See also

16.01.2025 07:45 AM

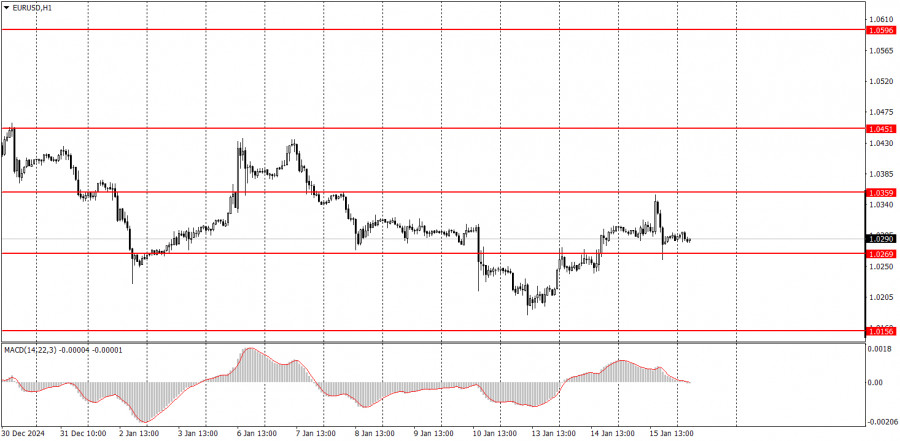

16.01.2025 07:45 AMThe EUR/USD pair exhibited significant volatility on Wednesday. Initially, the price remained stagnant as traders awaited the release of the US inflation report. Following the report, there was a sharp rise in the exchange rate, despite the inflation data not being decisively negative for the dollar. However, within an hour, the euro dropped steeply again. This recent movement suggests that the market has undergone another corrective phase, which may have concluded yesterday.

It is important to note that a downtrend has persisted for the past three and a half months, and a broader downtrend has been in effect for the last 16 years. Therefore, it is reasonable to expect further declines in the pair. Regarding the inflation report, while interpretations may differ, we believe the key takeaway is that the Consumer Price Index has risen for the third consecutive month. This trend raises doubts about the anticipated two rate cuts by the Federal Reserve in 2025, thereby reinforcing the dollar's growth potential.

On the 5-minute timeframe, two clear trading signals emerged on Wednesday. Initially, the pair rebounded from the 1.0334–1.0359 range and then dropped to the 1.0269–1.0277 range. In both instances, a rebound occurred, creating a trading signal. Novice traders could have first opened a short position and subsequently a long one, with both trades resulting in profits. In fact, the long position could even be carried over into Thursday.

On the hourly timeframe, the EUR/USD pair remains in a downtrend. We believe the decline of the euro has resumed in the medium term, with little distance left to reach parity. As observed previously, the euro is likely to fall further, supported by fundamental and macroeconomic factors that favor the US dollar.

Movements in the pair on Thursday may be relatively muted due to a weak macroeconomic backdrop, meaning that technical signals will play a more significant role in trading decisions.

On the 5-minute timeframe, we should consider the following levels: 1.0156, 1.0221, 1.0269–1.0277, 1.0334–1.0359, 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, and 1.0845–1.0851. In the Eurozone, only the second estimate of December inflation in Germany will be released on Thursday, and no surprises are expected. In the US, the most critical report will be on retail sales, but it is unlikely to trigger a significant market reaction.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair also traded with minimal volatility. Strangely enough, there was quite a lot of interesting data released yesterday

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair traded in a near-flat range with very low volatility (around 50 pips). After the storm

The GBP/USD currency pair remained flat with minimal volatility throughout Thursday. The current decline halted around the 1.3369 level, and the technical picture now suggests that the dollar's rise

The EUR/USD currency pair continued to decline on Thursday after an unexpected surge on Wednesday evening. Recall that on Wednesday evening, it became known that Donald Trump again wants

On Wednesday, the GBP/USD currency pair continued to decline throughout most of the day, until an inexplicable surge in the evening. Recall that on Tuesday, the U.S. inflation report

On Wednesday, the EUR/USD currency pair continued to trade downward, but in the evening it suddenly surged upward. Once again, there were no clear reasons or grounds for the pair's

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair also plummeted on Tuesday following the release of the U.S. inflation report. In recent weeks, the British pound

Analysis of Tuesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair plunged sharply on Tuesday following the release of the U.S. inflation report. As the saying goes, nothing foretold

On Tuesday, the GBP/USD currency pair continued its downward movement. Although core inflation in the U.S. rose exactly in line with forecasts—and the core rate even accelerated less than expected—the

For most of Tuesday, the EUR/USD currency pair continued to trade with minimal volatility, moving sideways. The Eurozone industrial production report showed a relatively strong reading

Graphical patterns

indicator.

Notices things

you never will!

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.