See also

15.04.2025 09:08 AM

15.04.2025 09:08 AMBitcoin strengthened its position fairly well, nearly reaching the 86,000 level. Ethereum also showed gains but lost them by the end of the U.S. trading session.

With easing tensions over U.S. tariffs and a softer approach from Trump, who continues to make concessions, the cryptocurrency market is showing signs not necessarily of a recovery but at least of a much-needed pause. This break is giving traders some breathing room after recent sell-offs.

Meanwhile, according to the latest report, Strategy purchased an additional 3,459 BTC at $82,618. The company now holds 531,644 BTC, which accounts for about 2.52% of the current supply. Since 2020, the firm has spent $35.92 billion, with an average purchase price of $67,556 per BTC.

This move underscores the company's confidence in cryptocurrency's long-term potential as a reliable store of value amid economic uncertainty. Increasing bitcoin holdings can also be seen as an effort to diversify their investment portfolio and hedge against inflation, which has shown persistent growth in recent years. However, such a large allocation to a single asset also carries certain risks.

As for intraday strategy in the crypto market, I will continue to rely on buying during major pullbacks in BTC and ETH, anticipating the continuation of a medium-term bullish trend still intact.

Details for short-term trading strategies are outlined below.

Scenario #1: I plan to buy Bitcoin today at the entry point around $85,800, targeting a rise to $86,800. I will exit long positions near $86,800 and sell immediately on the pullback.

Important: Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: I will also consider buying from the lower boundary at $85,000 if there's no market reaction to a breakout downward. The targets would be $85,800 and $86,800.

Scenario #1: I plan to sell Bitcoin at $85,000, targeting a decline to $84,100. I will exit short positions at $84,100 and immediately buy on the bounce.

Important: Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Selling from the upper boundary at $85,800 is also an option if there's no reaction to a breakout, targeting $85,000 and $84,100.

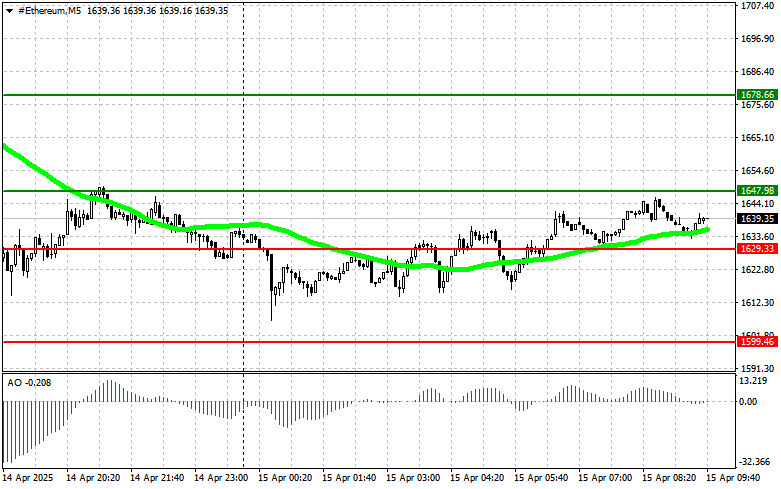

Scenario #1: I plan to buy Ethereum today at $1,647, targeting a rise to $1,678. I will exit long positions at $1,678 and sell on the pullback.

Important: Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buying from the lower boundary at $1,629 is valid if there's no downside breakout reaction, aiming for $1,647 and $1,678.

Scenario #1: I will sell Ethereum at $1,629, targeting a drop to $1,599. I will exit shorts at $1,599 and buy on the bounce.

Important: Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling from the upper boundary at $1,647 is also valid if there's no reaction to the breakout, targeting $1,629 and $1,599.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has successfully pushed above $90,000, while Ethereum added more than 10% in just one day, rebounding to $1800. The main catalyst was Donald Trump's statement yesterday, clarifying that firing

Bitcoin and Ethereum, having spent the entire weekend moving sideways within a range, surged sharply during today's Asian session. The rally was triggered by rumors that U.S. Federal Reserve Chair

Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However

After successfully exiting the Ascending Broadening Wedge pattern on the 4-hour chart of the Litecoin cryptocurrency followed by the appearance of Divergence between the Litecoin price movement and the Stochastic

Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two markets

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.