30.04.2023 12:39 PM

30.04.2023 12:39 PMThe GBP/USD pair steep decline spells for a capitulation event underway from the levels 1.2470 and 1.2448. More price decline is likely to occur, but traders should consider the bearish thesis event until 1.2502 is broken. The GBP/USD pair dropped sharply from the level of 1.2470 towards 1.2425. Now, the price is set at 1.2425. On the H1 chart, the resistance of GBP/USD pair is seen at the level of 1.2352 and 1.2502. It should be noted that volatility is very high for that the GBP/USD pair is still moving between 1.2425 and 1.2352 in coming hours. Moreover, the price spot of 1.2470 remains a significant resistance zone. Therefore, there is a possibility that the GBP/USD pair will move downside and the structure of a fall does not look corrective; in order to indicate the bearish opportunity below 1.2470, sell below 1.2470 with the first target at 1.2352 so as to test last week's bottom. Also, it should be noticed that support 1 is seen at the level of 1.2352 which coincides the daily double bottom. So, we expect the price to set below the strong resistance at the level of 1.2470; because the price is in a bearish channel now. The RSI starts signaling a downward trend. Consequently, the market is likely to show signs of a bearish trend. Additionally, if the GBP/USD pair is able to break out the bottom at 1.2352, the market will decline further to 1.2312 in order to test the weekly support 2.

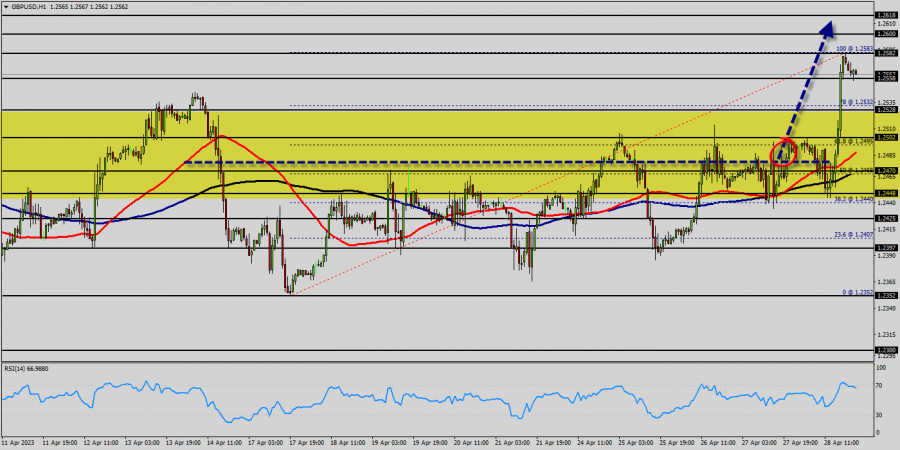

The GBP/USD pair steep decline spells for a capitulation event underway from the levels 1.2470 and 1.2448. More price decline is likely to occur, but traders should consider the bearish thesis event until 1.2502 is broken.

The GBP/USD pair dropped sharply from the level of 1.2470 towards 1.2425. Now, the price is set at 1.2425. On the H1 chart, the resistance of GBP/USD pair is seen at the level of 1.2352 and 1.2502. It should be noted that volatility is very high for that the GBP/USD pair is still moving between 1.2425 and 1.2352 in coming hours. Moreover, the price spot of 1.2470 remains a significant resistance zone.

The GBP/USD pair steep decline spells for a capitulation event underway from the levels 1.2470 and 1.2448. More price decline is likely to occur, but traders should consider the bearish thesis event until 1.2502 is broken. The GBP/USD pair dropped sharply from the level of 1.2470 towards 1.2425. Now, the price is set at 1.2425.

On the H1 chart, the resistance of GBP/USD pair is seen at the level of 1.2352 and 1.2502. It should be noted that volatility is very high for that the GBP/USD pair is still moving between 1.2425 and 1.2352 in coming hours.

Moreover, the price spot of 1.2470 remains a significant resistance zone. Therefore, there is a possibility that the GBP/USD pair will move downside and the structure of a fall does not look corrective; in order to indicate the bearish opportunity below 1.2470, sell below 1.2470 with the first target at 1.2352 so as to test last week's bottom. Also, it should be noticed that support 1 is seen at the level of 1.2352 which coincides the daily double bottom.

So, we expect the price to set below the strong resistance at the level of 1.2470; because the price is in a bearish channel now. The RSI starts signaling a downward trend. Consequently, the market is likely to show signs of a bearish trend. Additionally, if the GBP/USD pair is able to break out the bottom at 1.2352, the market will decline further to 1.2312 in order to test the weekly support 2.

Therefore, there is a possibility that the GBP/USD pair will move downside and the structure of a fall does not look corrective; in order to indicate the bearish opportunity below 1.2470, sell below 1.2470 with the first target at 1.2352 so as to test last week's bottom.

Also, it should be noticed that support 1 is seen at the level of 1.2352 which coincides the daily double bottom. So, we expect the price to set below the strong resistance at the level of 1.2470; because the price is in a bearish channel now.

The RSI starts signaling a downward trend. Consequently, the market is likely to show signs of a bearish trend. Additionally, if the GBP/USD pair is able to break out the bottom at 1.2352, the market will decline further to 1.2312 in order to test the weekly support 2.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

يتداول الذهب حول 2,402.86 تحت قناة الاتجاه الهابط التي تشكلت منذ 17 يوليو وداخل قناة الاتجاه الصاعد التي تشكلت بعد الوصول إلى أدنى مستوى عند 2,384. يبقى الذهب

تحليل للمعاملات ونصائح لتداول زوج الجنيه الإسترليني مقابل الدولار الأمريكي أصبح الانخفاض الإضافي محدودًا لأن اختبار 1.2477 حدث في وقت تحركت فيه خط MACD بقوة نحو الأسفل من الصفر. بينما

مراجعة: كان اتجاه زوج اليورو/الدولار الأمريكي متناقضًا حيث حدث في قناة الاتجاه الهابط. نظرًا للأحداث السابقة، لا يزال السعر محصورًا بين مستويات 1.0850 و 1.0773، لذا يُنصح بالحذر عند إجراء

كانت الاتجاه في زوج اليورو/الدولار الأمريكي متجادلاً حيث كان يتداول في قناة جانبية ضيقة، وأظهرت السوق علامات على عدم الاستقرار. وفي ظل الأحداث السابقة، لا يزال السعر يتحرك بين مستويات

ضرب زوج اليورو/الدولار الأمريكي نقطة الدعم الأسبوعية والمقاومة 1، بسبب سلسلة من القمم المتساوية والقيعان المتساوية نسبيًا. ولكن، ارتفع الزوج ليصل إلى نقطة 1.0588. وبالتالي، تم تحديد الدعم الرئيسي بالفعل

نادي إنستافوركس

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.