See also

11.07.2022 02:47 PM

11.07.2022 02:47 PMHello, dear traders!

Let's start today's review of the GBP/USD pair with the fact that the UK is expected to have serious problems in the coming winter period. The point is that energy prices are so high that the traditionally prosperous British will face tough times. While British Prime Minister Boris Johnson continues to dance to the tune of the United States, Great Britain risks being left without the necessary heating. In other words, Britain is braced for a cold winter, during which its citizens will have to hide under duvets and rugs. All this stems from the government's extremely aggressive policy regarding sanctions against Russia. Now let's consider the situation from a technical point of view, starting with the analysis of the previous trading week.

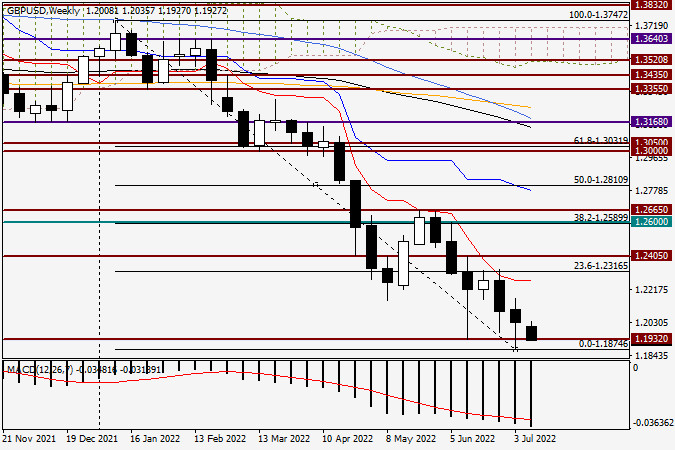

Weekly chart

Last week, pound bulls managed to turn the tide in their favor. This can be confirmed by the last weekly candlestick with a long lower shadow and a bullish body. After the formation of such candlesticks, the quote usually rises. However, this is not the case. The pound sterling is still trading under strong selling pressure against the US dollar. It is quite difficult to guess what will happen next. However, I still believe that the most likely scenario in the short term is bullish. If the pound sterling breaks through the support level of 1.1874, this scenario will be canceled. In the meantime, I expect the GBP/USD pair to form reversal candlestick signals at the bottom of the market. In this case, it will be possible to open long positions on the British pound. That's all for today. Tomorrow we will consider the pair's dynamics from a technical point of view on smaller time frames.

Have a good day!

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Although on the 4-hour chart the AUD/JPY cross currency pair is still moving above the WMA (30 Shift 2) which also has a slope that is going upwards, but because

From what is seen on the 4-hour chart of the Crude Oil commodity instrument, there are several interesting facts, first the appearance of a Double Bottom pattern followed by Convergence

Early in the American session, gold is trading around 3,249, rebounding after reaching the low of 3,224, which coincided with the 200 EMA. After reaching this bottom, gold is rebounding

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.