NZDPLN (New Zealand Dollar vs Polish Zloty). Exchange rate and online charts.

Currency converter

25 Mar 2025 18:09

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/PLN (New Zealand Dollar vs Polish Zloty)

The NZD/PLN currency pair belongs to the group of not actively traded instruments on Forex. It represents the cross rate against the U.S. dollar. To see how the U.S. dollar influences NZD/PLN, merge the NZD/USD and USD/PLN price charts and get an approximate NZD/PLN price chart.

As the U.S. dollar has a significant influence on both currencies, such U.S. economic indicators as the discount rate, GDP growth, unemployment rate, new vacancies, and others can weigh on the NZD/PLN quotes. However, the currencies can respond with different speed to the changes in the U.S. economy.

Besides, when trading NZD/MXN, it is necessary take into account such indicators of the New Zealand economy as GDP growth, discount rate, economic activity, level of trade with other countries, etc. New Zealand is one the largest wool producers in the world. This industry contributes a lot to the country's economy. It should be noted that New Zealand's economy is highly dependent on its main trading partners - the USA, Australia, and the Asia-Pacific region. For this reason, you should also take into account a variety of economic indicators of the main business partners of New Zealand.

Poland is set to introduce the euro in near future. At the same time, there are various internal problems that exist in the country (the budget deficit, high external debt, etc.) as well as the global economic crisis that prevent it from adopting the European currency on schedule. The European Central Bank announced strict conditions for the euro adoption. Thus, Poland will be able to join the euro area after fulfilling all the requirements.

Poland is a developed industrial country with high living standards. The main economic sectors are engineering, metallurgy, chemical and coal industries. Poland has robust automotive and shipbuilding industries at the shipyards of the Baltic Sea. The country is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the great amount of hydrocarbons, Polish economy is fully supplied with electricity. The factors that could affect the Polish zloty significantly are the country's international rating as well as the state of Polish and European leading industries.

NZD/PLN is relatively illiquid in contrast to such trading instruments as EUR/USD, USD/CHF, GBP/USD, and USD/JPY.

It should be noted that brokers usually set a higher rate for cross rates than for basic currency pairs. Before you start working with the cross rates, learn carefully the terms and conditions offered by the broker to trade the required instrument.

See Also

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1288

Will money return to North America?Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1213

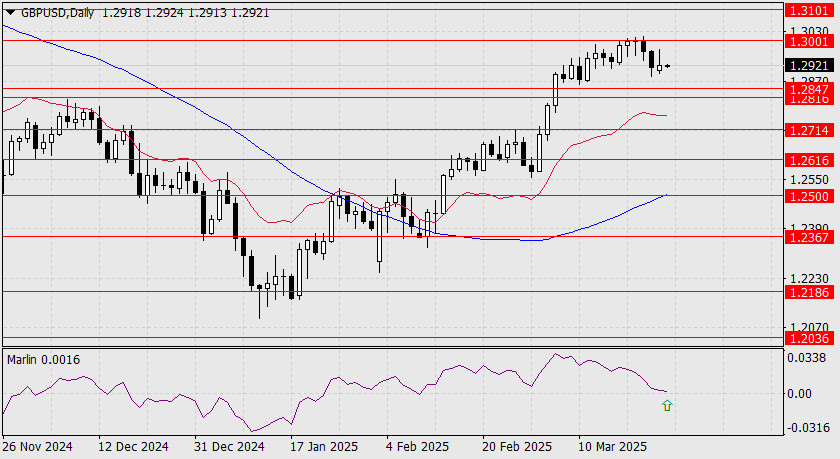

The Pound is Ready to Resume GrowthAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1168

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

1108

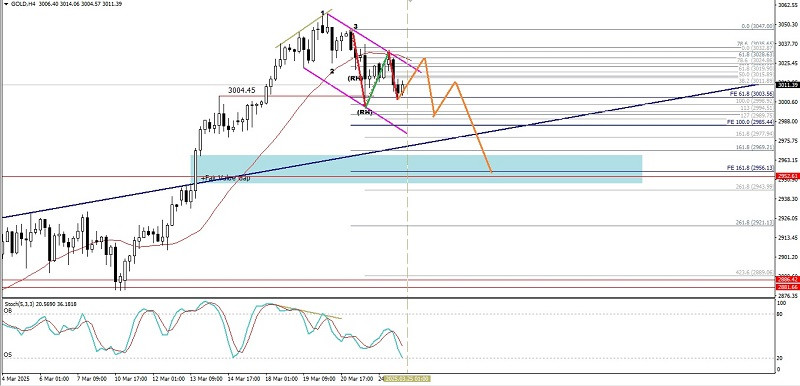

Technical analysisTechnical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

1063

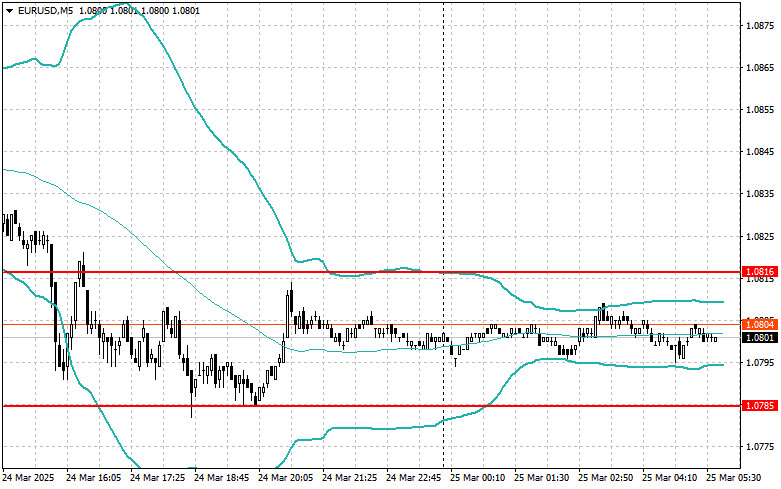

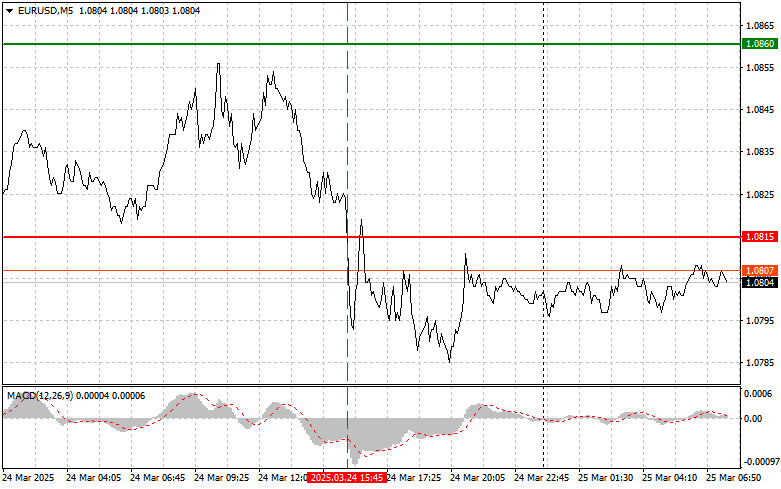

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-25 UTC+2

1048

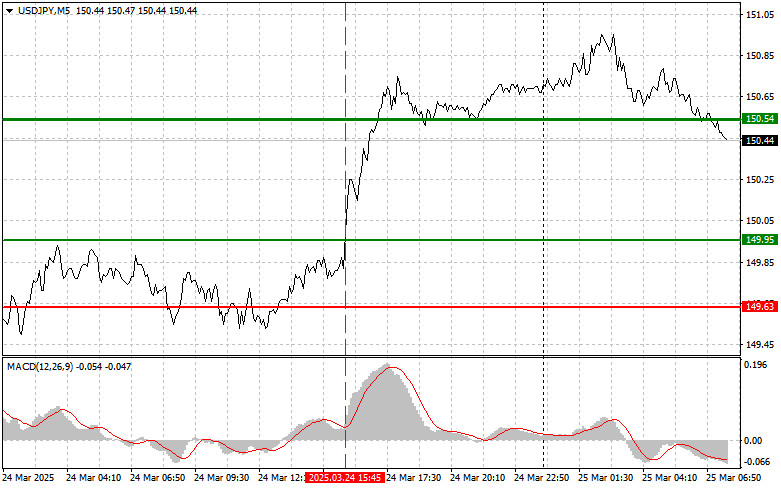

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1033

AUD/USD Eyes the Upside AgainAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1003

Technical analysisTrading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

988

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1288

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1213

- The Pound is Ready to Resume Growth

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1168

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

1108

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

1063

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-25 UTC+2

1048

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1033

- AUD/USD Eyes the Upside Again

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1003

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

988