See also

02.01.2025 08:05 AM

02.01.2025 08:05 AMA long way off! Following gold's impressive performance in 2024, banks and investment firms are predicting further rallies in 2025. Citi notes that in five of the last six years, when the precious metal gained over 20% in the preceding year, its average performance the following year was 15%. Experts at the Financial Times provide a consensus forecast of +7%. But how will it actually play out?

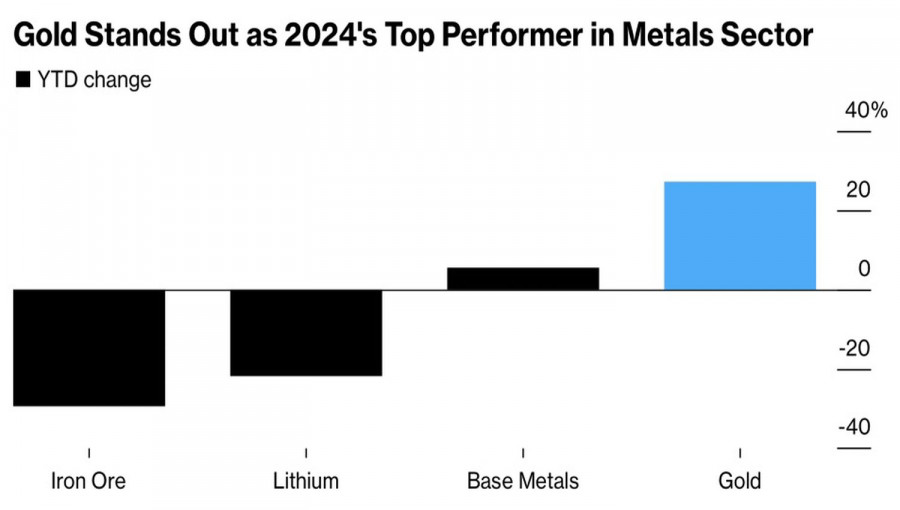

The year 2024 was remarkable for gold—not just for achieving its best performance since 2010 or for one of the largest annual gains in history. It wasn't only about reaching 40 record highs and a peak increase of +30%, marking the best trajectory since 1978. It wasn't solely due to gold's final gain of +27%, which outperformed the S&P 500 and most other commodity market assets. What truly stands out is that these successes were achieved under unfavorable conditions: the US dollar strengthened, and Treasury yields soared.

In 2023, a similar situation occurred when the Federal Reserve raised interest rates at the most aggressive pace seen in 40 years. Despite this, the USD index increased steadily, along with the yields on US debt, yet gold prices still managed to rise. Historically, a stronger US dollar and higher bond yields have presented significant challenges for XAU/USD bulls. Could this indicate a paradigm shift in financial markets?

It's no surprise that banks and investment firms are providing moderately optimistic forecasts for gold prices in 2025. The Financial Times consensus predicts a 7% increase. Goldman Sachs is the most bullish among analysts, forecasting that prices could reach $3,000 per ounce. Conversely, Barclays and Macquarie project declines to $2,500. Macquarie suggests that although the precious metal faces challenges from a stronger dollar, demand from consumers and central banks will help prevent a more significant drop.

XAU/USD bulls are hopeful for lower interest rates, geopolitical factors, and central bank purchases. Even as the pace of monetary policy easing slows, the Fed is still expected to lower borrowing costs further. This shift could redirect part of the $6.7 trillion capital in money market funds into gold-oriented ETFs.

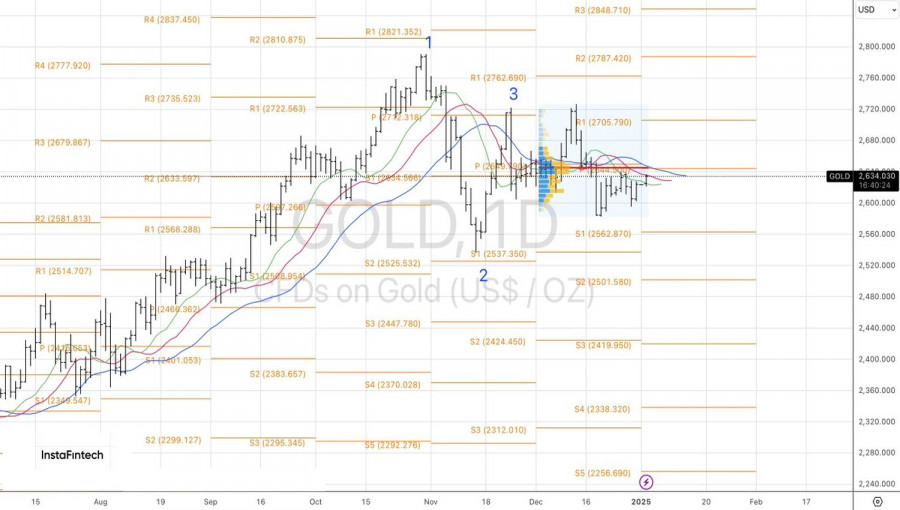

Gold reached an all-time high before experiencing a sharp decline in November, driven by the "buy the rumor, sell the fact" principle. XAU/USD bulls remained cautious about Donald Trump's potential return to power in the U.S. Once his return became a reality, many began to lock in their profits. Nevertheless, uncertainty persists, and Trump's policies are expected to heighten volatility in financial markets, which could continue to support gold prices.

From a technical perspective, the daily chart for gold illustrates the ongoing formation of a "Spike and Ledge" pattern. A rebound from the fair value of $2,645 per ounce might provide a basis for establishing or adding to short positions. Conversely, a breakout above this level would indicate potential opportunities for further purchases.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Market optimism, fueled by Donald Trump's active manipulation of the tariff narrative, was short-lived. Traders remain focused on the escalating tensions between the U.S. and China following the U.S. Department

A few macroeconomic events are scheduled for Wednesday, but some important reports will be released. However, the current key issue is not the reports' significance but how the market will

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.