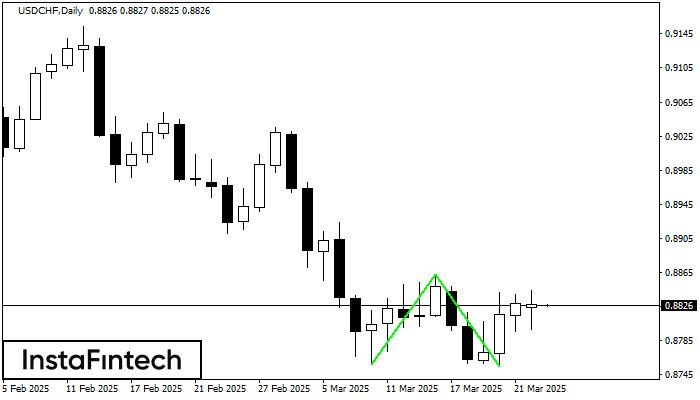

Double Bottom

was formed on 25.03 at 00:00:26 (UTC+0)

signal strength 5 of 5

The Double Bottom pattern has been formed on USDCHF D1. Characteristics: the support level 0.8757; the resistance level 0.8863; the width of the pattern 106 points. If the resistance level is broken, a change in the trend can be predicted with the first target point lying at the distance of 108 points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

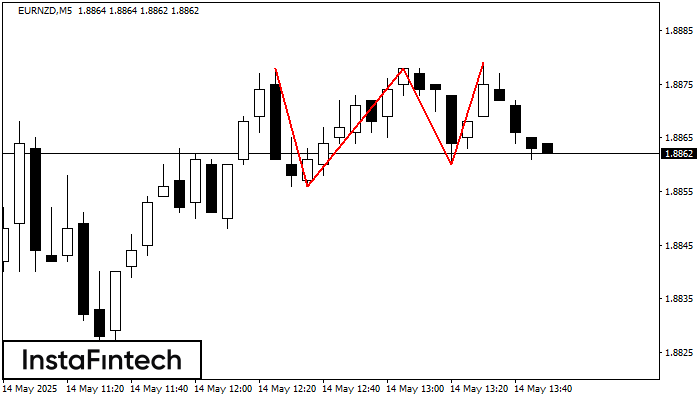

Triple Top

was formed on 14.05 at 12:50:24 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the EURNZD M5 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -1, support level -4

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

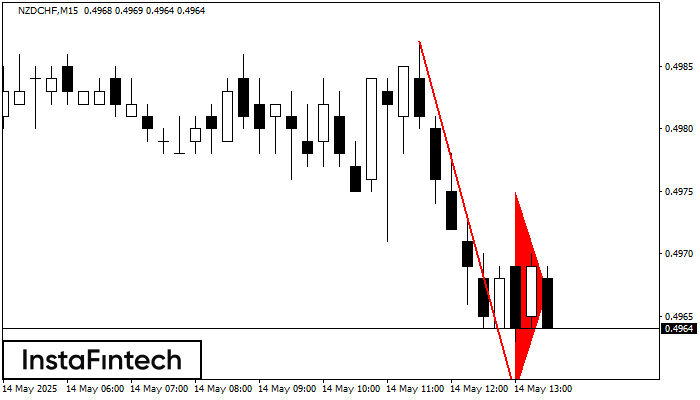

Bearish pennant

was formed on 14.05 at 12:38:21 (UTC+0)

signal strength 2 of 5

The Bearish pennant pattern has formed on the NZDCHF M15 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

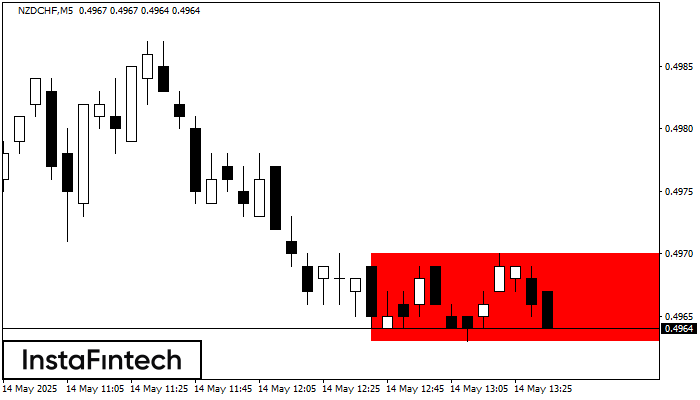

Bearish Rectangle

was formed on 14.05 at 12:38:19 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCHF formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 0.4970 - 0.0000

The M5 and M15 time frames may have more false entry points.

Open chart in a new window