See also

28.04.2025 07:07 PM

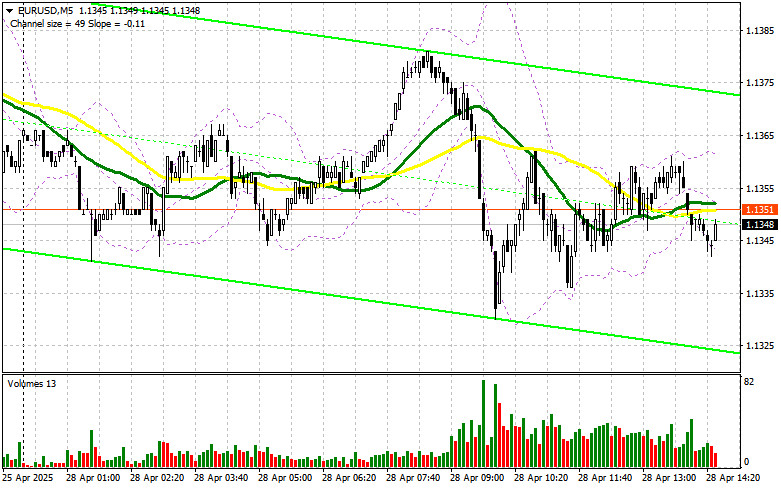

28.04.2025 07:07 PMIn my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there was an upward move, the pair never tested 1.1391, so I stayed out of the market. The technical picture for the second half of the day has been only slightly revised.

Traders ignored the economic data during the first half of the day, which was expected, keeping trading within a narrower sideways channel than anticipated. Unfortunately, there are no significant U.S. data releases scheduled for the second half of the day, meaning market volatility could decline even further. For this reason, I would not expect any sharp or directional moves. Perhaps comments from Trump or White House representatives regarding trade tariffs could impact the dollar, so it's better to focus on that.

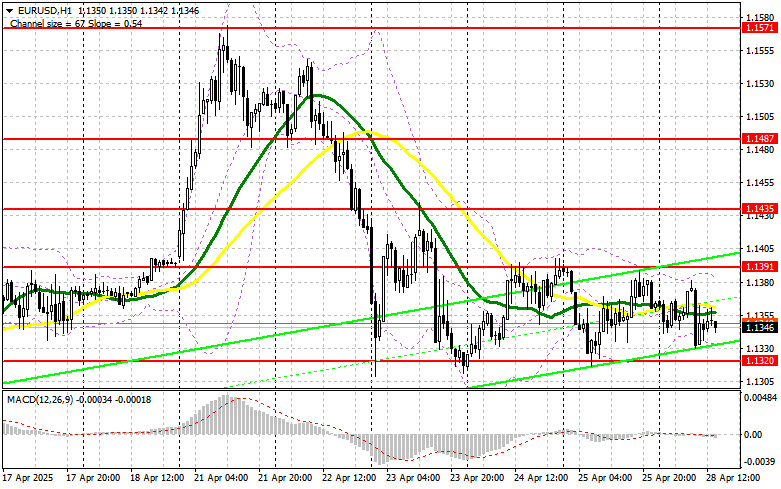

If the pair declines, only a false breakout around the new support at 1.1320 will serve as a reason to buy EUR/USD, aiming for a continuation of the bullish market trend with a target of retesting 1.1391. A breakout and retest of this range will confirm a correct entry point for a move toward 1.1435. The ultimate target remains at 1.1487, where I will be taking profit. If EUR/USD declines and there's no buying interest around 1.1320, the pair will break out of the sideways channel, possibly leading to a stronger downward move. In that case, bears could push the pair down to 1.1267. Only after a false breakout there would I consider buying the euro. Alternatively, I will plan to open long positions immediately after a rebound from 1.1206, aiming for a 30–35 point intraday correction.

If the euro rises in the absence of U.S. data, bears will have to assert themselves around 1.1391, which was not reached during the first half of the day. Slightly below are the moving averages, which favor sellers. Only a false breakout at this level will provide a reason to enter short positions targeting the 1.1320 support. A breakout and consolidation below this range will be a suitable selling opportunity toward the 1.1267 area, representing a fairly strong correction. The final target will be the 1.1206 level, where I plan to take profits. If EUR/USD continues to rise in the second half of the day and bears fail to defend 1.1391, buyers could push the pair to update 1.1435. I plan to sell there only after an unsuccessful consolidation. I also plan to open short positions immediately after a rebound from 1.1487, aiming for a 30–35 point downward correction.

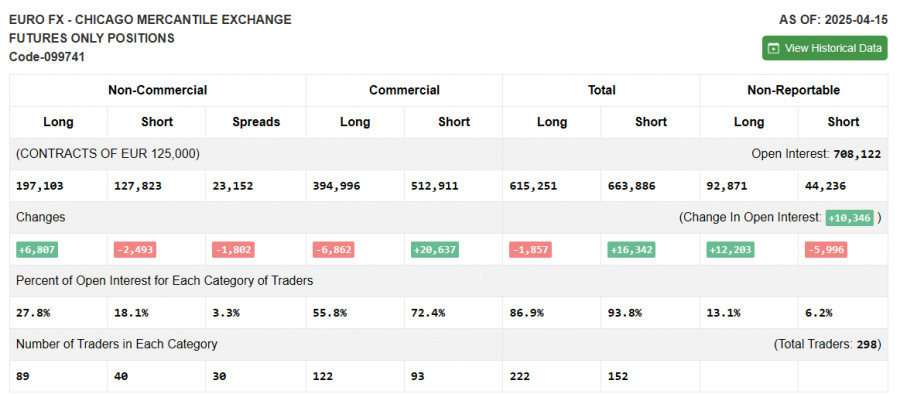

COT Report (Commitment of Traders) for April 15

The COT report showed an increase in long positions and a reduction in shorts. Given that the European Union and the U.S. have made no progress on a trade deal, the euro continues to strengthen while the dollar weakens. According to the COT data, non-commercial long positions rose by 6,807 to 197,103, while short non-commercial positions fell by 2,493 to 127,823. As a result, the gap between long and short positions narrowed by 2,493.

Indicator Signals:

Moving Averages: Trading is taking place around the 30- and 50-day moving averages, indicating market uncertainty.

Note: The periods and prices of moving averages are considered by the author based on the H1 timeframe and differ from the general definition of classical daily moving averages on the D1 timeframe.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.1345 will serve as support.

Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are no macroeconomic events scheduled for Friday. Fundamental developments will also be limited, but it's entirely unclear which factors influence price formation. The pound and the euro had reasons

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its choppy decline within the sideways channel and failed to break out, unlike the EUR/USD pair

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair unexpectedly exited the sideways channel where it had been trading for three weeks. This occurred during

On Thursday, the GBP/USD currency pair continued trading within the sideways channel, visible in the hourly timeframe. Two central bank meetings — each of which could be considered favorable

The EUR/USD currency pair exhibited a particularly interesting trend on Thursday. As a reminder, the FOMC meeting results were announced Wednesday evening, and we once again considered them hawkish. It's

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair showed no notable movements on Wednesday. After Jerome Powell stated the need for more time to assess the full

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade within the sideways channel on Wednesday, which is visible on the hourly timeframe

On Wednesday, the GBP/USD currency pair continued trading within a sideways channel, clearly visible on the hourly timeframe. There was virtually no movement throughout the day, and no fundamental

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.