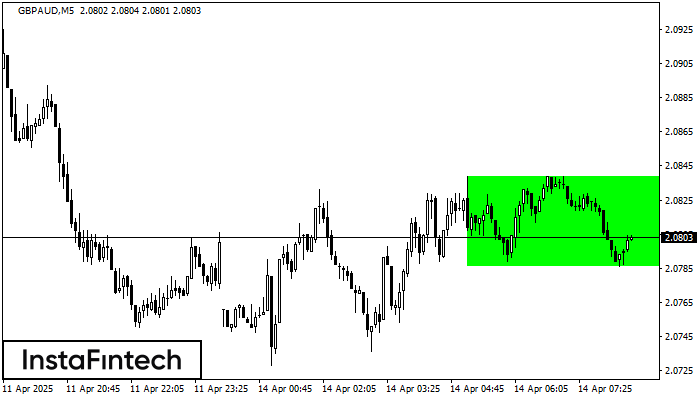

Bullish Rectangle

was formed on 14.04 at 07:32:34 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPAUD formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border 2.0786 – 2.0786 and upper border 2.0839 – 2.0839. In case the upper border is broken, the instrument is likely to follow the upward trend.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

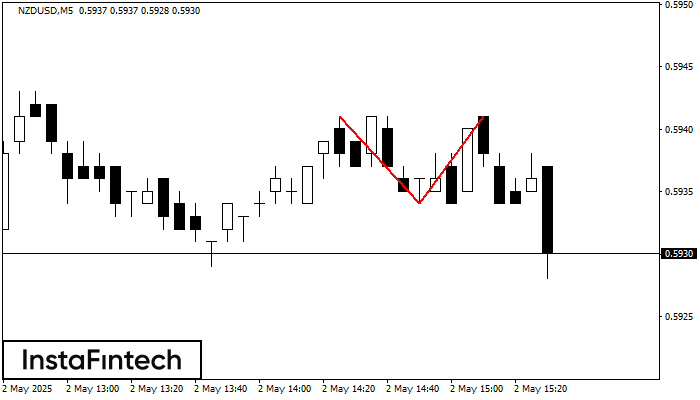

Double Top

was formed on 02.05 at 14:30:24 (UTC+0)

signal strength 1 of 5

On the chart of NZDUSD M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 0.5941; the lower boundary 0.5934; the width of the pattern 7 points

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

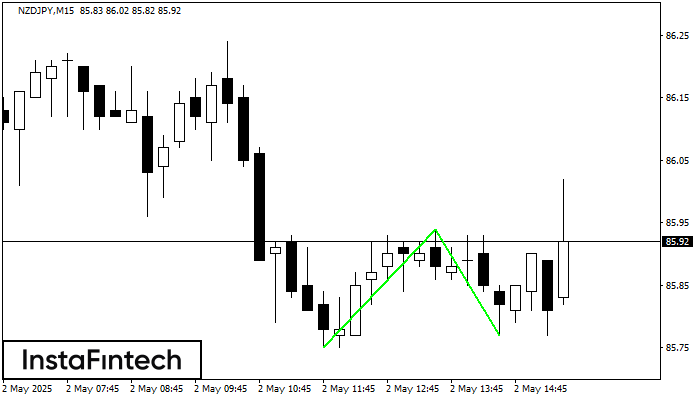

Double Bottom

was formed on 02.05 at 14:30:14 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on NZDJPY M15. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Inverse Head and Shoulder

was formed on 02.05 at 14:30:11 (UTC+0)

signal strength 2 of 5

According to M15, NZDCHF is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.4898/0.4897 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window