07.12.2021 11:30 AM

07.12.2021 11:30 AMThe gold market continues to struggle because investors are reacting to the hawkish rhetoric of Fed Chairman Jerome Powell.

Until three weeks ago, investors were all about keeping gold in their portfolio, trying to protect themselves from rising inflationary pressures. But now the Fed appears to be taking the threat more seriously, which, in turn, raises expectations for tighter monetary policy in the near future. Many anticipate an announcement of a much faster reduction of bond purchases in December.

But even if expectations begin to change, the broader investment landscape remains the same. Despite Powell's new aggressive stance, most economists and market analysts believe the Fed will lag behind the inflation curve. This means that real interest rates will remain negative, which will be good for gold.

Leigh Goehring, managing partner of Goehring & Rozencwajg Associates, said the long-term target for gold is $ 20,000 per ounce.

"We're getting closer to the explosion of gold prices to the upside. I'm a big believer that inflation is not going away. It's going to continue to be a problem," he said.

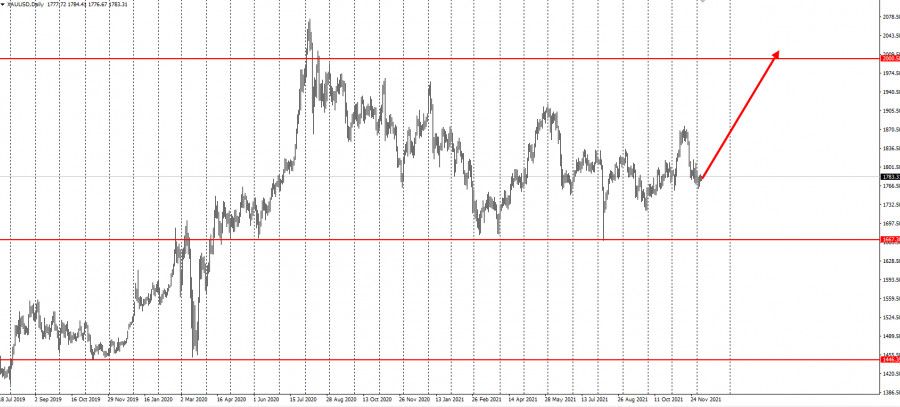

Meanwhile, Gerald Moser, chief market strategist at Barclays Bank, said gold prices will rise 20% over the next 12 months.

Although investors are ignoring gold as a hedge against inflation, other central banks are paying much more attention to it. The central bank of Singapore and the central bank of Ireland bought gold for the first time in decades.

Singapore reportedly bought 26.35 metric tons of gold between May and June, which was the first gold purchase by an Asian central bank since 2000. Ireland, on the other hand, bought two tons of gold, its first purchase since 2009.

Ireland's central bank governor, Gabriel Makhlouf, also said inflation was a growing concern for him.

新事物往往是被遺忘的舊事物。隨著春天即將結束,那句早已被拋之腦後的口號“賣出美國”在市場上重新流行起來。

美元/日元貨幣對正經歷加劇的價格波動。在四月底時,該對大幅下滑,達到七個月低點139.90。

不合時宜的必要項目。眾議院已批准唐納·川普的減稅計劃。

週四,英鎊/美元貨幣對交易相對平靜,但與歐元/美元一樣,已經連續兩週上漲。乍看之下,人們可能會想,交易者為何要有這樣的行為,其理由似乎並不明顯。

在週四,歐元/美元貨幣對相對平穩,但在過去兩週內顯著上升。這一走勢可以從多種角度解讀。

星期五幾乎沒有安排任何宏觀經濟報告。只有兩份報告值得注意:德國第一季度國內生產總值的最終估算和英國四月份的零售銷售數據。

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaForex俱乐部

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.