See also

06.03.2025 11:03 AM

06.03.2025 11:03 AMThe S&P 500 found solid ground after the White House decided to exempt the auto industry from the 25% tariffs imposed on Mexico and Canada. Donald Trump and his team are now considering another exception—agricultural products, particularly potash and fertilizers. This move could provide yet another boost for US stocks.

However, the revision of the tariff list was not the only reason for the S&P 500's rebound. Support also came from international markets. Germany plans to create a €500 billion special infrastructure fund and exempt defense spending from fiscal constraints. The European Union is preparing to increase military spending by €800 billion. China has maintained its 5% GDP growth target, signaling further fiscal and monetary stimulus. Countries are bracing for trade wars, which suggests that such conflicts won't completely derail the global economy.

Recession fears grow for the US economy

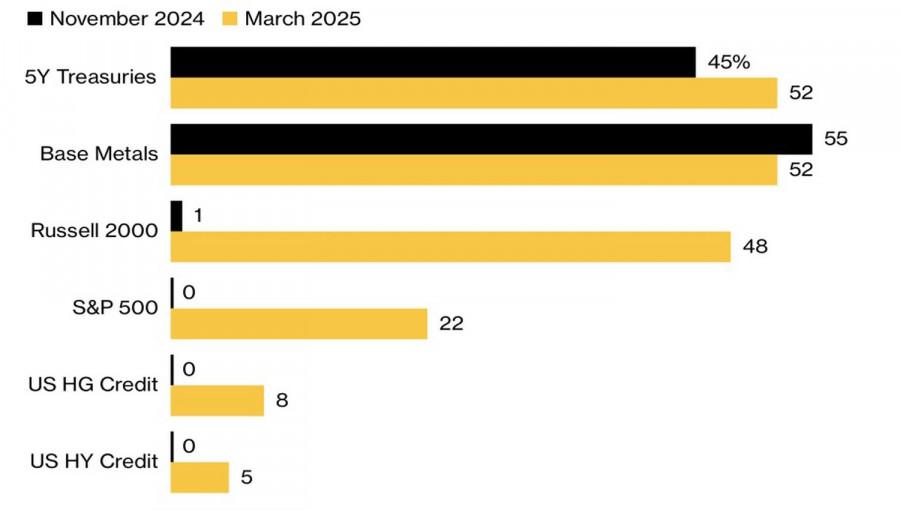

Meanwhile, recession risks for the US economy have resurfaced. According to JP Morgan, the likelihood of a recession in the next 12 months has risen from 17% to 31% since late November. Goldman Sachs estimates that the scenario has increased from 14% in January to 23%.

Recession risks for US stocks

A recession spells trouble for US stocks. Donald Trump's statement that America must endure "some pain" before entering a new Golden Age is not reassuring for investors. The President's rapid tariff rollout has shattered market hopes that his threats were merely a bluff.

At the same time, Elon Musk is also pushing forward aggressively, accelerating efforts to reduce government bureaucracy—a move that could further slow the US economy. A fresh warning sign came with February's ADP employment report, which showed only 77,000 new private-sector jobs, the smallest increase in two years. Fearing the White House's aggressive protectionism, companies are hesitant to expand hiring.

Will Powell step in to support the market?

Investors are now eagerly awaiting US labor market data and Jerome Powell's comments. If Trump refuses to throw a lifeline to the S&P 500, could the Federal Reserve Chairman step in instead?

Signs of a cooling US economy have led futures markets to raise expectations for three rate cuts in 2025, up from two previously. If Powell confirms this outlook, it could trigger another wave of optimism for the S&P 500.

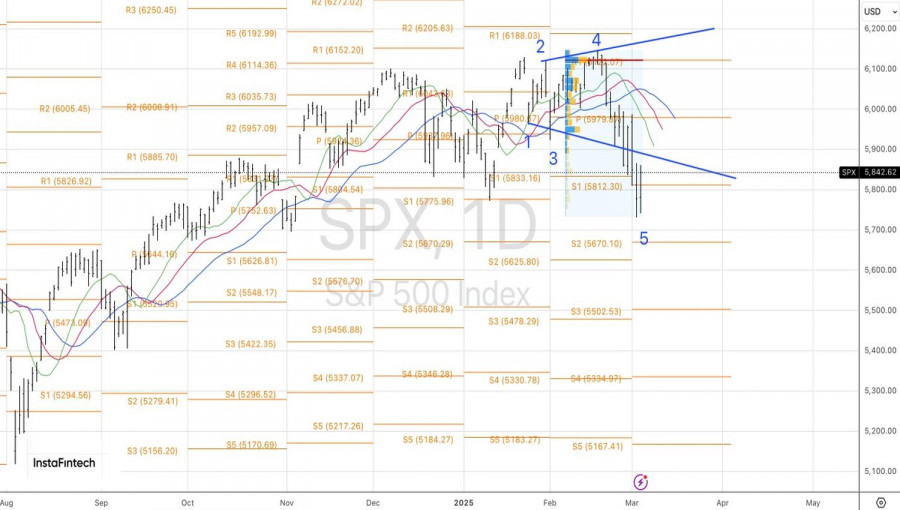

Technical outlook for S&P 500

On the daily chart, the S&P 500 has bounced off the expected support at 5,740, forming a potential bottom. The probability of consolidation is increasing, with the upper border likely near 5,940 or 5,980. A rejection from these levels could signal profit-taking on long positions from the dip and a possible reversal.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.