See also

28.04.2025 03:51 AM

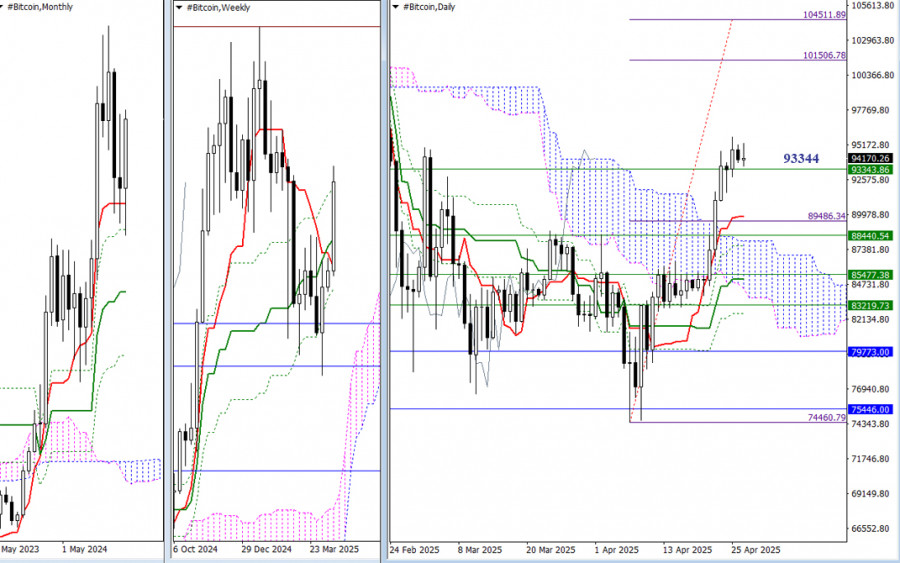

28.04.2025 03:51 AMCurrently, bullish players are attempting to change the situation and achieve bullish optimism for April. Last week, resistance at the final level of the weekly Ichimoku cross (93344) was tested, and on the daily timeframe, the price managed to consolidate above this level, closing the week higher. The elimination of the weekly "dead cross" will open up new prospects, which in the current situation can be noted at the levels of 101507–104512 (daily target for a cloud breakout) and 109986 (the last historical all-time high).

Failure by the bulls and a rebound from the encountered resistance (93344) will return the market to the zone of attraction and influence of the weekly and daily Ichimoku crosses, as well as the daily cloud. All these levels are currently concentrated around 89827–88441–85477–83220. This support zone is further reinforced by monthly levels 79774 (monthly short-term trend) and 75446 (monthly Fibonacci Kijun).

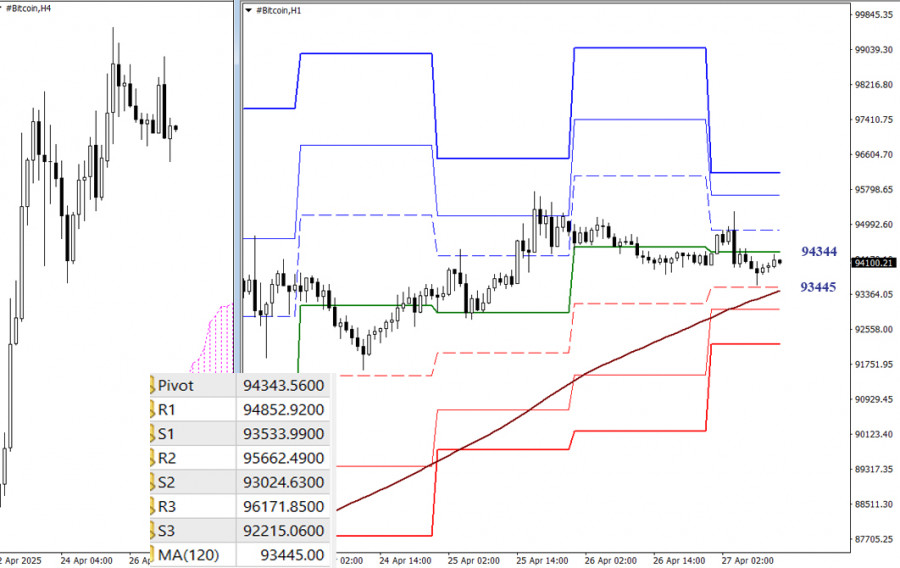

On the lower timeframes, the advantage still belongs to bullish players, but they are currently within a downward corrective zone and close to testing the weekly long-term trend (93445). A breakout and reversal of the trend could change the current balance of power. Classic Pivot levels provide additional intraday reference points. Bullish players will focus on resistances, while bearish players will monitor the classic Pivot supports.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin's price is hovering near a psychologically significant threshold, with market participants bracing for another upward surge or a sudden reversal that could erase short-term bullish expectations. More chart

Bitcoin and Ethereum spent the day in a sideways channel, although signs of active selling during yesterday's American session raise certain questions about the trading instruments' further short-term upward prospects

Bitcoin is under pressure once again. On Monday, the price of the world's largest cryptocurrency dropped below $95,000, and this is more than just another correction. It's a symptom

Bitcoin and Ethereum buyers have achieved new key resistance levels, indicating strong demand. Bitcoin has reached the $97,400 level, while Ethereum has approached the $1,870 mark. Meanwhile, the buzz around

With the appearance of the Bullish 123 pattern followed by the appearance of the Bullish Ross Hook which managed to break the previous downtrend line and the Stochastic Oscillator indicator

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.