day rally in U.S. equities, which began last week, marks the longest stretch of gains since November of last year. However, this week will be a major test, with upcoming data on the labor market, inflation, and economic growth. Don't forget about earnings reports from some of the largest tech companies. For now, calm prevails as the Trump administration's trade policy appears to be softening.

That said, caution is still advised — especially when it comes to portfolio positioning. Every day brings conflicting news surrounding tariff policy. Therefore, a more cautious and wait-and-see approach is currently the best strategy.

Tariff policy continues to set the tone and direction of the market, frequently appearing in headlines. Recently, Treasury Secretary Scott Bessent stated that the U.S. has put China on the back burner as it seeks trade agreements with 15–17 other countries. He also said that Beijing must take the first step toward de-escalating the tariff battle. Simultaneously, the European Union is actively pursuing trade negotiations with various countries, aiming to diversify its economic ties and strengthen its global position. Issues such as standards, regulations, and intellectual property are becoming key discussion points, shaping the future of international economic relations.

Recently, the Communist Party of China declared that the U.S. must cease its improper actions regarding tariffs. Chinese Foreign Minister Wang Yi also stated that if countries remain silent, compromise, and back down, it will only lead to another deadlock. Chinese authorities believe that the U.S. tariff hikes have disrupted the global air transport market, severely impacting both Chinese airlines and Boeing Co. However, according to Goldman Sachs, Chinese buyers remain rational and have avoided large-scale boycotts of American goods despite the ongoing U.S.-China trade conflict.

In commodities, oil stabilized after a drop caused by signs of strain in the U.S. economy. Gold edged slightly lower ahead of this week's key economic data.

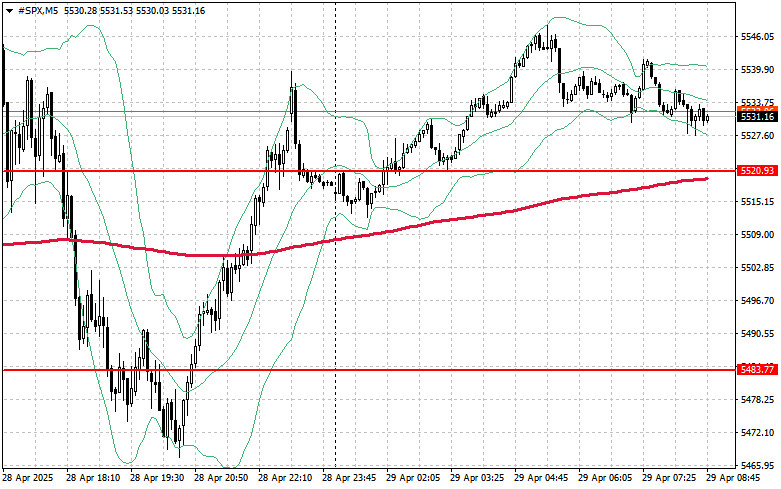

Technical Outlook for the S&P 500

Today, the main goal for buyers is to break through the nearest resistance at $5520. Achieving this would support further growth and open the way for a push toward $5552. An equally important objective for bulls is to gain control over $5586, which would further solidify buyer positions.

In the event of a downward move amid declining risk appetite, buyers must assert themselves near the $5483 level. A break below this level would quickly drag the instrument back to $5443 and pave the way toward $5399.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.