See also

19.02.2025 06:56 PM

19.02.2025 06:56 PMToday, USD/CAD encountered fresh selling pressure, pausing its two-day recovery from a two-month low.

Investor expectations for a March rate cut by the Bank of Canada (BoC) have diminished following a slight acceleration in Canadian consumer inflation. At the same time, renewed U.S. dollar weakness is adding further pressure on USD/CAD.

According to Statistics Canada, the headline Consumer Price Index (CPI) rose by 0.1% in January, while the annual rate stood at 1.9%. The core CPI, which excludes volatile components, increased to 2.1%. Combined with strong labor market data, these figures have led investors to reassess their expectations regarding a rate cut at the BoC's March 12 meeting.Crude oil prices continue to recover, supporting the Canadian dollar. Rising oil prices are being driven by geopolitical tensions and concerns over supply disruptions due to severe winter conditions in the United States.This adds further support to CAD, while the U.S. dollar is weakening amid expectations of further Fed rate cuts following an unexpected decline in U.S. retail sales.

Traders will closely watch the FOMC meeting minutes, which may provide clues about the Federal Reserve's policy outlook. This could have a significant impact on the U.S. dollar and, consequently, USD/CAD. Additionally, oil price movements could create short-term trading opportunities for the pair.

Last week, a break below the 1.4270 support level served as a key bearish signal. Oscillators on the daily chart remain in negative territory, suggesting a potential for further downside. A break below 1.4150 could confirm a bearish trend, leading to a test of 1.4100. If the decline extends further, USD/CAD could challenge the psychological level of 1.4000, though some support may emerge along the way.

On the other hand, if USD/CAD manages to recover above yesterday's high of 1.4215, it will encounter strong resistance in the 1.4255–1.4270 range. A sustained break above this area could trigger a short-covering rally, pushing the pair back toward the 1.4300 round number.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

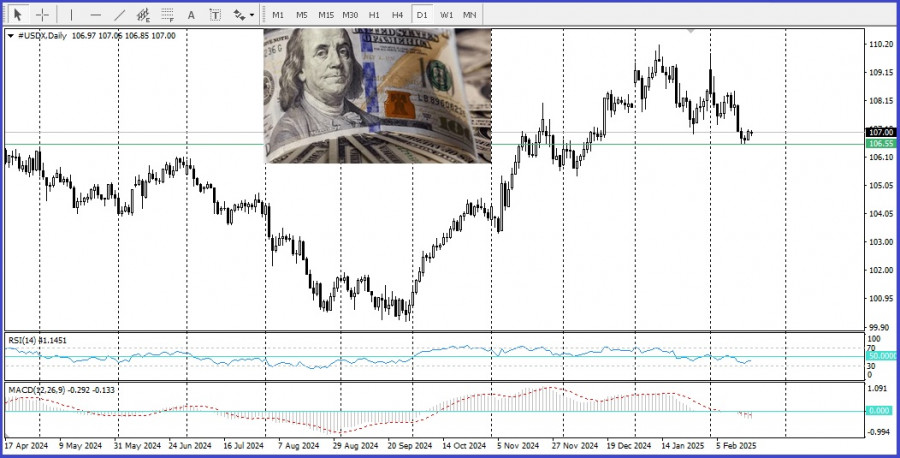

Markets remain tense. The U.S. Dollar Index and the cryptocurrency market are stagnating, caught between opposing forces. Investors are tensely awaiting the outcome of the Federal Reserve's monetary policy meeting

There are very few macroeconomic events scheduled for Tuesday. In the Eurozone and Germany, the second estimate of April's services PMI will be published, but these are unlikely to attract

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.