See also

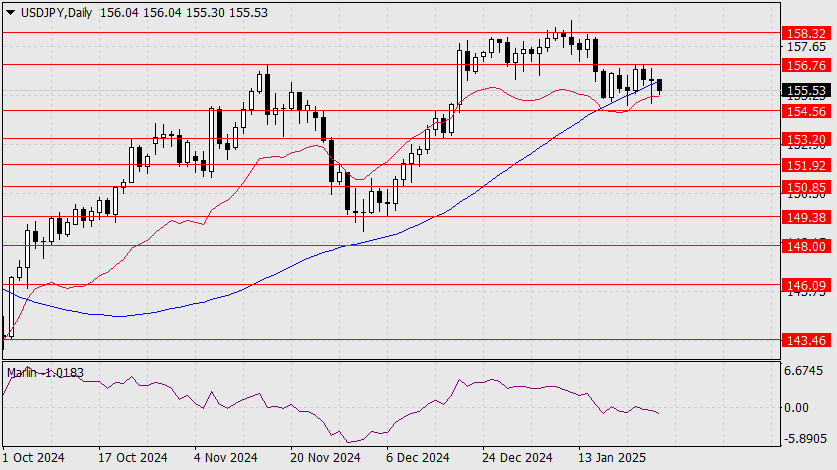

The USD/JPY pair did not experience a downward break following the Bank of Japan meeting; however, a technical reversal occurred at the expected Fibonacci 11th time line date. We now anticipate the price will move toward the target support level at 151.30.

In the longer term, the price may test the lower boundary of the green descending price channel, intersecting with the ascending line of the purple channel (indicated by the gray rectangle). The target level of 145.90 aligns with the lows recorded on September 11, 2023, and February 1, 2024.

On another daily chart, the price has overcome the support of the MACD line and is preparing to breach the balance line. The price will next encounter key target support at 154.56. Additionally, the signal line of the Marlin oscillator has firmly consolidated in negative territory.

On the four-hour timeframe, the price has spent adequate time consolidating in preparation for a breakout below the balance and MACD indicator lines. The Marlin oscillator remains in bearish territory. We anticipate further strengthening of the yen and weakening of the dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.