Triple Bottom

was formed on 28.03 at 21:55:08 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of #AMZN M5. Features of the pattern: The lower line of the pattern has coordinates 193.15 with the upper limit 193.15/192.69, the projection of the width is 131 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 191.84, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

انظر أيضا

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

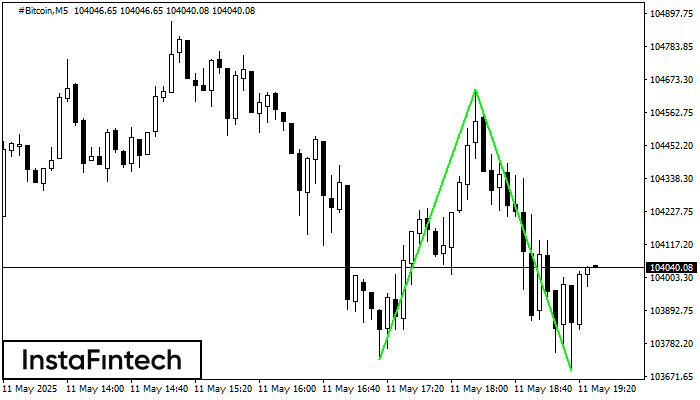

Đáy ba

was formed on 11.05 at 19:05:15 (UTC+0)

signal strength 1 of 5

Mô hình Đáy ba đã được hình thành trên biểu đồ của #Bitcoin M5. Các tính năng của mô hình: Đường dưới của mô hình có tọa độ 104640.24

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

Open chart in a new window

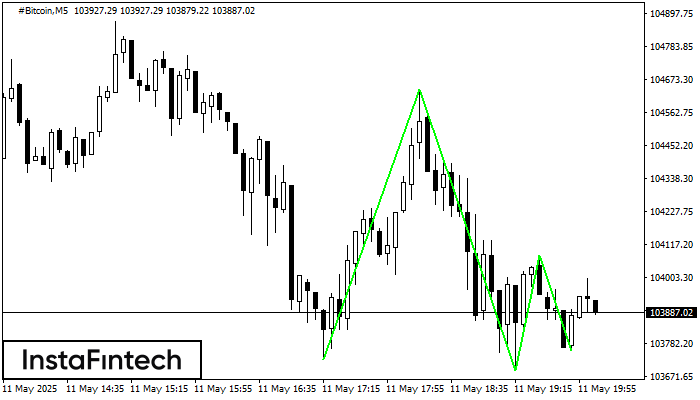

Đáy đôi

was formed on 11.05 at 18:30:15 (UTC+0)

signal strength 1 of 5

Mô hình Đáy đôi đã được hình thành trên #Bitcoin M5; đường viền trên là 104640.24; đường viền dưới là 103691.15. Độ rộng của mô hình là 91343 điểm. Trong

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

Open chart in a new window

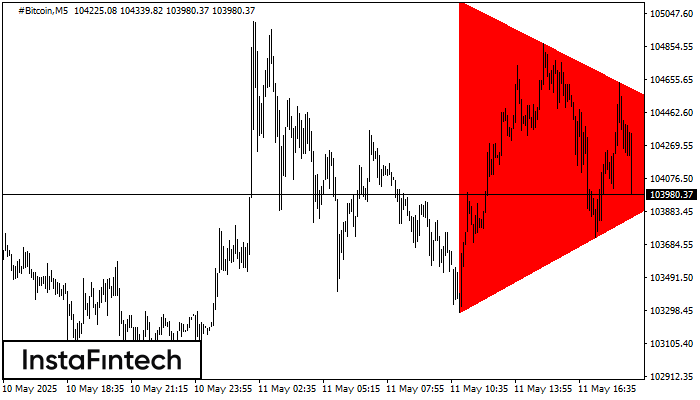

Tam giác Cân Giảm

was formed on 11.05 at 17:48:22 (UTC+0)

signal strength 1 of 5

Theo biểu đồ của M5, #Bitcoin đã hình thành mô hình Tam giác Cân Giảm. Mô tả: Đường biên giới thấp hơn là 103283.53/104238.33 và đường biên giới

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

Open chart in a new window