See also

17.01.2025 07:35 AM

17.01.2025 07:35 AMOn Thursday, the GBP/USD pair exhibited low volatility and mostly moved sideways. This week has brought an unusual amount of notable reports from the UK, but what conclusions can we draw from them? The inflation rate has declined, which is bearish for the GBP since it may prompt the Bank of England to lower interest rates more quickly. Additionally, the UK economy showed slower growth than expected in November, essentially barely registering any growth at all. Industrial production, as is often the case, contracted once again, this time by 0.4%. Given these factors, it is difficult to see a basis for the pound to strengthen. We must also consider the rising inflation in the US, which diminishes the Federal Reserve's inclination to lower the key rate. Overall, it seems that the four most significant reports of the week suggest a potential continuation of the GBP/USD decline.

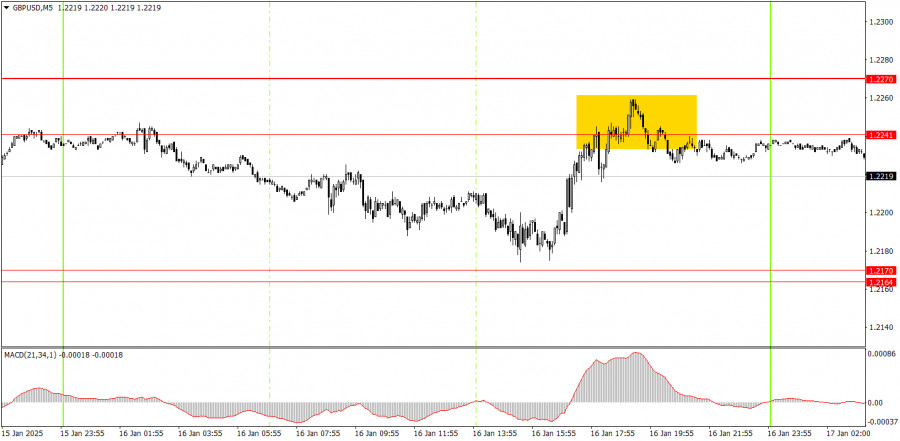

On the 5-minute timeframe, only one sell signal was generated on Thursday, appearing late in the evening and lacking precision. By the middle of the U.S. trading session, the price approached the 1.2241-1.2270 zone but failed to break through. Although there wasn't a clear rebound, the currency pair still has the potential to continue its downward movement today, as the macroeconomic data continue to favor the dollar over the pound. A strong buy signal could have been established near the 1.2170 level; however, the price fell short by just 4 pips.

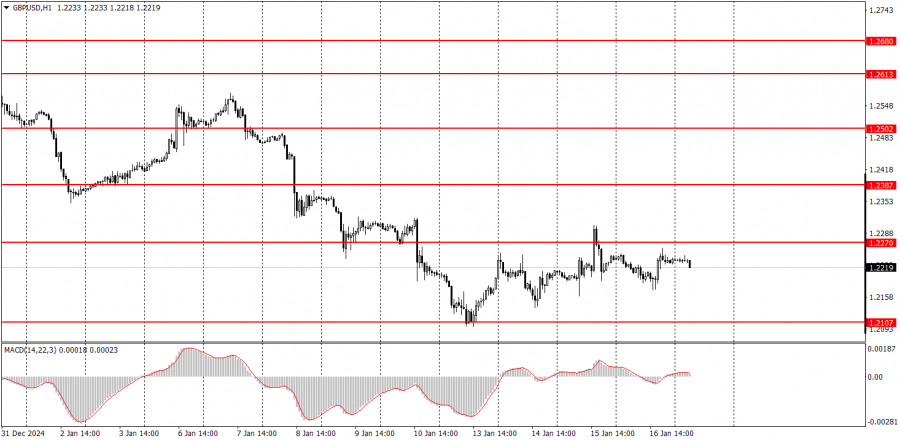

On the hourly chart, GBP/USD is continuing its downward trend. In the medium term, we fully support the scenario of the pound falling toward 1.1800, as this appears to be the most logical outcome. Therefore, we expect further declines, but trading should be guided by technical signals. This week has only reinforced the case for a continued drop in the pound, with no obstacles standing in its way.

On Friday, GBP/USD may experience calm trading, and macroeconomic data is unlikely to enable the pair to overcome the resistance zone between 1.2241 and 1.2270. As a result, a further decline seems more likely.

On the 5-minute timeframe, trading opportunities can be found at the following levels: 1.2010, 1.2052, 1.2089-1.2107, 1.2164-1.2170, 1.2241-1.2270, 1.2316, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, and 1.2791-1.2798. On Friday, the UK will release its retail sales report, which is unlikely to have a significant impact on the pound. In the U.S., two relatively minor reports on industrial production and approved building permits will be released.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair continued its upward movement throughout Wednesday, despite the absence of any specific fundamental reasons. The day before, a U.S

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair experienced upward movement for approximately half of Wednesday. The latest "surge" in the euro was particularly "impressive," although

On Wednesday, the GBP/USD currency pair continued trading with an upward bias for some time, but it resumed its decline in the afternoon. From our perspective, the U.S. dollar

The EUR/USD currency pair continued upward movement on Wednesday, but only briefly. In the afternoon, the euro started to decline, despite the lack of macroeconomic factors supporting such moves. Donald

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair experienced significant growth, despite no clear catalyst behind it. On Monday, the dollar rose on specific grounds

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair nearly fully recovered from Monday's decline. As reality has shown, strong reasons are required

On Tuesday, the GBP/USD currency pair easily recovered from the losses it experienced on Monday. Once again, we observe that the British pound rises more strongly than the euro

The EUR/USD currency pair effortlessly regained most of Monday's losses. On Monday, it was reported that import tariffs between China and the U.S. had been reduced, which can legitimately

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair also collapsed sharply, though it's more accurate to say the U.S. dollar showed strong growth. In recent

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair plunged. Traders have likely gotten used to the idea that the U.S. dollar can't show strong

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.