#GS (Goldman Sachs Group Inc.). Exchange rate and online charts.

Currency converter

19 May 2025 22:59

(0.07%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869 by Marcus Goldman, the firm is headquartered in New York and has offices in all major financial centers around the world.

Since September 20, 2013, the bank has been included in the Dow Jones Industrial Average. The Goldman Sachs Group, Inc. trades on the New York Stock Exchange under the symbol GS. As of December 3, 2016, the bank’s market capitalization was estimated at $88.82 billion.

In the early 20 century, Goldman Sachs was the only major player in the IPO market. Goldman Sachs underwrote the IPO of several large companies such as Microsoft, Yahoo!, Ford, GE. At the moment, the financial group owns 962,000 shares of Tesla and a 30% stake in Burger King's.

One of the most important events in the history of the bank was its own IPO, held in 1999. Approximately 48% of the company belongs to partnership associations, 22% are held by the company's employees, 18% are held by long-term investors Sumitomo Bank Ltd. and Hawaii's Kamehameha Activities Assn. About 12% of its shares were withdrawn directly to the market. In the fourth quarter of fiscal 2008, Goldman Sachs suffered a loss of $2.1 billion for the first time since its IPO in 1999.

The main source of the profit is the stock exchange trading and investments. Asset management accumulates 19% of the company's profit. This area of activity attracts private investors and various large organizations.

Goldman Sachs is one of the leaders in the investment banking sphere. In the mergers & acquisitions market, the company has proved itself as a bank advising their clients on how to avoid hostile takeovers. This business segment generates about 15% of the turnover of Goldman Sachs.

See Also

- Technical analysis / Video analytics

Forex forecast 19/05/2025: EUR/USD, GBP/USD, USD/JPY, USD/CAD, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USD/CAD, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

10:52 2025-05-19 UTC+2

3193

Wave analysisWeekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold on May 19th

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold on May 19thAuthor: Isabel Clark

11:40 2025-05-19 UTC+2

2113

Bears receive positive signals but still remain cautiousAuthor: Samir Klishi

10:45 2025-05-19 UTC+2

1663

- Theft of funds and personal data haunts the crypto industry

Author: Marek Petkovich

13:20 2025-05-19 UTC+2

1573

Is the Loss of American Exceptionalism Temporary—or the Beginning of a Long, Painful Decline?Author: Marek Petkovich

09:18 2025-05-19 UTC+2

1393

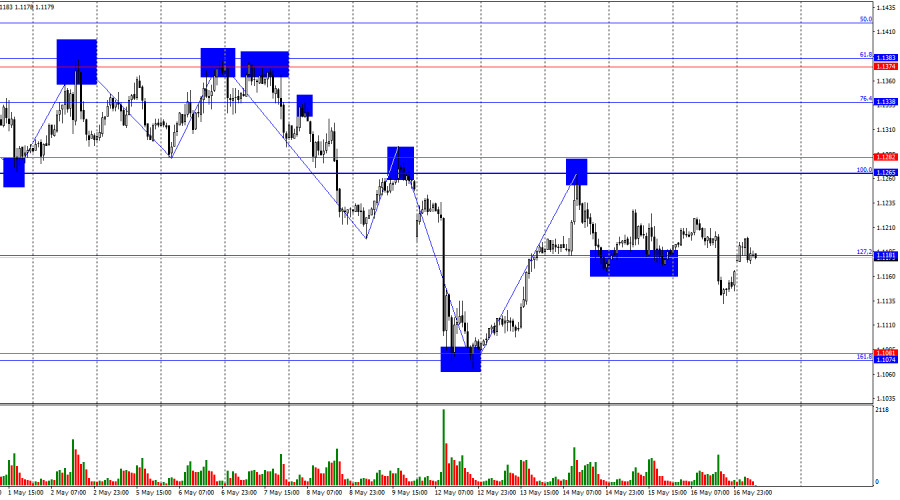

Technical analysisTrading Signals for EUR/USD for May 19-21, 2025: sell below 1.1285 (200 EMA - GAP)

Our trading plan for the coming hours is to sell the euro below the top of the downtrend channel, with targets at 1.1189, and to cover the gap left last week around 1.1150.Author: Dimitrios Zappas

14:30 2025-05-19 UTC+2

1393

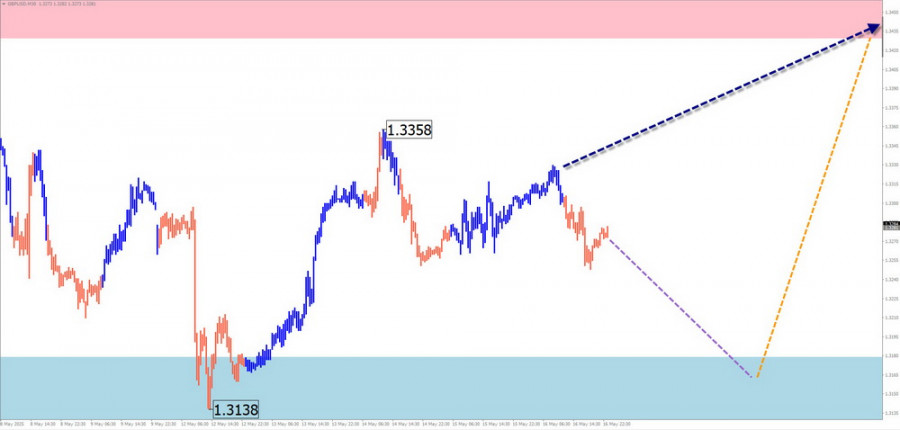

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19thAuthor: Isabel Clark

11:43 2025-05-19 UTC+2

1393

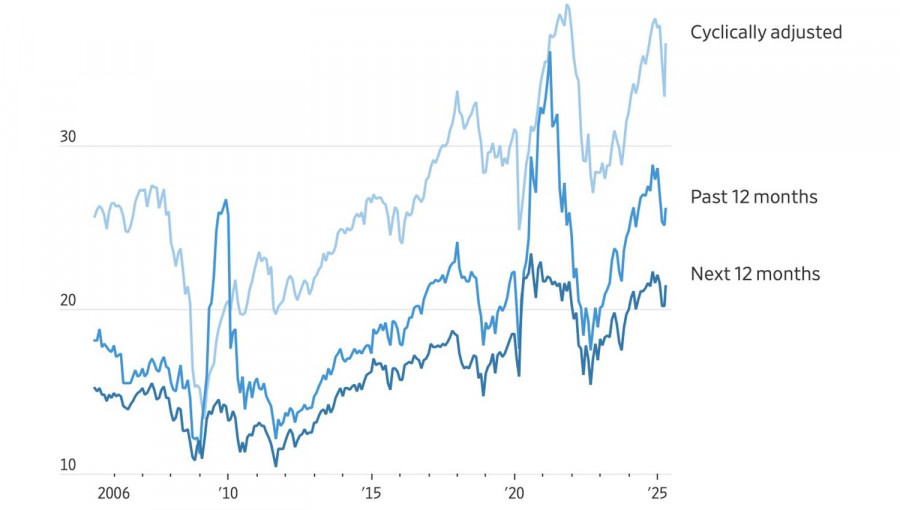

Despite encouraging statements about progress in trade negotiations and high-level diplomatic visits, forecasts for the S&P 500 remain restrained. Analysts point to the index's lack of growth compared to its European counterparts, signaling a loss of competitive edge for the US marketAuthor: Ekaterina Kiseleva

12:20 2025-05-19 UTC+2

1348

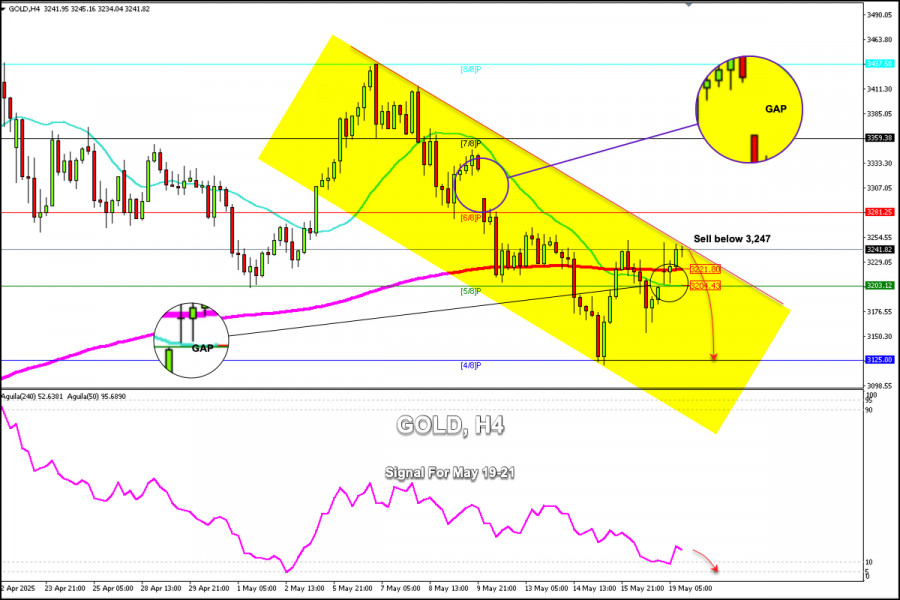

Gold left another gap on May 8 around 3,325 and is likely to break above 3,250. The outlook could be bullish, and we could expect it to cover this gap and even reach 7/8 Murray at 3,360.Author: Dimitrios Zappas

14:29 2025-05-19 UTC+2

1348

- Technical analysis / Video analytics

Forex forecast 19/05/2025: EUR/USD, GBP/USD, USD/JPY, USD/CAD, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USD/CAD, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

10:52 2025-05-19 UTC+2

3193

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold on May 19th

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold on May 19thAuthor: Isabel Clark

11:40 2025-05-19 UTC+2

2113

- Bears receive positive signals but still remain cautious

Author: Samir Klishi

10:45 2025-05-19 UTC+2

1663

- Theft of funds and personal data haunts the crypto industry

Author: Marek Petkovich

13:20 2025-05-19 UTC+2

1573

- Is the Loss of American Exceptionalism Temporary—or the Beginning of a Long, Painful Decline?

Author: Marek Petkovich

09:18 2025-05-19 UTC+2

1393

- Technical analysis

Trading Signals for EUR/USD for May 19-21, 2025: sell below 1.1285 (200 EMA - GAP)

Our trading plan for the coming hours is to sell the euro below the top of the downtrend channel, with targets at 1.1189, and to cover the gap left last week around 1.1150.Author: Dimitrios Zappas

14:30 2025-05-19 UTC+2

1393

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19thAuthor: Isabel Clark

11:43 2025-05-19 UTC+2

1393

- Despite encouraging statements about progress in trade negotiations and high-level diplomatic visits, forecasts for the S&P 500 remain restrained. Analysts point to the index's lack of growth compared to its European counterparts, signaling a loss of competitive edge for the US market

Author: Ekaterina Kiseleva

12:20 2025-05-19 UTC+2

1348

- Gold left another gap on May 8 around 3,325 and is likely to break above 3,250. The outlook could be bullish, and we could expect it to cover this gap and even reach 7/8 Murray at 3,360.

Author: Dimitrios Zappas

14:29 2025-05-19 UTC+2

1348