01.07.2024 10:58 AM

01.07.2024 10:58 AMAnalysis:

Since July last year, the direction of euro price fluctuations has been set by a downward wave algorithm. Lines drawn through the extremums on the chart show a "horizontal pennant" figure, which has not yet been completed. The upward segment from April 16 has no reversal potential and remains within the current wave model.

Forecast:

The euro currency price is expected to continue its flat, sideways movement in the coming days. There is a high chance of a halt and the formation of reversal conditions in the area of the calculated support. The upward vector movement of the euro is expected to begin by the end of the week.

Resistance:

Support:

Recommendations:

Analysis:

Since December last year, a dominant, currently incomplete upward wave has set the direction of price fluctuations for the Japanese yen major. The final part (C) of the wave has been forming over the past two months. This movement has entered its final phase.

Forecast:

During the upcoming weekly period, the upward price movement of the major is expected to continue, with the prospect of rising to the calculated resistance zone. In the first few days, a sideways flat movement is more likely. A short-term decline, not exceeding the support boundaries, cannot be ruled out.

Resistance:

Support:

Recommendations:

Analysis:

Since early May this year, the short-term price movement of the GBP/JPY pair has been set by an upward wave. The quotes have reached the boundaries of a strong potential reversal zone on the weekly timeframe. Analysis of the structure shows its incompleteness.

Forecast:

In the upcoming weekly period, the upward movement of the cross is expected to continue until it contacts the calculated resistance zone. A reversal is highly likely to follow. The price movement of the pair downwards is limited by the calculated support zone.

Resistance:

Support:

Recommendations:

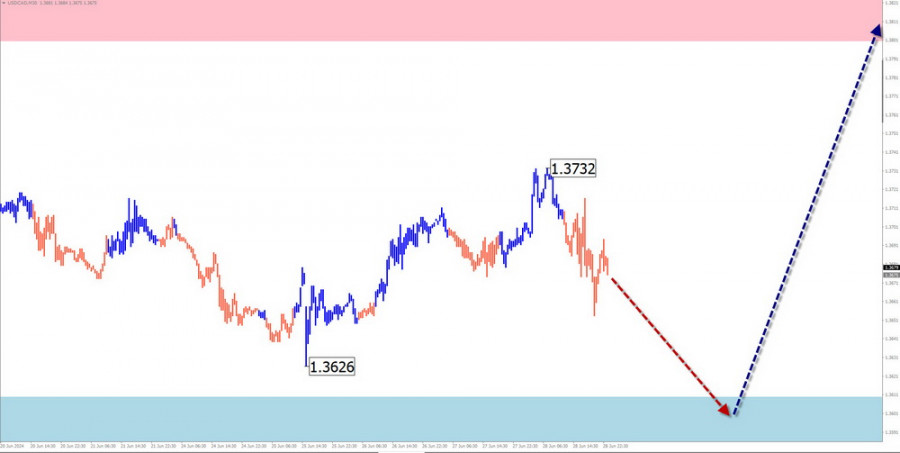

Analysis:

This year, the upward wave formed on the Canadian dollar chart creates an opposing corrective flat. Quotes have been moving in a sideways price corridor for the third month. Analysis of the current wave structure shows its incompleteness. The price is approaching the upper boundary of the potential reversal zone on the daily chart.

Forecast:

In the coming days, continued downward movement is expected until the calculated zone is reached. After that, a bounce upward from the support boundaries is likely. The resistance zone represents the maximum expected upper level of the pair's weekly volatility.

Resistance:

Support:

Recommendations:

Brief Analysis:

The New Zealand dollar has been moving downward within the dominant bearish wave since last summer. The wave's extremes on the price chart form a "horizontal pennant." At the time of analysis, the bullish segment from April 19 remains within the boundaries of an internal correction. Within this framework, a downward pullback has been forming in recent weeks.

Weekly Forecast:

In the next couple of days, continued downward movement is expected. A change in the movement direction to sideways is anticipated in the calculated support zone, forming conditions for a reversal. An upward price movement is likely in the week's second half.

Resistance:

Support:

Recommendations

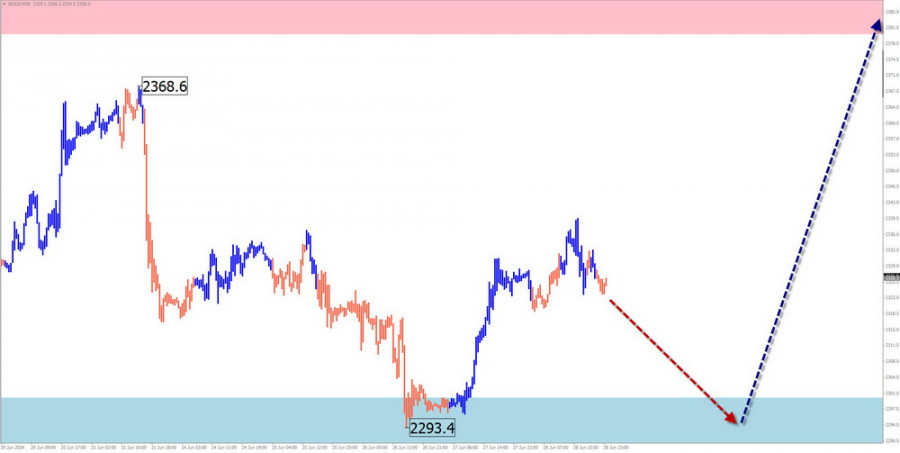

Analysis:

Gold prices have been moving predominantly horizontally since April this year. The downward plane is forming in place of a correction of the previous bullish trend. The price is pressing against the upper boundary of the sideways corridor formed on the chart over the past two months.

Forecast:

Pressure on the support zone may end in the next few days. Afterward, a reversal and resumption of price growth can be expected. The highest activity of price fluctuations is expected closer to the weekend.

Resistance:

Support:

Recommendations:

Explanations: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed on each timeframe. Dotted lines indicate expected movements.

Attention: The wave algorithm does not account for the duration of instrument movements over time!在 4 小時圖上,歐元/美元的波動模式已轉變為一種上升結構並繼續維持這種形式。我相信毫無疑問,這一轉變完全是由於美國新貿易政策的緣故。

英鎊/美元的波浪模式持續顯示形成上升衝動波結構的跡象。這種波浪圖幾乎與歐元/美元的情況相同。

在4小時圖上,EUR/USD 的波動形態已經轉變為向上結構並保持這種狀態。我認為毫無疑問,這種轉變完全是由於美國新貿易政策所致。

英鎊/美元的波浪結構繼續顯示出上升衝擊波形態的發展。這波形態幾乎與歐元/美元對相同。

在4小時圖上,歐元兌美元的波浪結構已轉變為看漲形態,並繼續保持該形態。我認為這一轉變毫無疑問是由於新的美國貿易政策所引起的。

英鎊/美元的波浪結構持續顯示出一個看漲的衝動波浪模式。此波浪模式與歐元/美元的走勢非常相似。

GBP/USD的波浪結構繼續表明正在發展上行衝動波浪型態。其波浪型態幾乎與EUR/USD相同。

在歐元/美元的4小時圖表上,波浪形態已經轉變為上升結構,並且持續如此。很明顯,這種轉變完全是由於美國新貿易政策的影響。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.