See also

26.03.2025 06:55 AM

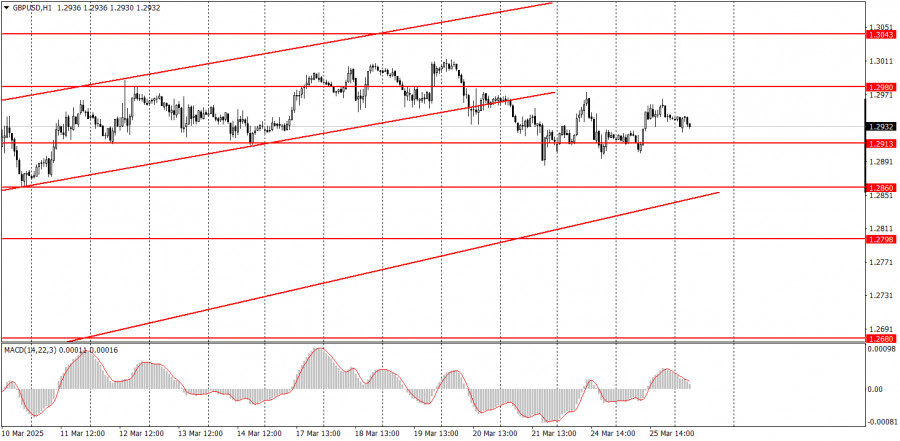

26.03.2025 06:55 AMOn Tuesday, the GBP/USD pair traded with a slight increase, but the overall movement of recent weeks increasingly resembles a flat market. The assumed sideways channel has no clearly defined boundaries, but the chart shows that the price moves sideways. As a result, the price rose yesterday without any particular reason, and today, it may just as easily fall. The uptrend is in place, as indicated by the ascending trendline. Therefore, a resumption of the British pound's growth is possible, even though there are no valid reasons for it apart from Donald Trump. However, if the market only considers that factor, what's the point of denying the move? No significant reports were released in the U.S. or the UK yesterday, so there is nothing to analyze fundamentally.

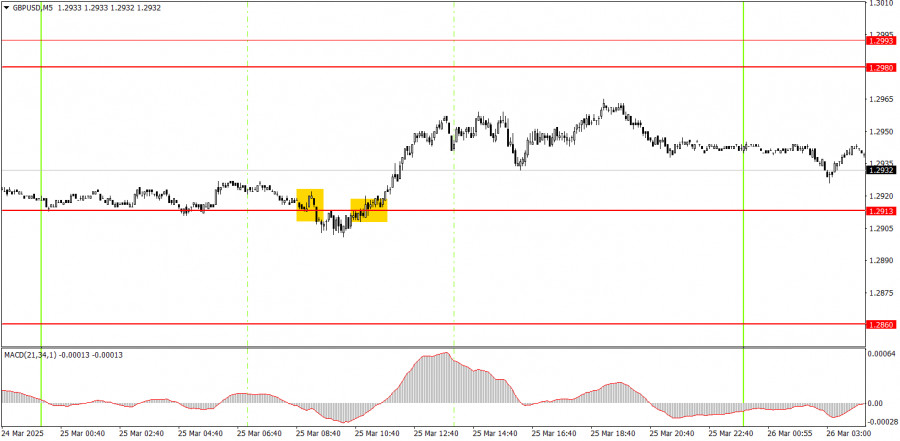

On the 5-minute timeframe, two trading signals were formed on Tuesday near the 1.2913 level. Let's recall that this is not the most important or strongest level, and the price has been moving sideways for several weeks. Any levels or lines can be easily ignored within such a sideways movement. Nevertheless, while the first sell signal was false, the second buy signal was successful. The first signal resulted in a small loss for novice traders, but the second brought a profit of about 25–30 pips.

On the hourly timeframe, the GBP/USD pair should have started a downtrend long ago, but Trump is doing everything to prevent that. In the medium term, we still expect the pound to fall with a target of 1.1800. However, it's unclear how long the dollar will continue to collapse "because of Trump." Once this movement ends, the technical picture on all timeframes could change dramatically, but long-term trends still point south. The British pound did not grow without cause, but the growth appeared excessive and irrational once again.

The GBP/USD pair may decline on Wednesday as the hourly chart's technical setup favors that direction. The pound is again overbought and unjustifiably expensive. At the same time, the movement may remain sideways in nature.

On the 5-minute timeframe, the following levels can be used for trading: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107. On Wednesday, the UK is scheduled to release the second estimate of February inflation, and in the U.S., a report on durable goods orders will be published. The UK inflation report may provoke a market reaction only if it differs from the first estimate.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are no macroeconomic events scheduled for Friday. Fundamental developments will also be limited, but it's entirely unclear which factors influence price formation. The pound and the euro had reasons

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its choppy decline within the sideways channel and failed to break out, unlike the EUR/USD pair

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair unexpectedly exited the sideways channel where it had been trading for three weeks. This occurred during

On Thursday, the GBP/USD currency pair continued trading within the sideways channel, visible in the hourly timeframe. Two central bank meetings — each of which could be considered favorable

The EUR/USD currency pair exhibited a particularly interesting trend on Thursday. As a reminder, the FOMC meeting results were announced Wednesday evening, and we once again considered them hawkish. It's

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair showed no notable movements on Wednesday. After Jerome Powell stated the need for more time to assess the full

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade within the sideways channel on Wednesday, which is visible on the hourly timeframe

On Wednesday, the GBP/USD currency pair continued trading within a sideways channel, clearly visible on the hourly timeframe. There was virtually no movement throughout the day, and no fundamental

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.