See also

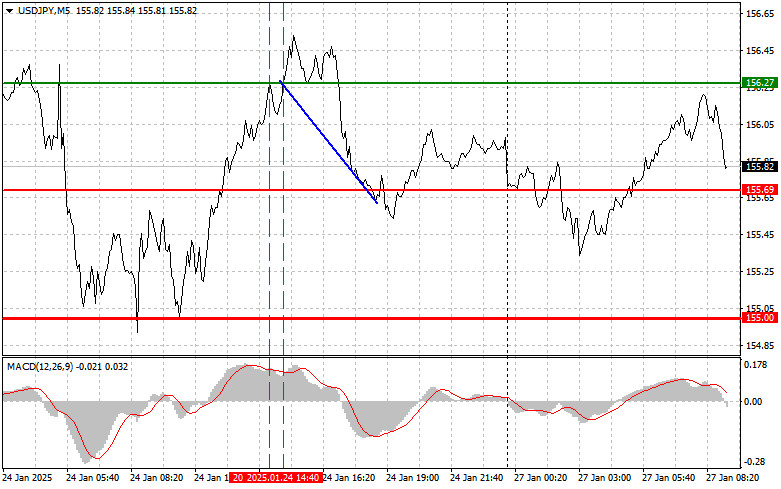

The first test of the 156.27 level occurred when the MACD indicator had risen significantly above the zero mark, limiting its upward potential. For this reason, I refrained from buying the dollar. The second test of 156.27 shortly thereafter coincided with the MACD being in the overbought zone, confirming a valid entry point for selling the dollar. This resulted in a decline of the pair by more than 50 pips.

The yen continues to exhibit high volatility after the Bank of Japan raised the key interest rate to its highest level in 17 years. The Bank's stance on inflation has heightened expectations of further rate hikes, providing support for the yen. However, this support was short-lived, and the dollar quickly recovered some of its losses. Further growth was constrained by weak U.S. data released at the end of last week. As a result, trading is likely to remain within a broad horizontal channel, with the lower boundaries near last week's lows.

Regarding the intraday strategy, I will primarily rely on the execution of Scenario #1 and Scenario #2.

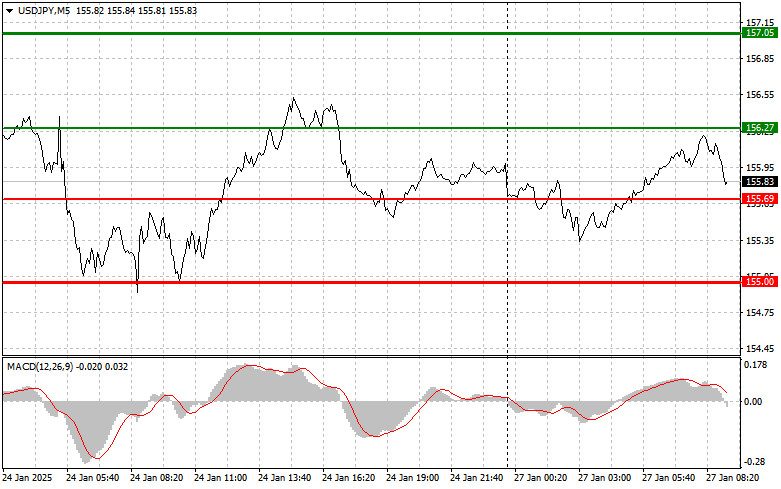

Scenario #1: Today, I plan to buy USD/JPY at the 156.27 level (green line on the chart), targeting a rise to 157.05 (thicker green line). At 157.05, I plan to exit buy positions and open sell positions in the opposite direction (expecting a 30–35-pip downward movement from this level). The best approach is to re-enter buying positions during corrections or significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 155.69 level, with the MACD indicator in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. A rise toward the 156.27 and 157.05 levels can be expected.

Scenario #1: I plan to sell USD/JPY only after the 155.69 level is broken (red line on the chart), likely triggering a quick decline. The key target for sellers will be 155.00, where I plan to exit sell positions and immediately open buy positions in the opposite direction (expecting a 20–25-pip upward movement from this level). Pressure on the pair may return at any moment. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of the 156.27 level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the 155.69 and 155.00 levels can be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.