04.10.2021 01:45 PM

04.10.2021 01:45 PMBITCOIN

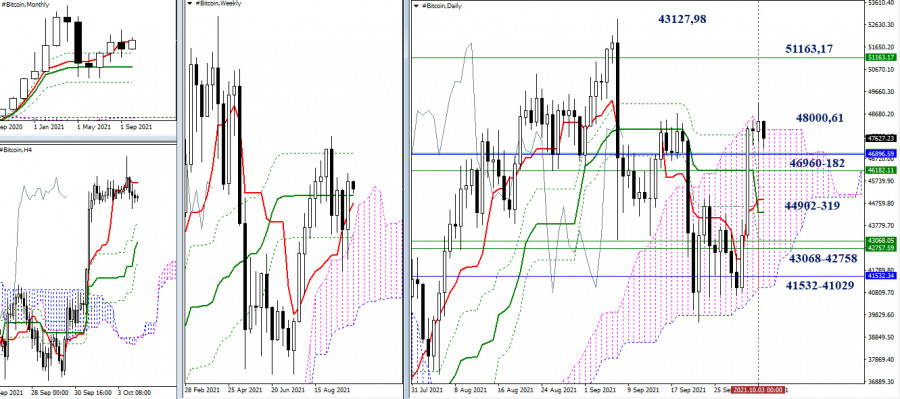

The previous week managed to confirm and strengthen the rebound from the encountered accumulation of support levels. This became possible due to the consolidation above the zone, which is formed by associations of different levels. So, for example, it is possible to designate and highlight the areas of 46182.11 - 46960.39 (weekly Tenkan + weekly Kijun + monthly Tenkan); 44901.61 - 44318.86 (daily Tenkan + daily Kijun); 43068.05 - 42757.59 (upper border of the weekly cloud + weekly Fibo Kijun + daily Fibo Kijun) and 41532.34 - 41028.86 (monthly Fibo Kijun + lower border of the daily cloud).

These accumulations of levels currently retain the role of supports, and as before, they will try to defend the bullish interests when interacting and testing. Today, the current attraction on the daily timeframe continues to resist the upper border of the daily Ichimoku cloud (48000.61). Consolidation in the bullish zone relative to the daily cloud will set the following tasks for the bulls – breaking through the weekly dead Ichimoku cross (51163.17) and updating the maximum extremum (43127.98).

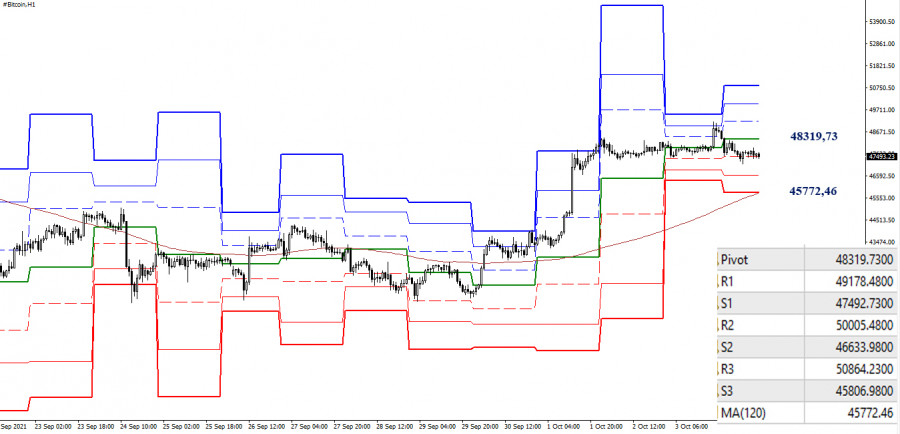

The main advantage in the smaller timeframes continues to be on the bulls' side. However, the price has been in the correction zone for a long time, and bearish traders were able to consolidate below the central pivot level of the day (48319.73) today. It should be noted that another decline will lead to testing of the key level – the weekly long-term trend (45772.46). The nearest support on this path can be noted today at 46633.98 (S2).

In turn, the breakdown and reversal of the moving (45772.46) will change the current balance of power in the same timeframe. In this case, it would be better to re-evaluate the situation and prospects. The interests of the bulls may be represented by the resistance levels of 48319.73 - 49178.48 - 50005.48 - 50864.23 (classic pivot levels).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of this cryptocurrency.

在週四,比特幣的價格達到了111,770這一目標水平。Marlin振盪器似乎落後於價格,這給人一種可能的背離印象——儘管是不尋常的。

根據近期的表現來看,比特幣需求似乎正在激增。截至本文發表時,BTC/USD 交易對的交易價格接近 111,200.00,稍低於今日及歷史高點 111,865.00。

近月來,我們在 BTC/USD 的4小時圖表上觀察到波動模式越來越複雜。我們觀察到一個糾正向下的結構,這個結構在約 75,000 級別完成了形成。

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaForex在图中

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.