See also

12.03.2025 12:36 PM

12.03.2025 12:36 PMS&P 500

Overview for March 12

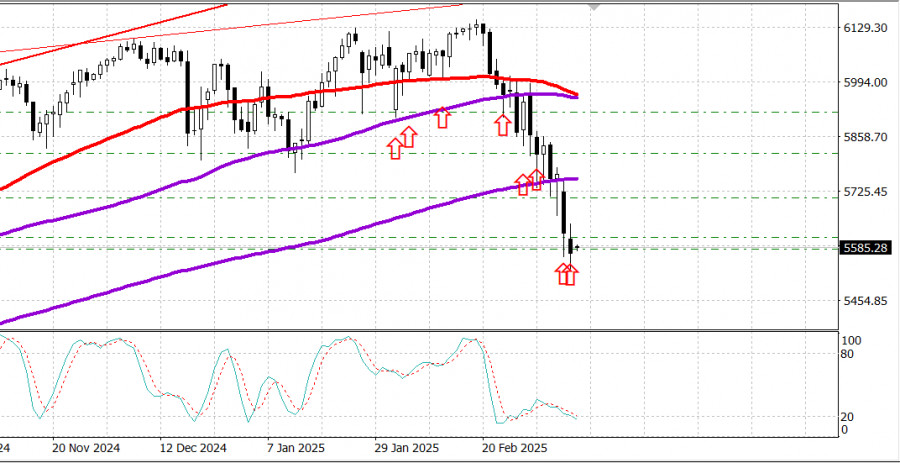

The US market is experiencing a strong correction.

US major indices on Tuesday: the Dow -1.1%, the NASDAQ -0.2%, the S&P 500 -0.8%, the S&P 500: 5,572, trading range: 5,400 - 6,000.

The stock market once again recorded losses. The market remains in a steady downward trend as tensions from Trump's trade wars intensify and growth concerns rise.

This became evident today after President Trump announced that the US would impose a 50% tariff on Canadian steel and aluminum imports starting Wednesday, instead of the initially announced 25%. The escalation followed Ontario's countermeasure, which imposed a 25% tariff on electricity exports to the US in response to the originally planned 25% tariff on Canadian imports. Investors were also hit with warnings on corporate earnings from several airlines and retail companies.

Late in the day, however, reports surfaced suggesting that Trump might reconsider and not impose the 50% tariffs on Canada.

Delta Airlines (DAL 46.68, -3.65, -7.3%), American Airlines (AAL 11.46, -1.04, -8.3%), and Southwest Airlines (LUV 30.53, +2.35, +8.3%) lowered their first-quarter revenue forecasts, also citing the negative impact of Trump's trade wars.

Dick's Sporting Goods (DKS 198.97, -12.05, -5.7%) and Kohl's (KSS 9.15, -2.90, -24.1%) disappointed with full-year forecasts after reporting their quarterly results.

The CBOE Volatility Index (VIX) surged above 29.5, indicating the potential for further market declines.

However, not all was bleak in the stock market.

The Nasdaq Composite traded above its previous close, hitting its daily high, supported by a rebound in some large-cap companies. Tesla (TSLA 230.58, +8.43, +3.8%) and NVIDIA (NVDA 108.76, +1.78, +1.7%) stood out as notable gainers.

Economic data review:

February NFIB Small Business Optimism: 100.7; Previous: 102.8

January JOLTS Job Openings: 7.740 million; the previous figure was revised from 7.600 million to 7.508 million.

Wednesday's macroeconomic calendar includes:

7:00 ET: MBA Weekly Mortgage Index (Previous: 20.4%)

8:30 ET: February CPI (Consensus: 0.3%; Previous: 0.5%) and Core CPI (Consensus: 0.3%; Previous: 0.4%)

10:30 ET: Weekly Crude Oil Inventories (Previous: -2.33 million)

14:00 ET: February Treasury Budget (Previous: -$129.0 billion)

Energy:

Brent crude oil: $69.90 - Oil did not fall amid the US market's slide. Likely, the levels of $65-$68 will act as strong support in the medium term.

Conclusion:

The decline in the US market has shown signs of slowing down, and a significant rebound is now possible. Today's key inflation report will be crucial in determining the next market move, so it is essential to assess the market's reaction. It is advisable to hold long positions from support levels. If funds are available, consider cautious buying opportunities.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Buying company shares (#IBM) International Business Machines (IBM) is one of the largest US-based IT companies, engaged in hardware manufacturing, software development, and more. On the daily chart, Monday's session

US benchmark stock indices closed the previous regular session with gains. The S&P 500 rose by 0.43%, the Nasdaq 100 added 0.27%, and the industrial Dow Jones climbed 0.70%. Futures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.