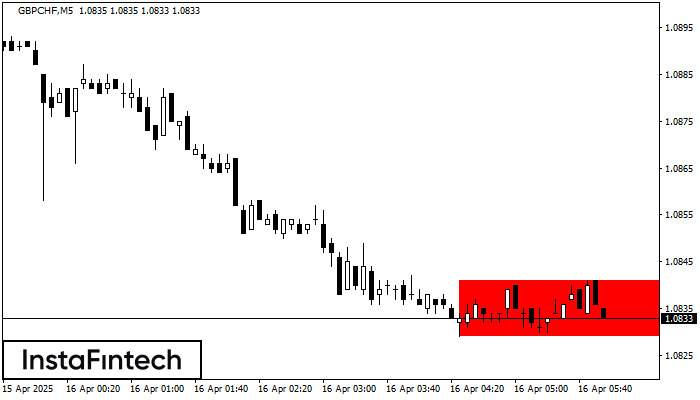

Bearish Rectangle

was formed on 16.04 at 04:57:51 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GBPCHF formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 1.0841, the lower border is 1.0829. The signal means that a short position should be opened after fixing a price below the lower border 1.0829 of the Bearish Rectangle.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

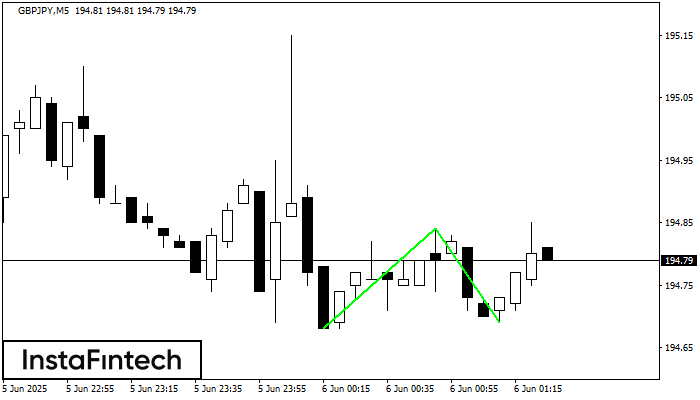

Double Bottom

was formed on 06.06 at 00:25:20 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on GBPJPY M5. Characteristics: the support level 194.68; the resistance level 194.84; the width of the pattern 16 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Bottom

was formed on 06.06 at 00:20:24 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on NZDJPY M5; the upper boundary is 86.73; the lower boundary is 86.53. The width of the pattern is 20 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Bottom

was formed on 05.06 at 22:50:11 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on GBPJPY M5; the upper boundary is 195.10; the lower boundary is 194.74. The width of the pattern is 35 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window