USDMXN (US Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

26 Mar 2025 08:31

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/MXN (United States Dollar vs Mexican Peso)

USD/MXN is actively traded on Forex. This currency pair is gaining more popularity among traders since the Mexican peso became freely convertible against the other currencies on the market in 2008.

To date, Mexico is one of the most developed countries in Latin America, taking the leading position among them in terms of per capita income. The Mexican economy is mainly represented by the private sector as in 1980s there was a mass privatization program aimed at fighting against the crisis. Thus, the majority of Mexican enterprises are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country has an active trade with its neighbors - the United States and Canad - which makes up the largest part of the country's income.

Mexico is the major exporter of oil in its region. Currently, most of the country's revenues are generates by oil sector. However, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. The Mexican government has to reduce the volumes of extracted oil and natural gas to avoid new problems in the economy. According to forecasts, the country will soon be forced to import oil from abroad to meet the needs of its economy. All these circumstances have a significant impact on the Mexican national currency which is largely dependent on world oil prices. In addition, the Mexican peso exchange rate hinges on international ranking of the country which is calculated by the leading rating agencies.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

1393

USD/JPY: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)Author: Jakub Novak

19:29 2025-03-25 UTC+2

1228

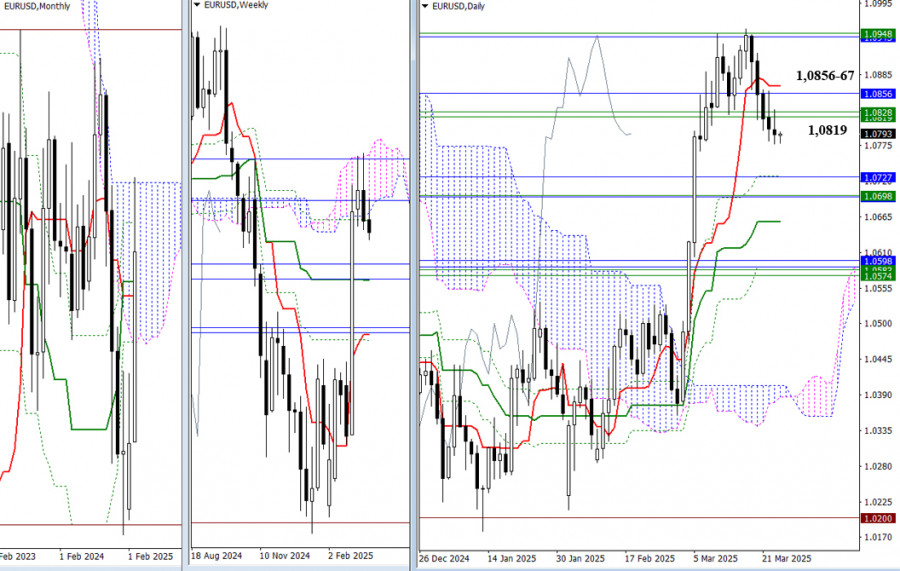

As the week begins, bearish players are trying to confirm and extend the prevailing downtrend, but they have yet to achieve strong results — The pair continues to stay close to the weekly levels. (1.0819 – 1.0828). If the decline does progress, the nearest target and next support zone for todayAuthor: Evangelos Poulakis

05:26 2025-03-26 UTC+2

1198

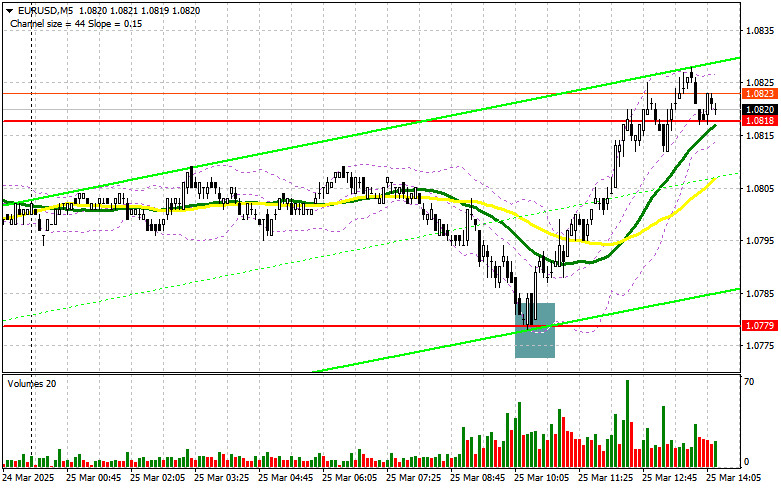

- The EUR/USD currency pair traded with low volatility on Tuesday

Author: Paolo Greco

03:40 2025-03-26 UTC+2

1183

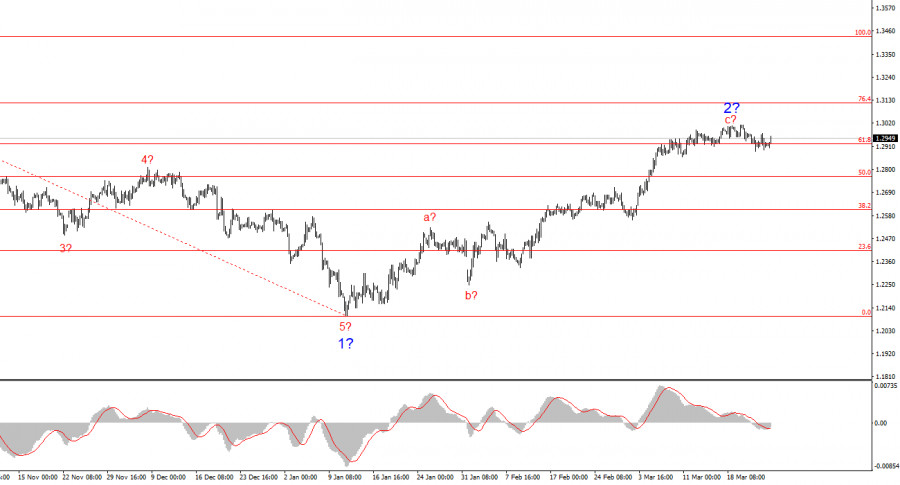

The GBP/USD rate rose by 30 basis points on Tuesday.Author: Chin Zhao

19:36 2025-03-25 UTC+2

1183

Despite "unipolar" macroeconomic reports, long positions in EUR/USD still appear risky.Author: Irina Manzenko

00:59 2025-03-26 UTC+2

1153

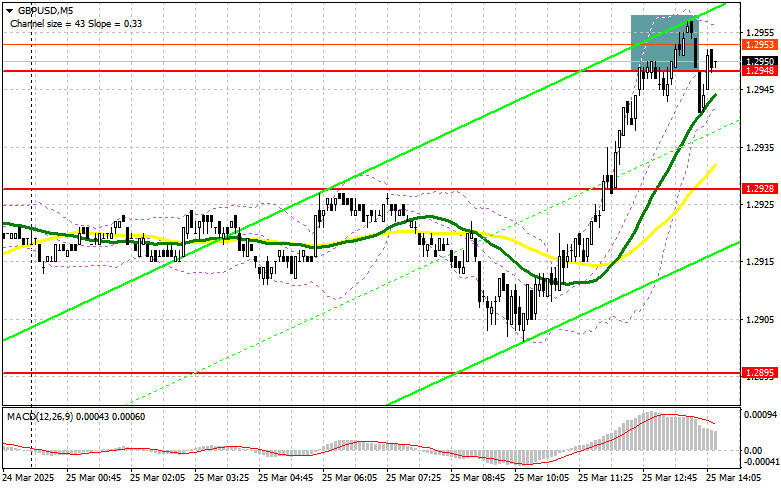

- GBP/USD: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)

Author: Jakub Novak

19:26 2025-03-25 UTC+2

1093

GBP/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)Author: Miroslaw Bawulski

19:15 2025-03-25 UTC+2

1093

EUR/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)Author: Miroslaw Bawulski

19:13 2025-03-25 UTC+2

1078

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

1393

- USD/JPY: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)

Author: Jakub Novak

19:29 2025-03-25 UTC+2

1228

- As the week begins, bearish players are trying to confirm and extend the prevailing downtrend, but they have yet to achieve strong results — The pair continues to stay close to the weekly levels. (1.0819 – 1.0828). If the decline does progress, the nearest target and next support zone for today

Author: Evangelos Poulakis

05:26 2025-03-26 UTC+2

1198

- The EUR/USD currency pair traded with low volatility on Tuesday

Author: Paolo Greco

03:40 2025-03-26 UTC+2

1183

- The GBP/USD rate rose by 30 basis points on Tuesday.

Author: Chin Zhao

19:36 2025-03-25 UTC+2

1183

- Despite "unipolar" macroeconomic reports, long positions in EUR/USD still appear risky.

Author: Irina Manzenko

00:59 2025-03-26 UTC+2

1153

- GBP/USD: Simple Trading Tips for Beginner Traders on March 25th (U.S. Session)

Author: Jakub Novak

19:26 2025-03-25 UTC+2

1093

- GBP/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:15 2025-03-25 UTC+2

1093

- EUR/USD: Trading Plan for the U.S. Session on March 25th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:13 2025-03-25 UTC+2

1078