See also

Today, the Japanese yen is trying to counter the U.S. dollar, strengthening following the release of Tokyo CPI inflation data for the Consumer Price Index. These figures suggest that the Bank of Japan might proceed with raising interest rates in January.

Additionally, the Bank of Japan released a summary of opinions from its December monetary policy meeting, emphasizing plans to adjust easing measures. One board member highlighted the importance of monitoring wage negotiation trends, while another stressed the need for careful analysis of data to determine any changes in monetary policy.

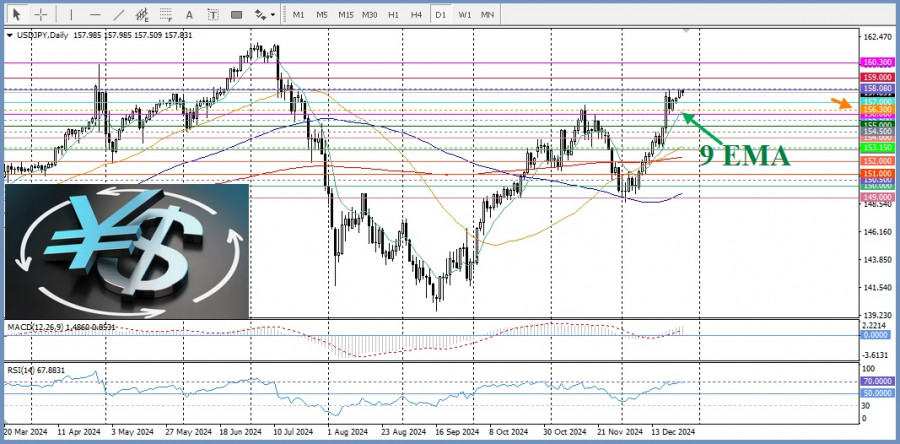

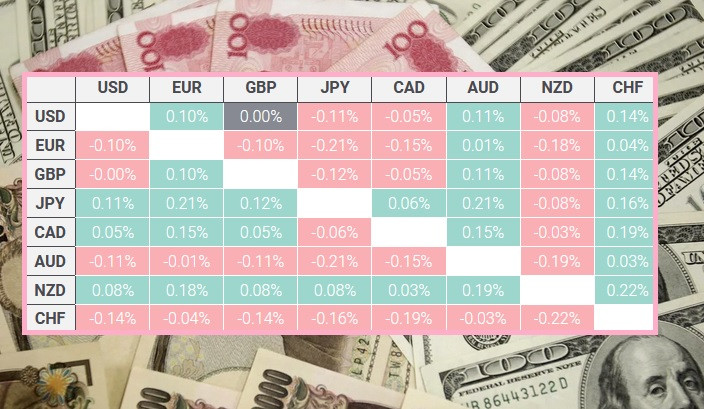

Today, the USD/JPY pair tested its monthly high at 158.08. A breakthrough above this level could enable the pair to advance towards the 159.00 psychological level, with the next significant resistance at 160.30. Daily chart oscillators remain in positive territory, bolstering the bullish outlook. However, traders should note the 14-day Relative Strength Index (RSI), currently just below 70. While this reinforces a bullish forecast, an RSI crossing above 70 may signal a potential downward correction. Thus, traders with bullish positions should exercise caution. On the other hand, a drop below 156.30, near the 9-day Exponential Moving Average (EMA), would shift the bias in favor of bearish traders.The table below illustrates the percentage change of the Japanese yen against major listed currencies today:

JPY Strength: The yen showed the most strength against the Australian dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.