See also

28.02.2025 10:34 AM

28.02.2025 10:34 AMEarlier reports indicated that the U.S. president had decided to delay the implementation of tariffs on Canada and Mexico from March 4 to April 2, providing a temporary sense of relief to global financial markets. However, yesterday's news once again sent shockwaves through the markets.

On Thursday, Donald Trump reaffirmed his plans to impose a 25% tariff on imports from Mexico and Canada, which will take effect on March 4 without further delay, alongside an additional 10% tariff on Chinese goods. This announcement caused a sharp reversal in the U.S. dollar, which gained strong support against a basket of major currencies on the Forex market. Meanwhile, gold prices and stock indices accelerated their declines, along with cryptocurrency assets, which suffered further losses.

Unfortunately, no. In addition to the escalation of trade wars, U.S. economic data has also weighed heavily on market sentiment. The latest reports on core durable goods orders and total orders volume were mixed, failing to instill confidence in a stronger economic recovery.

Revised Q4 GDP figures confirmed a slowdown in economic growth from 3.1% to 2.3%, aligning with forecasts. However, the most concerning data came from the Core Personal Consumption Expenditures (PCE) Price Index for Q4 2024, which surged from 2.2% to 2.7%, exceeding the 2.5% forecast. The headline PCE also rose from 1.5% to 2.4%, surpassing expectations of 2.3%. While the monthly figure remained flat at 0.0%, compared to a forecasted increase of 0.25% from 0.1%, the overall inflationary trend left a negative impression on investors.

Essentially, these figures suggest that inflation is rising despite an economic slowdown, reinforcing fears of stagflation—a scenario that could be detrimental to the import-dependent U.S. economy.

Key Focus: Upcoming U.S. PCE Inflation Data

Today, market attention will turn to the annual and monthly PCE price index readings from the U.S., which are closely watched indicators of inflation. These figures are typically more relevant than quarterly data due to their freshness and immediate impact on monetary policy expectations.

Consensus forecasts suggest:

If the PCE data meets or exceeds expectations, market sentiment will likely remain negative, reinforcing trends in favor of:

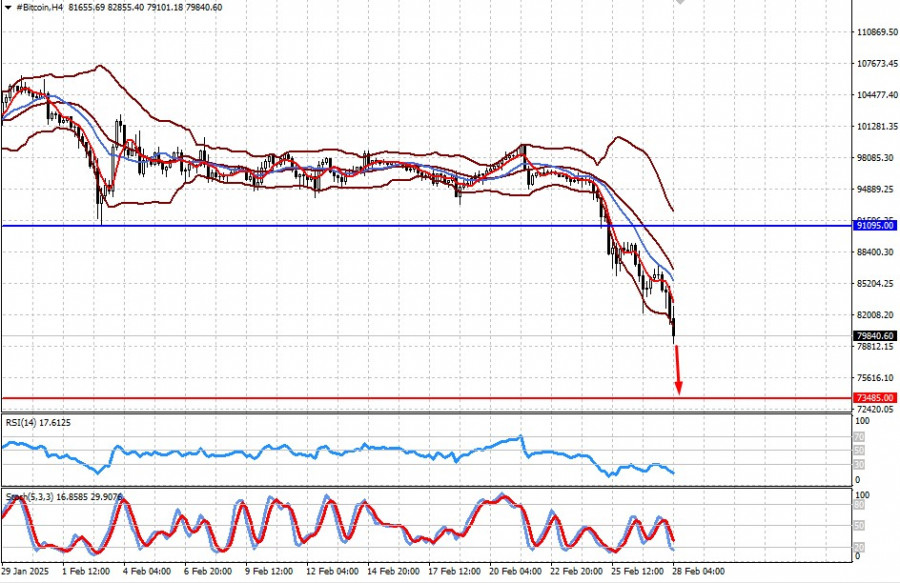

The sharp decline in Bitcoin continues amid widespread market negativity. The next downward target is $73,485, with further losses possible if PCE data signals rising U.S. inflation.

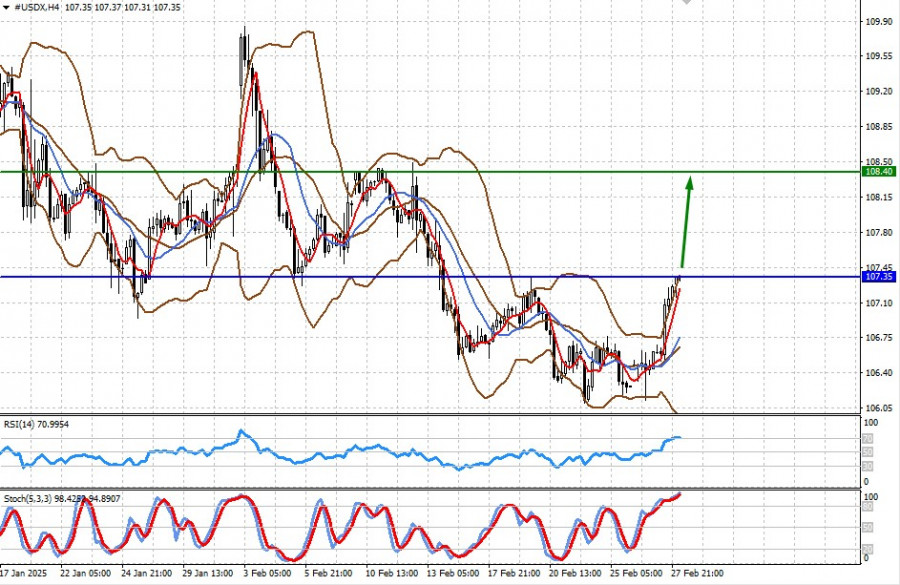

The Dollar Index is testing key resistance at 107.35. Given overall market sentiment, the upward trend is likely to persist. A break above resistance could push USDX towards 108.40 early next week.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

While Europe and parts of Asia continue celebrating Easter and political life has temporarily paused, in the U.S., the "Make America Great Again" trend set by Donald Trump continues

No macroeconomic events are scheduled for Monday—not in the U.S., the Eurozone, Germany, or the U.K. Therefore, even if the market was paying attention to the macroeconomic backdrop, today, there

On Friday, the EUR/USD currency pair made no notable movements whatsoever. This was unsurprising, as Friday marked Good Friday, and Sunday was Easter. Many banks and trading venues were closed

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.