See also

21.06.2022 03:14 PM

21.06.2022 03:14 PMMarket participants as a whole reacted rather restrainedly to the decision of the central bank to raise the interest rate and to today's speech of the head of the RBA, and the publication of minutes from the June meeting of the bank.

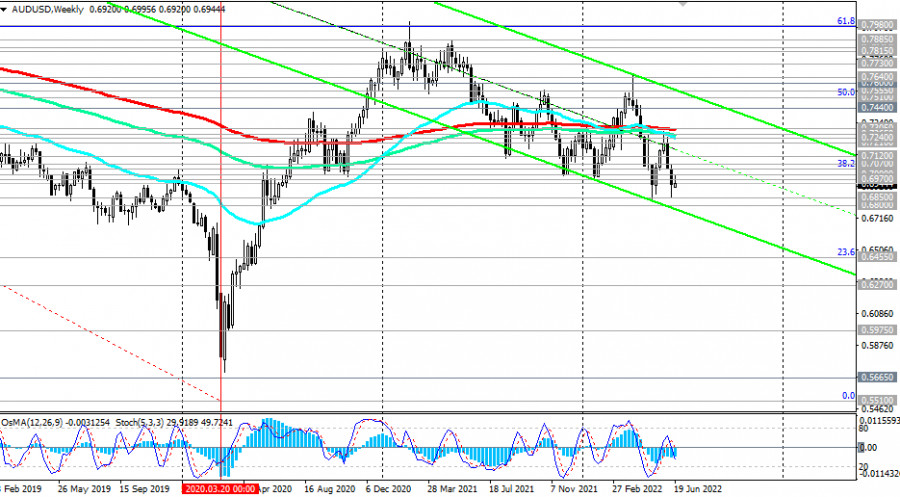

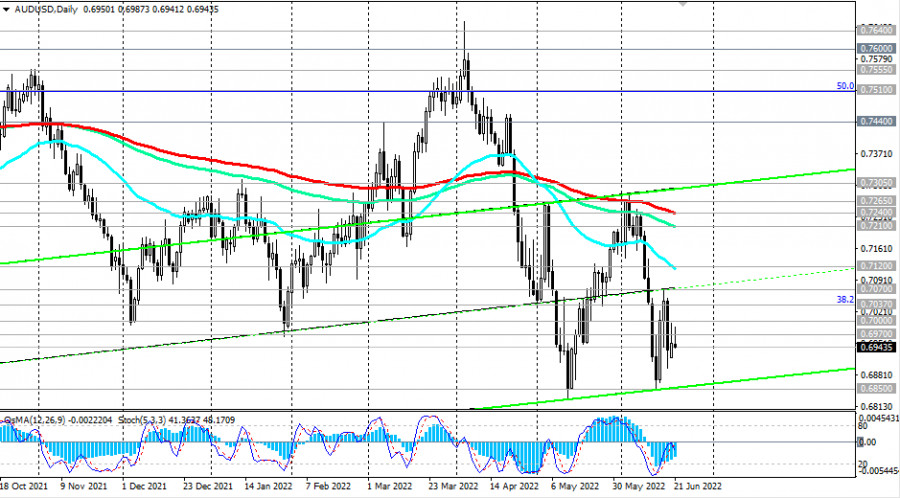

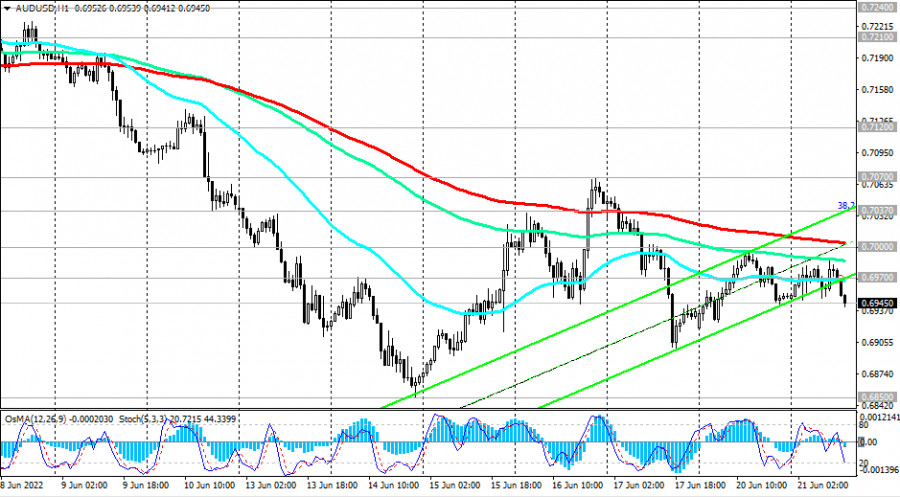

AUD remains under pressure, primarily against the US dollar. As of this writing, AUD/USD is trading near 0.6945, continuing to decline towards the lower border of the descending channel on the weekly chart, which is currently below 0.6800.

Given the Fed's propensity to pursue a tighter monetary policy and in anticipation of further strengthening of the US dollar, a deeper decline in AUD/USD should be expected.

A breakdown of local support levels 0.6850, 0.6800 will confirm our assumption, and AUD/USD will head towards multi-year lows reached in March 2020 near 0.5665, 0.5510 with intermediate targets at support levels 0.6500, 0.6455 (23.6% Fibonacci retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), 0.6270, 0.5975.

The continued positive upward trend in 10-year US bond yields makes the dollar an attractive asset for investment, given the prospects for further tightening of the Fed's monetary policy. The dollar is also actively used as a defensive asset, winning over traditional defensive assets such as gold, franc, and yen.

In an alternative scenario, AUD/USD will again try to break through the key resistance levels 0.7240 (200 EMA on the daily chart), 0.7210 (144 EMA on the daily chart), 0.7305 (200 EMA on the weekly chart, 50 EMA on the monthly chart). A breakdown of the resistance levels 0.7600 (200 EMA on the monthly chart), 0.7640 (144 EMA on the monthly chart) will bring AUD/USD into the zone of a long-term bull market.

Support levels: 0.6900, 0.6850, 0.6800, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6970, 0.7000, 0.7037, 0.7070, 0.7120, 0.7210, 0.7240, 0.7265, 0.7305

Trading Tips

Sell Stop 0.6915. Stop-Loss 0.7010. Take-Profit 0.6900, 0.6850, 0.6800, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.7010. Stop-Loss 0.6915. Take-Profit 0.7037, 0.7070, 0.7120, 0.7210, 0.7240, 0.7265, 0.7305

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair continued to trade strictly sideways. Although we don't see a clearly defined flat range for the pound

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair once again traded both upward and downward, confirming the presence of a flat market. The price

On Monday, the EUR/USD currency pair resumed its favorite activity right from the morning—moving north. It was revealed that after a three-week pause, Donald Trump decided to bring

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.