See also

28.04.2025 01:05 AM

28.04.2025 01:05 AMThe United States is facing an important week, but it is unlikely to be important for the U.S. dollar. Significant reports on the labor market, job openings, unemployment, and GDP and ISM business activity data will be released this week. Therefore, we might expect market reactions and intense movements. However, I highly doubt that we will see them. When a similar set of economic data was released in the U.S. a month ago, the market practically ignored it. Both instruments have been stagnant for almost three weeks, and they are awaiting new decisions from Donald Trump. Consequently, the labor market and unemployment data might also be overlooked.

At this point, there's not much more to say about the dollar. There will be a few important reports that may be ignored. What and when Donald Trump decides regarding tariffs remains unknown. Recently, the U.S. President has been focusing more on the conflict in Ukraine, assuring that a peace agreement might be signed soon. Undoubtedly, this is a vital topic for the entire world, as it could mean one less military conflict. If only India and Pakistan hadn't started their own conflict this week.

The primary focus should still be on Trump, as he remains the key market driver. I believe that over time, Trump will try to find a way out of the situation he created, but there's no room left to lower tariffs further for 75 countries — they are already at minimal levels. Negotiations with China are not underway, so there's no reason to lower tariffs for Beijing either. At the moment, I don't see what could drive demand for the U.S. dollar in the new week.

Based on the analysis of EUR/USD, I conclude that the instrument continues to build a new upward trend segment. Donald Trump's actions reversed the previous downward trend. Therefore, the wave structure will entirely depend on the position and actions of the US president for the foreseeable future. It is essential always to keep this in mind. Based solely on the wave structure, I expected constructing a three-wave correction within wave 2. However, wave 2 has already been completed, taking a single-wave form. The construction of wave 3 of the upward segment has begun, and its targets may extend to the 1.2500 area ("the 25th figure"). Achieving these targets will depend solely on Trump, and the internal structure of this wave is already becoming rather "awkward."

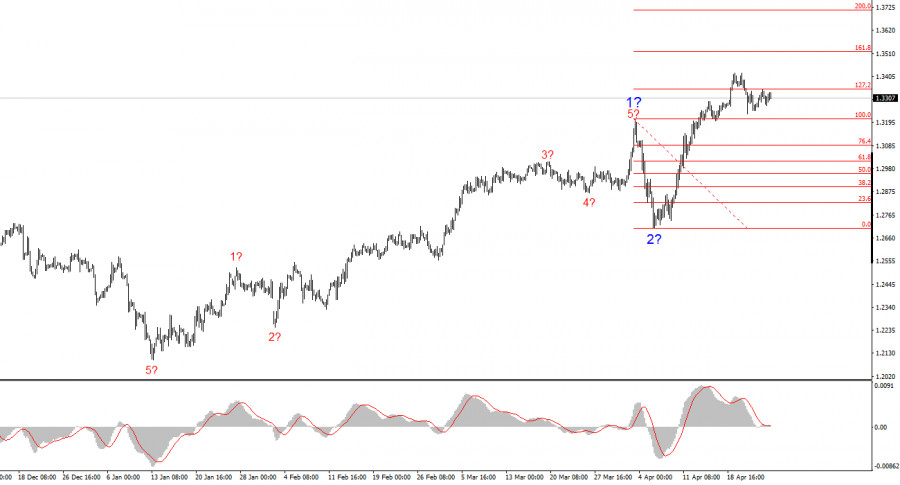

The wave structure of the GBP/USD instrument has transformed. Now, we are dealing with an upward, impulsive trend segment. Unfortunately, under Donald Trump, markets may experience many shocks and reversals that do not conform to any wave structure or technical analysis. The supposed wave 2 has been completed, as quotes have exceeded the peak of wave 1. Therefore, the construction of an upward wave 3 should be expected, with immediate targets at 1.3345 and 1.3541. Ideally, it would be good to see a corrective wave 2 within wave 3, but the dollar would need to rise for that to happen. And for that, someone would have to start buying it.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The turbulence of recent months, driven by Donald Trump's actions and the release of fresh U.S. economic data, has done little to help investors understand the true direction of asset

The GBP/USD currency pair failed to show any decisive movement on Friday—it neither rose nor fell significantly. Many analysts interpreted the U.S. labor market and unemployment data as positive simply

The new week promises to be informative for EUR/USD traders. Most notably, the next Federal Reserve meeting, scheduled for May 6–7, will determine the central bank's future course of action

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.