18.10.2022 03:38 PM

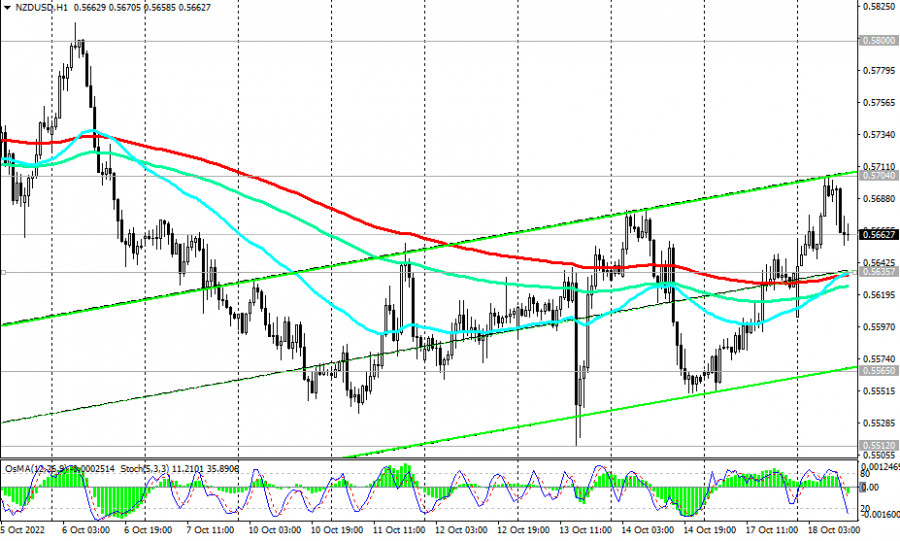

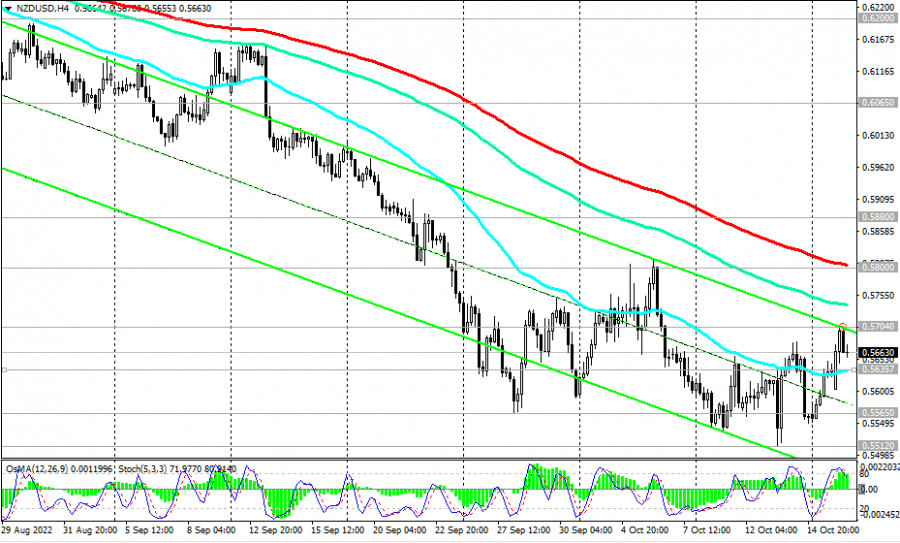

18.10.2022 03:38 PMToday, NZD/USD half retains the bullish momentum gained from the inflation data in New Zealand that exceeded the forecast, while also trying to stay in the zone above the short-term important support level of 0.5635 (200 EMA on the 1-hour chart). As of writing, the pair is trading near the 0.5662 mark. It is characteristic that the OsMA and Stochastic technical indicators paint a contradictory picture: on the daily and weekly charts they turn to long positions, and on the 1-hour and 4-hour charts they turn to short positions, signaling the end of the upward correction.

The signal for the resumption of sales will be a breakdown of the support level of 0.5635. In this case, NZD/USD will head deeper into the descending channel on the weekly chart and towards 0.5470.

In an alternative scenario, the upward correction will continue to the resistance levels of 0.5800 (200 EMA on the 4-hour chart), 0.5880 (50 EMA on the daily chart).

In general, the downward dynamics of NZD/USD prevails, while the pair remains in the zone of a long-term bear market—below the key resistance levels of 0.6690 (200 EMA on the weekly chart), 0.6310 (200 EMA on the daily chart). Only their breakdown will bring the pair back into the zone of a long-term bull market.

And today, the volatility in the NZD/USD pair may increase again (in the period after 13:15 - 14:00 GMT), which will be associated with the publication of macro statistics for the US and New Zealand, as well as at 21:30 during the speech of Fed representative Neel Kashkari.

Support levels: 0.5635, 0.5600, 0.5565, 0.5512, 0.5470

Resistance levels: 0.5704, 0.5800, 0.5880, 0.6065, 0.6200, 0.6310, 0.6560, 0.6690, 0.6735

Trading Tips

Sell Stop 0.5620. Stop-Loss 0.5710. Take-Profit 0.5600, 0.5565, 0.5512, 0.5470

Buy Stop 0.5710. Stop-Loss 0.56250. Take-Profit 0.5800, 0.5880, 0.6065, 0.6200, 0.6310, 0.6560, 0.6690, 0.6735

在今天上午的預測中,我專注於1.3456水平,並計劃從此處做出市場進入決策。讓我們來看看5分鐘圖表,看看發生了什麼。

在我上午的預測中,我專注於1.1336水平並計劃從那裡做出市場進入決策。讓我們來看一下5分鐘圖表,看看發生了什麼情況。

歐元/美元貨幣對週四開始時急劇下跌,但在一天中的其餘時間裡則呈現強勁增長。解釋週四的走勢有些困難,但我們會試著來闡述。

GBP/USD 貨幣對在週四的波動性比 EUR/USD 對更低,這相當令人驚訝。同時,英鎊輕鬆回升至關鍵線,而歐元則出於相同的原因恢復增長。

在我上午的預測中,我集中關注了1.3429這個水平,並計劃以此作為市場進入決策的依據。讓我們來看看5分鐘圖表並分析發生了什麼。

在我早上的預測中,我專注於1.1259這個水平,並計劃根據這一點位進行交易決策。讓我們來看看5分鐘圖表,以了解那裡發生了什麼情況。

週三,歐元/美元貨幣對持續其下跌趨勢,並在週四的凌晨經歷了一次大幅下跌。昨天甚至是午夜,都沒有強有力的理由促使美元再次上漲。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.