See also

16.04.2025 07:03 AM

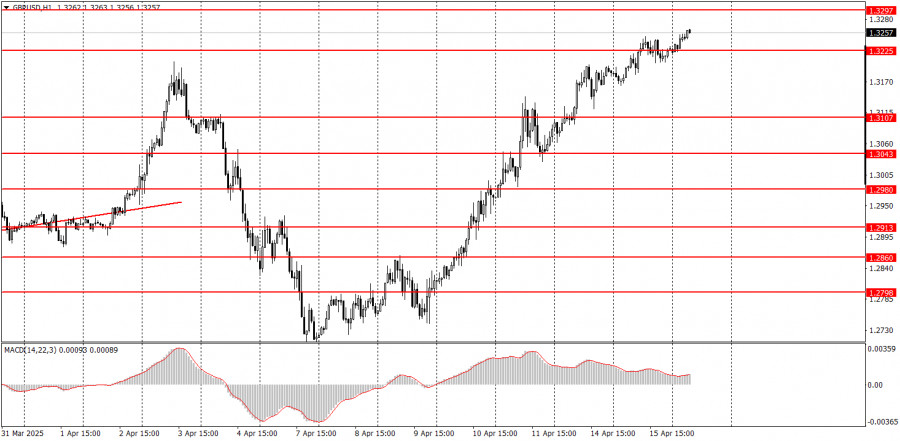

16.04.2025 07:03 AMThroughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason to keep rising. We've said several times that there's little logic in market movements right now — and that's something to keep in mind. Yesterday, Donald Trump refrained from introducing new tariffs. A few macroeconomic reports were published in the UK, but they couldn't reasonably be interpreted in favor of the pound. The unemployment rate remained unchanged, wages rose by 5.6%, and jobless claims were only slightly below forecasts.

Formally, the reports weren't worse than expected by traders, but in reality, the deviations were minor, and the key unemployment report showed no change at all. Yet the pound gained another 40 pips on that data — adding another 40 overnight.

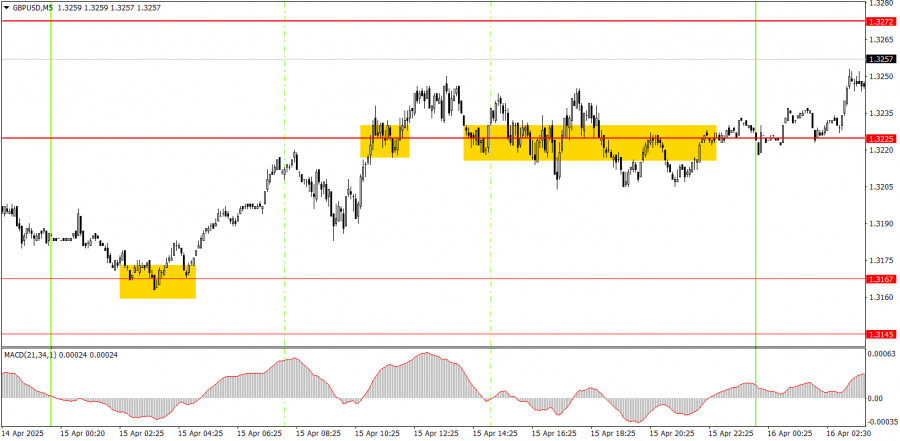

On Tuesday, several trading signals formed in the 5-minute time frame, but they all left much to be desired. The 1.3325 level was ignored throughout the day. The pair can't show any correction; it rises or moves sideways. The price action is entirely non-technical and illogical.

In the hourly time frame, GBP/USD should have already started a downward trend, but Trump continues to do everything to bring down the dollar. Since the official start of the global trade war, we've stopped making long-term forecasts for currency pairs. The market remains under Trump's control and is subject to his decisions. Trump announces new tariffs — the dollar drops. Trump raises tariffs — the dollar drops. Even a pause in escalation leads to a flat market, or the dollar still drops.

On Wednesday, GBP/USD may remain highly emotional. Predicting where the pound and dollar will move today is nearly impossible. The dollar continues to decline, even though no new trade war updates have emerged. The uptrend has continued overnight without a break.

On the 5-minute TF it is now possible to trade at 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3365. Inflation data for March is scheduled to be released in the UK on Wednesday, and traders may again interpret the report in favor of the pound. Even if the data is weak, the dollar may only strengthen briefly before resuming its decline.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair experienced significant growth, despite no clear catalyst behind it. On Monday, the dollar rose on specific grounds

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair nearly fully recovered from Monday's decline. As reality has shown, strong reasons are required

On Tuesday, the GBP/USD currency pair easily recovered from the losses it experienced on Monday. Once again, we observe that the British pound rises more strongly than the euro

The EUR/USD currency pair effortlessly regained most of Monday's losses. On Monday, it was reported that import tariffs between China and the U.S. had been reduced, which can legitimately

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair also collapsed sharply, though it's more accurate to say the U.S. dollar showed strong growth. In recent

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair plunged. Traders have likely gotten used to the idea that the U.S. dollar can't show strong

On Monday, the GBP/USD currency pair experienced a significant decline, which was driven by progress in negotiations between China and the United States. The logic here is strikingly simple

The EUR/USD currency pair showed strong downward movement on Monday, which hasn't happened in quite a while. However, the reasons behind the sharp and sudden surge in the U.S. dollar

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.