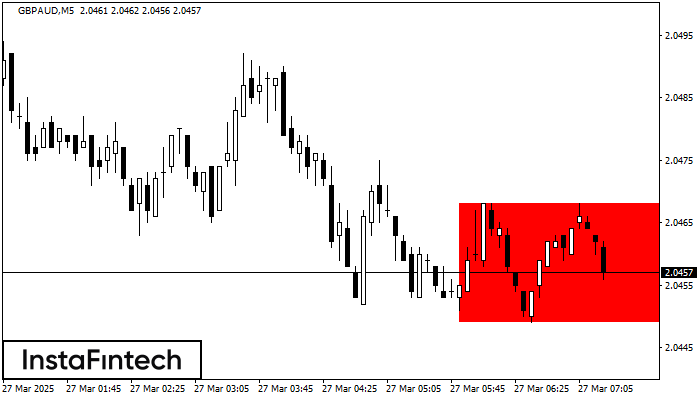

Bearish Rectangle

was formed on 27.03 at 07:21:11 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPAUD formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 2.0468 - 0.0000 and support 2.0449 – 2.0449. In case the resistance level 2.0449 - 2.0449 is broken, the instrument is likely to follow the bearish trend.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

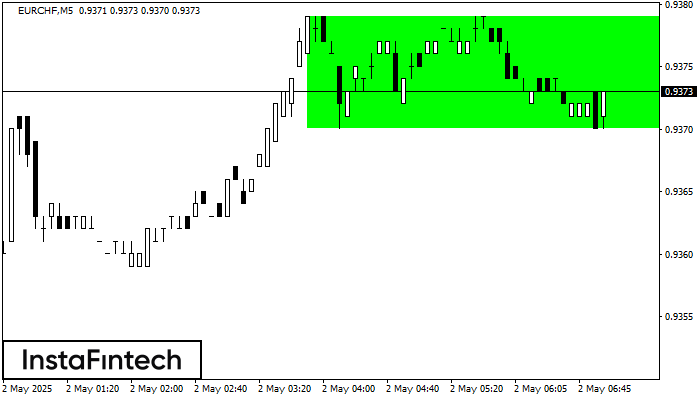

Bullish Rectangle

was formed on 02.05 at 06:03:50 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURCHF formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Flag

was formed on 02.05 at 05:53:04 (UTC+0)

signal strength 1 of 5

The Bearish Flag pattern has been formed on USDCHF at M5. The lower boundary of the pattern is located at 0.8283/0.8287 while the upper boundary lies at 0.8287/0.8291. The projection

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish pennant

was formed on 02.05 at 05:52:58 (UTC+0)

signal strength 1 of 5

The Bearish pennant pattern has formed on the USDCHF M5 chart. The pattern signals continuation of the downtrend in case the pennant’s low of 0.8283 is broken through. Recommendations: Place

The M5 and M15 time frames may have more false entry points.

Open chart in a new window