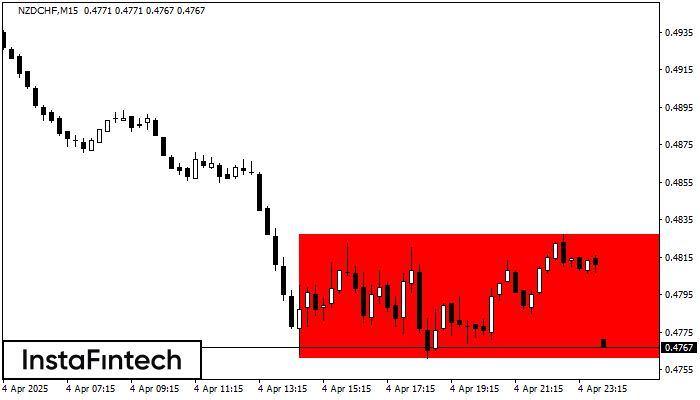

Bearish Rectangle

was formed on 06.04 at 23:00:12 (UTC+0)

signal strength 2 of 5

According to the chart of M15, NZDCHF formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 0.4827, the lower border is 0.4761. The signal means that a short position should be opened after fixing a price below the lower border 0.4761 of the Bearish Rectangle.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Symmetrical Triangle

was formed on 23.04 at 07:02:40 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDJPY formed the Bearish Symmetrical Triangle pattern. Trading recommendations: A breach of the lower border 84.36 is likely to encourage a continuation

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Top

was formed on 23.04 at 06:45:11 (UTC+0)

signal strength 2 of 5

The Double Top reversal pattern has been formed on EURCHF M15. Characteristics: the upper boundary 0.9376; the lower boundary 0.9367; the width of the pattern is 9 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

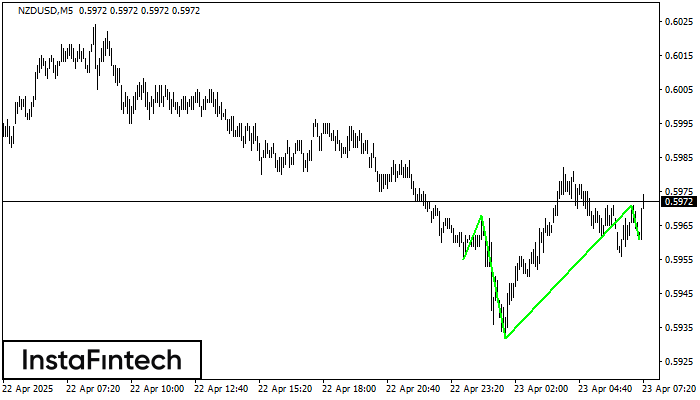

Inverse Head and Shoulder

was formed on 23.04 at 06:25:20 (UTC+0)

signal strength 1 of 5

According to M5, NZDUSD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.5968/0.5971 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window