See also

04.04.2025 05:34 AM

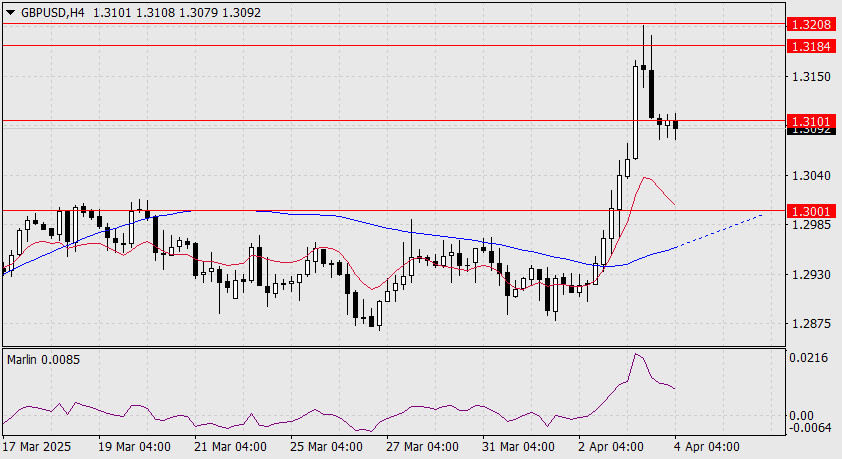

04.04.2025 05:34 AMBy the end of yesterday, the British pound had risen by 92 pips, with a peak gain of 204 pips. The price reached the target range of 1.3184–1.3208 before retreating to the support level 1.3101. This is a convenient area to await today's U.S. employment data, as it sits near the midpoint of the 1.3001–1.3208 range.

The forecast for new nonfarm jobs in March is 137,000, down from 151,000 in February. Unemployment is expected to remain unchanged at 4.1%.

If the data comes close to forecasts, the pound could decline due to the relative speed at which U.S. bond yields are falling compared to those in the UK. U.S. 5-year Treasury yields are at 3.40%, while their UK counterparts yield 4.10%.

The nearest downside target for the pound is 1.3001. Additionally, the Marlin oscillator is rising much more slowly than March 3–6, signaling a possible transition to either consolidation or a reversal. A break below 1.3001 would push the oscillator into negative territory, opening the way to the target range of 1.2816–1.2847.

On the H4 chart, the price is beginning to consolidate below the 1.3101 level. Marlin is declining, indicating a bearish bias. A drop below 1.3001 would also signify a break of the MACD line. As of this morning, the outlook is bearish. We await the release of U.S. employment data. Weak figures followed by price growth could lead the pound toward the target level of 1.3311.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Early in the American session, the EUR/USD pair is trading around 1.1178, below the 200 EMA, and below the 21 SMA under bearish pressure. Having reached the 1.1270 area

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.