See also

30.06.2022 10:18 AM

30.06.2022 10:18 AMAs for the price dynamics of the GBP/USD currency pair, it cannot be called pronounced either. However, at the same time, the downside risks for the British pound have not disappeared, especially after the statements of the head of the Bank of England, Andrew Bailey, about complete indifference to the exchange rate of their national currency. The weakness of the pound is not reflected in the growth of exports. Today at 07:00 London time, the final data on UK GDP has already been released, which did not bring unexpected changes and coincided with the forecast values. Thus, the GDP of the United Kingdom in quarterly terms was at the expected level of 0.8%, and in annual terms, GDP growth was 8.7%. During the American session, or rather from 13:30 (London time), statistics on personal income and expenses, initial applications for unemployment benefits, and also data on the basic index of prices for personal consumption will begin to arrive from the United States. All details about these and other events can be found in the economic calendar, and we turn to the technical analysis of GBP/USD.

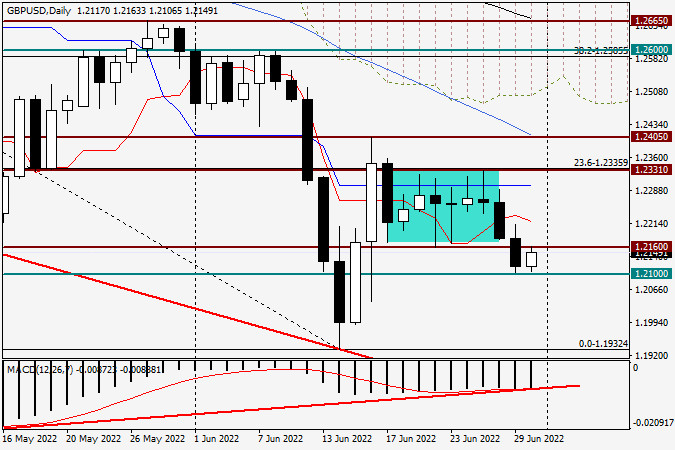

Daily

As can be seen on the daily chart, the pair's consolidation in the range of 1.2160-1.2331 was completed yesterday. The quote broke through the strong technical support level of 1.2160, and the auction closed at 1.2117 on June 29. At the same time, another fairly strong support is located near the landmark level of 1.2100. It was there that yesterday's depreciation stopped, and today, at the time of writing the article, the pound/dollar has already given a rollback to the level of 1.2160 broken the day before. If today's trading ends above this mark, then its breakdown will be considered false, which can revive the actions of players to increase the exchange rate. Often false breakouts lead to this. If the current bullish sentiment on sterling undergoes drastic changes and the pair closes today's trading below 1.2100, a meeting with the iconic round mark of 1.2000 is inevitable, where, in my personal opinion, the future fate of the "Briton" will be decided.

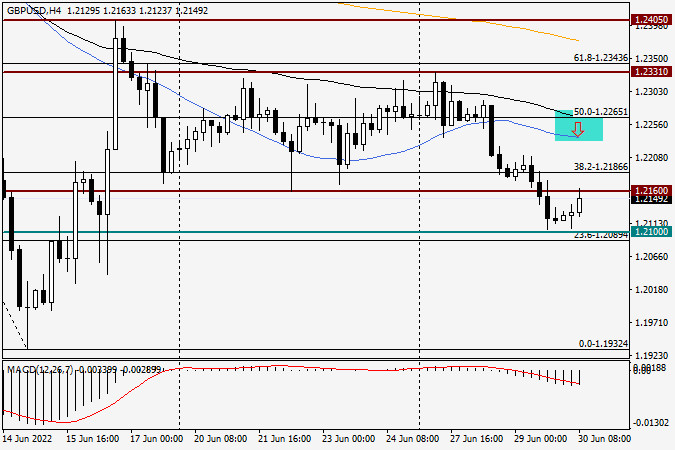

H4

Given the fact that the pound/dollar pair is trading under all three moving averages used, a rise in each of them can be considered a potential sales opportunity. The author finds the price area 1.2235-1.2265 the most interesting for opening meek positions, it is allocated on a four-hour timeframe. As you can see, this is where the blue 50 simple and black 89 exponential moving averages are located. I believe that both of the indicated moves can repel the bulls' attacks on the pound and turn the course down. More aggressively and riskily, you can try to sell GBP/USD from the price zone 1.2160-1.2175. Purchases, of course, are also possible, but they will become more relevant only after a true breakdown of the key resistance of sellers at this stage, which passes at 1.2405.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On the 4-hour chart, the GBP/AUD cross currency pair appears to still be dominated by Sellers, which is confirmed by its price movement which is moving below the WMA (30

With the price movement forming Higher Low - Lower Low and supported by the decreasing slope of WMA (30 Shift 2) and the movement of Crude Oil prices moving below

Early in the American session, the EUR/USD pair is trading around 1.1345, reaching the top of the downtrend channel and showing signs of exhaustion. The euro could resume its bearish

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.