EURCZK (Euro vs Czech Koruna). Exchange rate and online charts.

Currency converter

25 Mar 2025 18:09

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The EUR/CZK currency pair is a popular one on Forex market. Since the Czech Republic has an active trade with the European Union, the experienced traders choose this trading instrument because of high stability and predictability of the eurozone and the Czech Republic's economies. The most intense EUR/CZK bidding is observed during the european session.

This pair is the cross rate against the U.S. dollar. There is no U.S. dollar in this currency pair, but the euro and the Czech koruna are under its great influence. To see it graphically, just combine the EUR/USD and USD/CHK charts in the same price chart, and you will get the approximate chart of EUR/CZK.

The U.S. dollar extends an enormous influence over both currencies. Therefore, for a better prediction of the future rate movement of this currency pair you should consider the main economic indicators of the U.S.A., such as interest rate, GDP, unemployment, new created workplaces indicator and many others. Remember that the currencies listed above can react differently react to the changes in the economic situation in the United States.

The economy of the Czech Republic is considered as prosperous and stable and it puts this country among the most advanced and industrial countries of the Central Europe. Its economic development is provided by the high rate of personal income.

Machinery, iron and steel production, chemical industry, electronics, beer production, as well as agriculture are the main economic sectors of the Czech Republic. The most developed industry sector is the automotive. This automobile sector's output, which mostly goes on export, has one of the highest rates of car production in the world. Moreover, the Czech Republic is one of the largest exporters of beer and shoes. The Czechs also export a variety of chemical products like tires, synthetic fibers, etc. The Czech Republic has an active trade with Germany, Russia, Slovakia, and Austria. A wide rage of possibilities to produce the electric power(nuclear, thermal, hydro, and solar and wind power) makes it one of the European leaders of the electricity production.

If you trade cross rates, pay your attention to the spread that can be higher than for more popular currency pairs. Thus, before you start dealing with cross currency pairs, read and understand the broker's conditions for this specified trade instrument.

See Also

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1288

Will money return to North America?Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1213

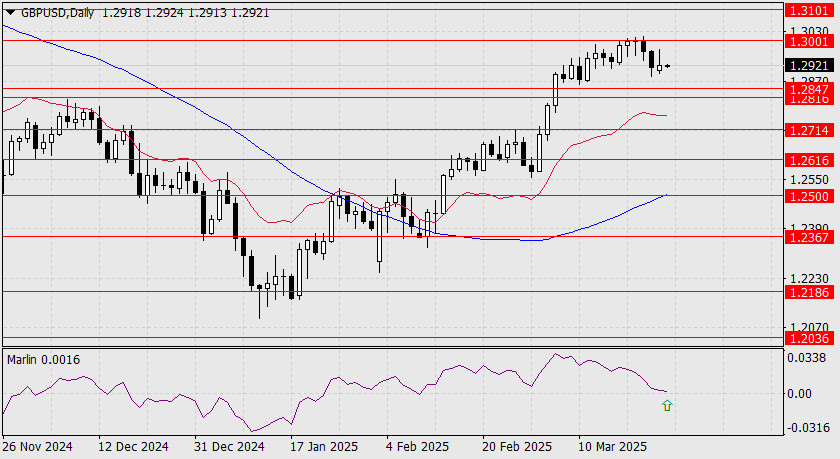

The Pound is Ready to Resume GrowthAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1168

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

1108

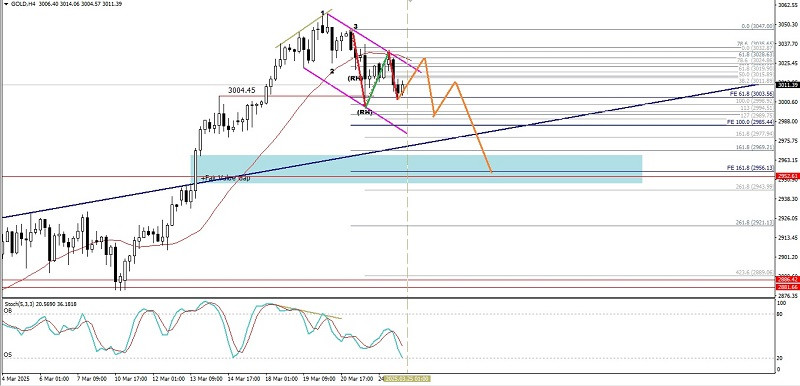

Technical analysisTechnical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

1063

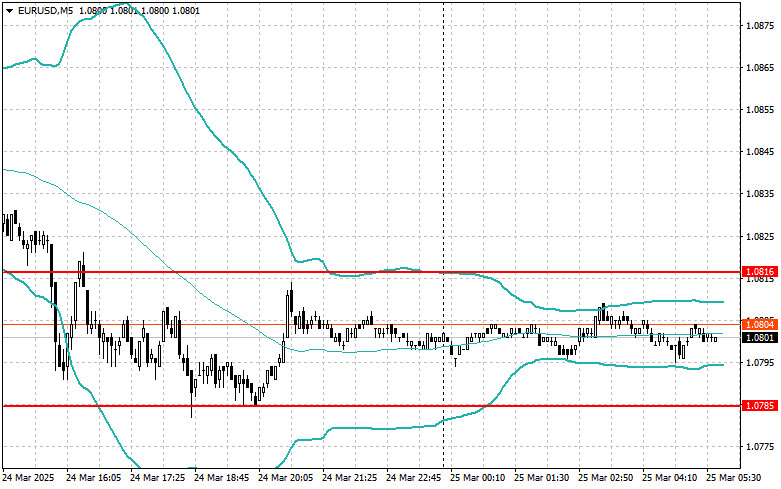

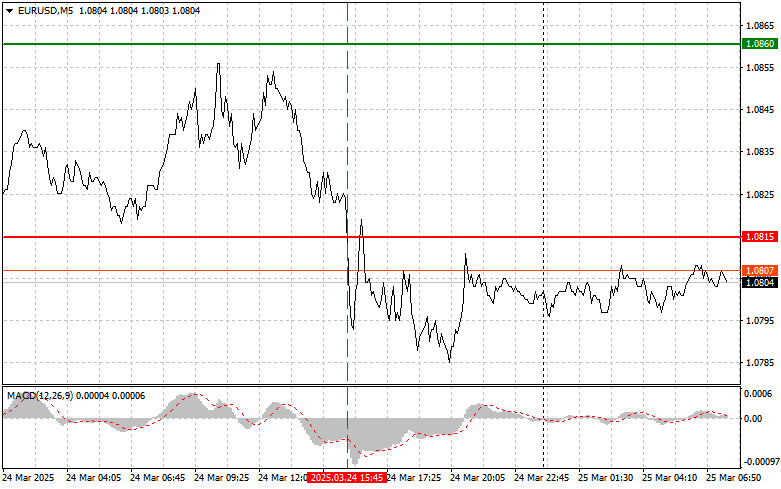

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-25 UTC+2

1048

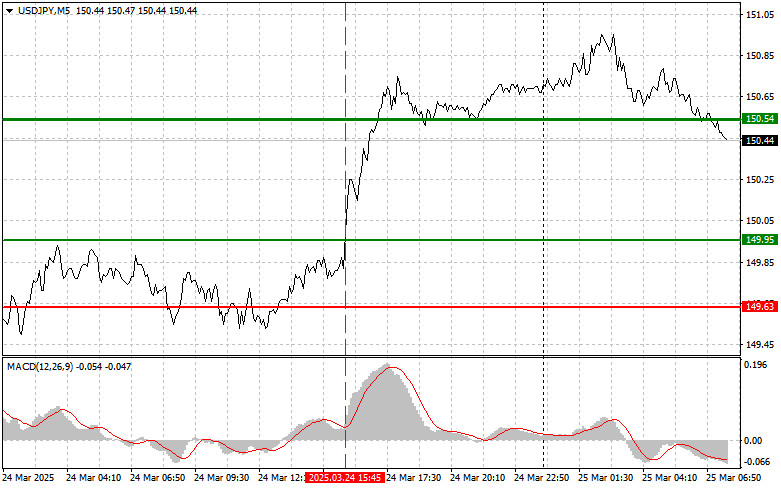

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1033

AUD/USD Eyes the Upside AgainAuthor: Laurie Bailey

05:59 2025-03-25 UTC+2

1003

Technical analysisTrading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

988

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1288

- Will money return to North America?

Author: Marek Petkovich

09:18 2025-03-25 UTC+2

1213

- The Pound is Ready to Resume Growth

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1168

- Intraday Strategies for Beginner Traders on March 25

Author: Miroslaw Bawulski

08:49 2025-03-25 UTC+2

1108

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 25,2025.

If we look at the 4-hour chart of the Gold commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

08:19 2025-03-25 UTC+2

1063

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-25 UTC+2

1048

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-03-25 UTC+2

1033

- AUD/USD Eyes the Upside Again

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

1003

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 25-27, 2025: buy above $3,024 (21 SMA - 7/8 Murray)

On the H4 chart, we can see that gold is under bearish pressure and is expected to continue trading within this channel in the coming days.Author: Dimitrios Zappas

15:00 2025-03-25 UTC+2

988