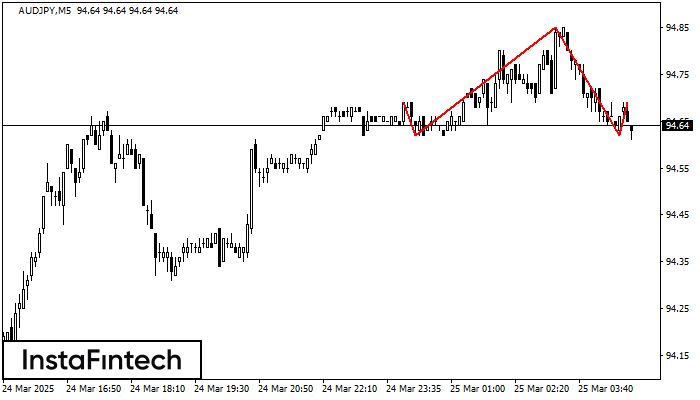

Head and Shoulders

was formed on 25.03 at 04:50:35 (UTC+0)

signal strength 1 of 5

The technical pattern called Head and Shoulders has appeared on the chart of AUDJPY M5. There are weighty reasons to suggest that the price will surpass the Neckline 94.62/94.62 after the right shoulder has been formed. So, the trend is set to change with the price heading for 94.47.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

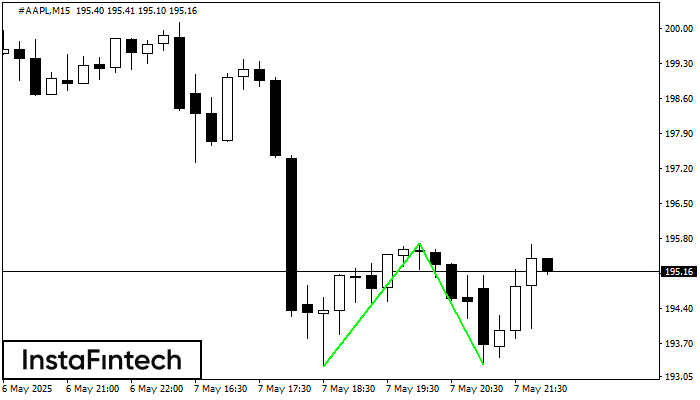

Bawah Ganda

was formed on 07.05 at 21:00:20 (UTC+0)

signal strength 2 of 5

Pola Bawah Ganda telah terbentuk pada #AAPL M15. Formasi ini mensinyalkan reversal tren dari arah penurunan ke arah kenaikan. Sinyal menunjukkan bahwa transaksi beli harus dibuka setelah batas atas pola

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window

Bawah Ganda

was formed on 07.05 at 20:35:20 (UTC+0)

signal strength 1 of 5

Pola Bawah Ganda telah terbentuk pada EURCHF M5. Karakteristik: level support 0.9300; level resistance 0.9316; lebar pola 16 poin. Jika level resistance ditembus, perubahan dalam tren dapat diprediksi dengan target

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window

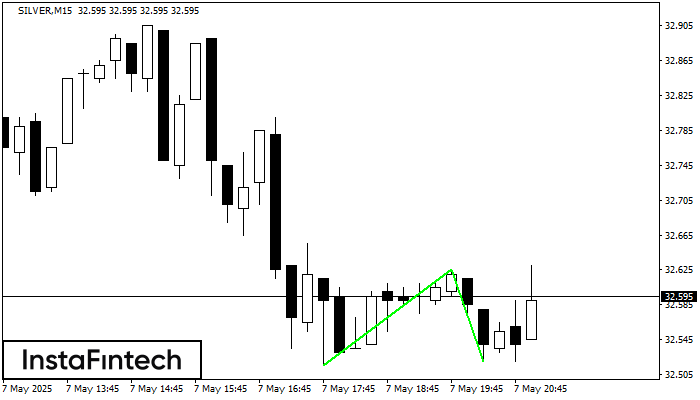

Bawah Ganda

was formed on 07.05 at 20:15:19 (UTC+0)

signal strength 2 of 5

Pola Bawah Ganda telah terbentuk pada SILVER M15. Formasi ini mensinyalkan reversal tren dari arah penurunan ke arah kenaikan. Sinyal menunjukkan bahwa transaksi beli harus dibuka setelah batas atas pola

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window